Air New Zealand 2016 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

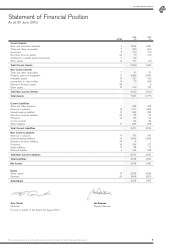

As at 30 June 2016

15

AIR NEW ZEALAND GROUP

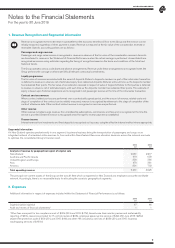

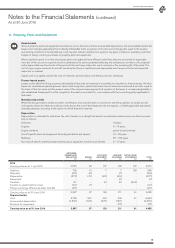

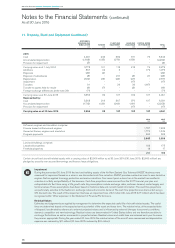

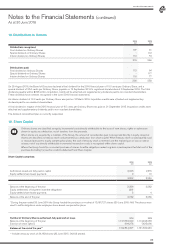

11. Property, Plant and Equipment

Owned assets

Items of property, plant and equipment are stated at cost or deemed cost less accumulated depreciation and accumulated impairment

losses. Cost includes expenditure that is directly attributable to the acquisition of the item and in bringing the asset to the location

and working condition for its intended use. Cost may also include transfers from equity of any gains or losses on qualifying cash flow

hedges of foreign currency purchases of property, plant and equipment.

Where significant parts of an item of property, plant and equipment have different useful lives, they are accounted for separately.

A portion of the cost of an acquired aircraft is attributed to its service potential (reflecting the maintenance condition of its engines)

and is depreciated over the shorter of the period to the next major inspection event, overhaul, or the remaining life of the asset. The

cost of major engine overhauls for aircraft owned by the Group is capitalised and depreciated over the period to the next expected

inspection or overhaul.

Capital work in progress includes the cost of materials, services, labour and direct production overheads.

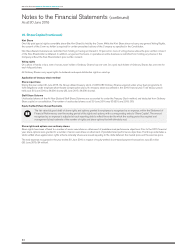

Finance leased assets

Leases under which the Group assumes substantially all the risks and rewards of ownership are classified as finance leases. All other

leases are classified as operating leases. Upon initial recognition, assets held under finance leases are measured at amounts equal to

the lower of their fair value and the present value of the minimum lease payments at inception of the lease. A corresponding liability is

also established. Subsequent to initial recognition, the asset is accounted for in accordance with the accounting policy applicable to

that asset.

Manufacturing credits

Where the Group receives credits and other contributions from manufacturers in connection with the acquisition of certain aircraft

and engines, these are either recorded as a reduction to the cost of the related aircraft and engines, or offset against the associated

operating expense, according to the reason for which they were received.

Depreciation

Depreciation is calculated to write down the cost of assets on a straight line basis to an estimated residual value over their economic

lives as follows:

Airframes 18 years

Engines 6 – 15 years

Engine overhauls period to next overhaul

Aircraft specific plant and equipment (including simulators and spares) 10 – 25 years

Buildings 50 – 100 years

Non-aircraft specific leasehold improvements, plant, equipment, furniture and vehicles 2 – 10 years

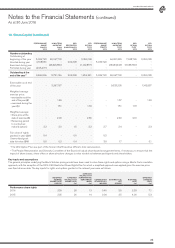

AIRFRAMES,

ENGINES AND

SIMULATORS

$M

SPARES

$M

PLANT AND

EQUIPMENT

$M

LAND AND

BUILDINGS

$M

CAPITAL WORK

IN PROGRESS

$M

TOTAL

$M

2016

Carrying value as at 1 July 2015 3,556

99 107 192 107 4,061

Additions

Disposals

Depreciation

Impairment

Transfers

Transfer to assets held for resale

Foreign exchange differences (refer note 24)

758

(29)

(373)

-

121

(20)

(26)

15

(6)

(10)

-

-

(1)

-

7

-

(28)

-

43

-

-

7

(1)

(26)

(1)

40

-

-

158

-

-

-

(204)

-

-

945

(36)

(437)

(1)

-

(21)

(26)

Carrying value as at 30 June 2016

Represented by:

Cost

Accumulated depreciation

Provision for impairment

3,987

5,789

(1,802)

-

97

200

(103)

-

129

404

(275)

-

211

409

(180)

(18)

61

61

-

-

4,485

6,863

(2,360)

(18)

Carrying value as at 30 June 2016 3,987 97 129 211 61 4,485