Air New Zealand 2016 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2016

28

AIR NEW ZEAL AND ANNUAL FINANCIAL RESULTS 2016

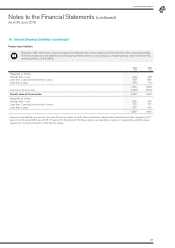

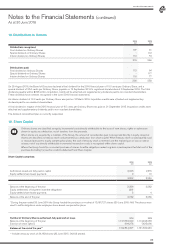

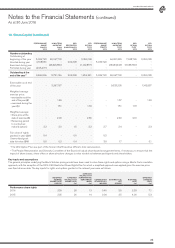

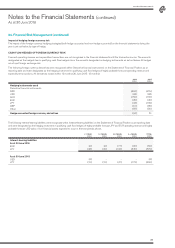

22. Capital Commitments

Commitments shown are for those asset purchases authorised and contracted for as at reporting date but not provided for in the

financial statements, converted at the year end exchange rate.

2016

$M

2015

$M

Aircraft and engines

Other property, plant and equipment and intangible assets

2,210

12

2,545

18

2,222 2,563

Commitments as at reporting date include six Boeing 787-9 aircraft (delivery from 2016 to 2018 calendar years), one Airbus A320 (delivery

in 2016 calendar year), four Airbus A321 NEOs and nine Airbus A320 NEOs (delivery from 2017 to 2019 calendar years) and sixteen

ATR72-600s (delivery from 2016 to 2020 calendar years).

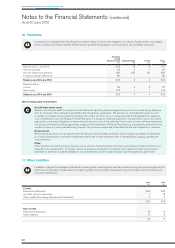

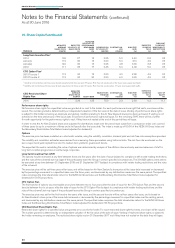

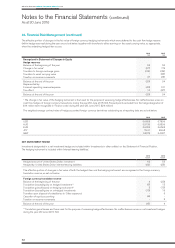

23. Contingent Liabilities

Contingent liabilities are subject to uncertainty or cannot be reliably measured and are not provided for. Disclosures as to the

nature of any contingent liabilities are set out below. Judgements and estimates are applied to determine the probability that an

outflow of resources will be required to settle an obligation. These are made based on a review of the facts and circumstances

surrounding the event and advice from both internal and external parties.

2016

$M

2015

$M

Letters of credit and performance bonds 33 58

All significant legal disputes involving probable loss that can be reliably estimated have been provided for in the financial statements. There are

no contingent liabilities for which it is practicable to estimate the financial effect.

Air New Zealand is defending a class action in the United States in which it is alleged that Air New Zealand together with other airlines acted

anti-competitively in respect of fares and surcharges on trans-Pacific routes.

Allegations of anti-competitive conduct in the air cargo business in Hong Kong and Singapore were the subject of proceedings by the

Australian Competition and Consumer Commission (ACCC). Following a defended hearing, the Federal Court released its decision in October

2014, finding in favour of Air New Zealand. The ACCC appealed the decision and the appeal was heard in August 2015 finding in favour of the

ACCC. Application has been made to the High Court of Australia for leave to appeal the latest decision.

In the event that a Court determined that Air New Zealand had breached competition laws, the Group would have potential liability for damages

or (in Australia) pecuniary penalties. No other significant contingent liability claims are outstanding at balance date.

The Group has a partnership agreement with Pratt and Whitney in relation to the Christchurch Engine Centre (CEC) (Note 13). By the nature of

the agreement, joint and several liability exists between the two parties. Total liabilities of the CEC are $68 million (30 June 2015: $76 million).

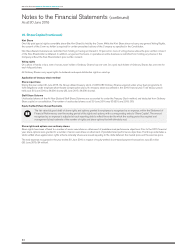

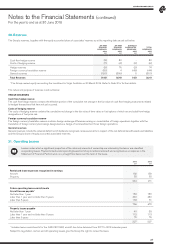

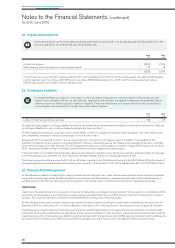

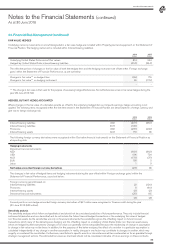

24. Financial Risk Management

Air New Zealand is subject to credit, foreign currency, interest rate and fuel price risks. These risks are managed with various financial instruments,

using a set of policies approved by the Board of Directors. Compliance with these policies is reviewed and reported monthly to the Board and is

included as part of the internal audit programme. Group policy is not to enter, issue or hold financial instruments for speculative purposes.

CREDIT RISK

Credit risk is the potential loss from a transaction in the event of default by a counterparty during the term of the transaction or on settlement of the

transaction. Air New Zealand incurs credit risk in respect of trade receivable transactions and other financial instruments in the normal course of

business. The maximum exposure to credit risk is represented by the carrying value of financial assets.

Air New Zealand places cash, short-term deposits and derivative financial instruments with good credit quality counterparties, having a minimum

Standard and Poors’ credit rating of A- or minimum Moodys’ credit rating of A3. Limits are placed on the exposure to any one financial institution.

Credit evaluations are performed on all customers requiring direct credit. Air New Zealand is not exposed to any concentrations of credit risk within

receivables, other assets and derivatives. Air New Zealand does not require collateral or other security to support financial instruments with credit risk.

A significant proportion of receivables are settled through the International Air Transport Association (IATA) clearing mechanism which undertakes its

own credit review of members. Over 93% of trade and other receivables are current, with less than 1% falling due after more than 90 days.