Air New Zealand 2016 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEAL AND ANNUAL FINANCIAL RESULTS 2016

Notes to the Financial Statements (continued)

As at 30 June 2016

38

AIR NEW ZEAL AND ANNUAL FINANCIAL RESULTS 2016

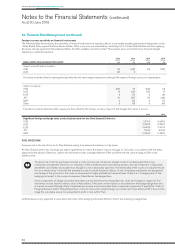

24. Financial Risk Management (continued)

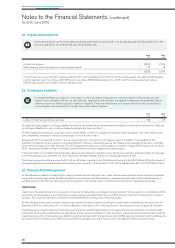

Capital risk management

The Group’s objectives when managing capital are to safeguard the company’s ability to continue as a going concern and to continue to generate

shareholder value and benefits for other stakeholders, and to provide an acceptable return for shareholders by removing complexity, reducing costs

and pricing our services commensurately with the level of risk. The Group is not subject to any externally imposed capital requirements.

The Group’s capital structure is managed in the light of economic conditions, future capital expenditure profiles and the risk characteristics of the

underlying assets. The Group’s capital structure may be modified by adjusting the amount of dividends paid to shareholders, initiating dividend

reinvestment opportunities, returning capital to shareholders, issuing new shares or selling assets to reduce debt. The capital management policies

and guidelines are regularly reviewed by the Board of Directors.

The Group monitors capital on the basis of gearing ratios. These ratios are calculated as net debt including capitalised operating leases over

net debt plus equity. Net debt is calculated as total borrowings, bonds and finance lease obligations (including net open derivatives on these

instruments) less cash and cash equivalents, non interest-bearing assets and interest-bearing assets. Capital comprises all components of equity.

These ratios and their calculation are disclosed in the Five Year Statistical Review.

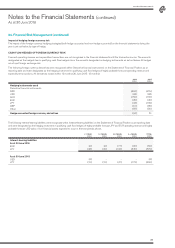

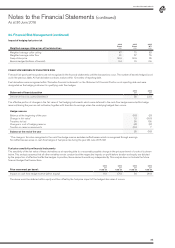

25. Offsetting Financial Assets and Financial Liabilities

Financial assets and financial liabilities are offset and the net amount reported in the Statement of Financial Position when there is

a legally enforceable right to offset the recognised amounts and there is an intention to settle on a net basis or realise the asset and

settle the liability simultaneously.

Amounts subject to potential offset

For financial instruments subject to enforceable master netting arrangements, each agreement allows the parties to elect net settlement of the

relevant financial assets and liabilities. In the absence of such election, settlement occurs on a gross basis, however each party will have the option

to settle on a net basis in the event of default of the other party.

The following table shows the gross amounts of financial assets and financial liabilities which are subject to enforceable master netting arrangements

and similar agreements, as recognised in the Statement of Financial Position. It also shows the potential net amounts if offset were to occur.

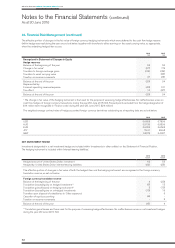

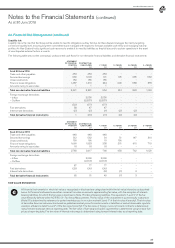

STATEMENT

OF FINANCIAL

POSITION

2016

$M

AMOUNTS

NOT OFFSET

2016

$M

NET

AMOUNTS

IF OFFSET

2016

$M

STATEMENT

OF FINANCIAL

POSITION

2015

$M

AMOUNTS

NOT OFFSET

2015

$M

NET

AMOUNTS

IF OFFSET

2015

$M

Financial assets

Bank and short-term deposits

Derivative financial assets

1,594

70

(59)

(10)

1,535

60

1,321

106

(23)

(18)

1,298

88

Financial liabilities

Derivative financial liabilities (69) 69 - (41) 41 -

Letters of credit and performance bonds are also subject to master netting arrangements. The amounts are disclosed in Note 23

Contingent Liabilities.