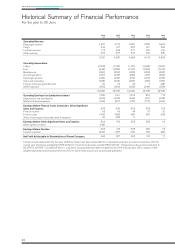

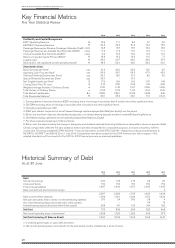

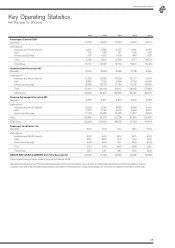

Air New Zealand 2016 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2016

37

AIR NEW ZEALAND GROUP

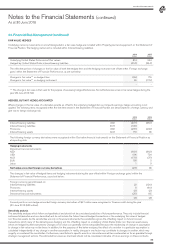

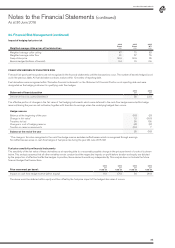

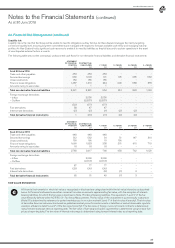

24. Financial Risk Management (continued)

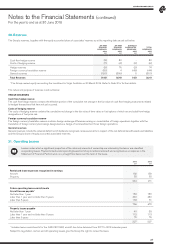

Liquidity risk

Liquidity risk is the risk that the Group will be unable to meet its obligations as they fall due. Air New Zealand manages the risk by targeting

a minimum liquidity level, ensuring long-term commitments are managed with respect to forecast available cash inflow and managing maturity

profiles. Air New Zealand holds significant cash reserves to enable it to meet its liabilities as they fall due and to sustain operations in the event

of unanticipated external factors or events.

The following table sets out the contractual, undiscounted cash flows for non-derivative financial liabilities and derivative financial instruments:

STATEMENT

OF FINANCIAL

POSITION

$M

CONTRACTUAL

CASH FLOWS

$M

< 1 YEAR

$M

1-2 YEARS

$M

2-5 YEARS

$M

5+ YEARS

$M

As at 30 June 2016

Trade and other payables

Secured borrowings

Unsecured bonds

Finance lease obligations

Amounts owing to associates

453

930

150

1,487

1

453

1,003

155

1,619

1

453

101

155

244

1

-

105

-

209

-

-

235

-

588

-

-

562

-

578

-

Total non-derivative financial liabilities 3,021 3,231 954 314 823 1,140

Foreign exchange derivatives

– Inflow

– Outflow

2,030

(2,087)

2,030

(2,087)

-

-

-

-

-

-

Fuel derivatives

Interest rate derivatives

(52)

58

(5)

(57)

47

(5)

(57)

47

(1)

-

-

(2)

-

-

(2)

-

-

-

Total derivative financial instruments 1 (15) (11) (2) (2) -

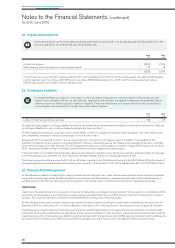

STATEMENT

OF FINANCIAL

POSITION

$M

CONTRACTUAL

CASH FLOWS

$M

< 1 YEAR

$M

1-2 YEARS

$M

2-5 YEARS

$M

5+ YEARS

$M

As at 30 June 2015

Trade and other payables

Secured borrowings

Unsecured bonds

Finance lease obligations

Amounts owing to associates

448

512

150

1,660

18

448

562

166

1,823

18

448

54

10

238

18

-

51

156

251

-

-

147

-

615

-

-

310

-

719

-

Total non-derivative financial liabilities 2,788 3,017 768 458 762 1,029

Foreign exchange derivatives

– Inflow

– Outflow

2,090

(2,013)

2,090

(2,013)

-

-

-

-

-

-

Fuel derivatives

Interest rate derivatives

87

(22)

-

77

(26)

-

77

(26)

(2)

-

-

(1)

-

-

3

-

-

-

Total derivative financial instruments 65 51 49 (1) 3 -

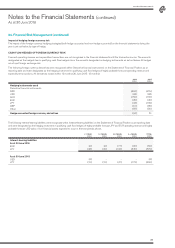

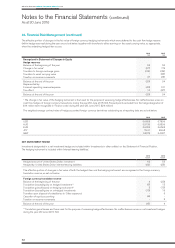

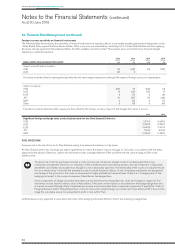

FAIR VALUE ESTIMATION

All financial instruments for which fair value is recognised or disclosed are categorised within the fair value hierarchy as described

below. All financial instruments are either carried at fair value or amounts approximating fair value, with the exception of interest-

bearing liabilities, for which the fair value is disclosed in Note 15 Interest-bearing liabilities. This equates to “Level 2” of the fair

value hierarchy defined within NZ IFRS 13 - Fair Value Measurement. The fair value of the investment in quoted equity instrument

(Note 9) is determined by reference to quoted market prices in an active market (“Level 1” of the fair value hierarchy). The fair value

of derivative financial instruments is based on published market prices for similar assets or liabilities or market observable inputs to

valuation at balance date (“Level 2” of the fair value hierarchy). The fair value of foreign currency forward contracts is determined

using forward exchange rates at reporting date. The fair value of fuel swap and option agreements is determined using forward fuel

prices at reporting date. The fair value of interest rate swaps is determined using forward interest rates as at reporting date.