Air New Zealand 2016 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2016

20

AIR NEW ZEAL AND ANNUAL FINANCIAL RESULTS 2016

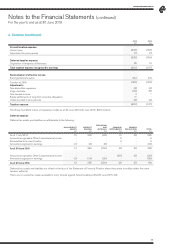

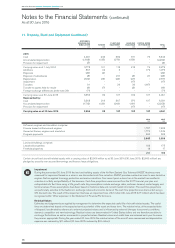

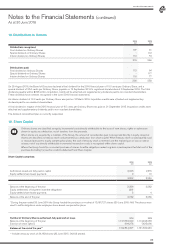

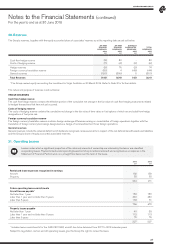

14. Revenue in Advance

Transportation sales in advance includes consideration received in respect of passenger and cargo sales for which the actual

carriage has not yet been performed.

Loyalty programme revenue in advance includes revenues associated with both the award of Airpoints Dollars to Airpoints

members as part of the initial sales transaction and with sales of Airpoints Dollars to third parties, net of estimated expiry

(non-redeemed Airpoints Dollars), in respect of which the Airpoints member has not yet redeemed their points.

Other revenue in advance includes membership subscriptions and contract related services revenue which relate to future periods.

2016

$M

2015

$M

Current

Transportation sales in advance

Loyalty programme

Other

972

121

18

924

110

21

1,111 1,055

Non-current

Loyalty programme

Other

157

4

145

5

161 150

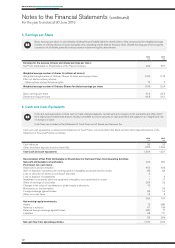

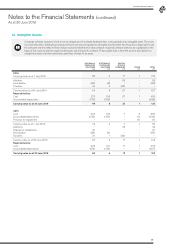

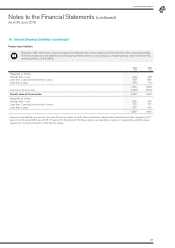

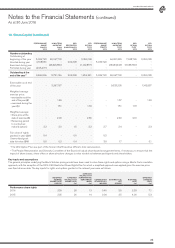

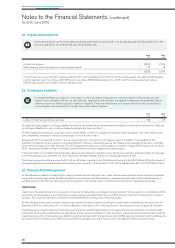

15. Interest-Bearing Liabilities

Borrowings, bonds and finance lease obligations are initially recognised at fair value, net of transaction costs incurred. They are

subsequently stated at amortised cost using the effective interest rate method, where appropriate. Borrowings, bonds and finance

lease obligations are classified as current liabilities unless the Group has an unconditional right to defer settlement of the liability

for more than 12 months after the balance date.

2016

$M

2015

$M

Current

Secured borrowings

Unsecured bonds

Finance lease liabilities

89

150

225

46

-

207

464 253

Non-current

Secured borrowings

Unsecured bonds

Finance lease liabilities

841

-

1,262

466

150

1,453

2,103 2,069

Interest rates basis:

Fixed rate

Floating rate

803

1,764

830

1,492

At amortised cost 2,567 2,322

At fair value 2,594 2,314

The fair value of interest-bearing liabilities for disclosure purposes is calculated based on the present value of future principal and interest cash

flows, discounted at the market rate of interest for similar liabilities at reporting date.

All secured borrowings are secured over aircraft or aircraft related assets and are subject to floating interest rates.

The unsecured, unsubordinated fixed rate bonds have a maturity date of 15 November 2016 and an interest rate of 6.90% payable semi-annually.