Air New Zealand 2016 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

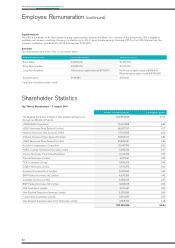

AIR NEW ZEALAND GROUP

Stock exchange listings

Air New Zealand’s Ordinary Shares are listed on:

NZX Main Board ASX

Ticker: AIR AIZ

Date of full listing: 24 October 1989 1 July 2002

Place of Incorporation

New Zealand

In New Zealand, the Company’s Ordinary Shares are listed with a “non-standard” (NS) designation. This is due to particular provisions of the

Company’s Constitution, including the rights attaching to the Kiwi Share1 held by the Crown and requirements regulating ownership and transfer

of Ordinary Shares.

Neither NZX nor ASX has taken any disciplinary action against the Company during the financial year ended 30 June 2016.

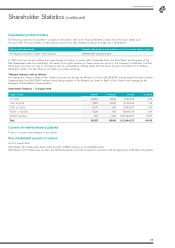

New Zealand Exchange

General:

An ongoing waiver granted to all companies dual listed on the NZX and the ASX from Listing Rules 11.1.1 and 11.1.4 to enable dual listed

issuers to comply with the ASX Listing Rules relating to the restrictions on transfer of restricted (vendor) securities during an escrow period.

The following waivers from the NZX Main Board Listing Rules were granted to the Company or relied upon by the Company during the financial

year ended 30 June 2016:

1. A waiver from NZSX Listing Rule 8.1.7(b) to enable the issue of Long-Term Incentive Scheme Options to be adjusted following a capital

restructure such as a rights issue, in accordance with an approach suggested by PricewaterhouseCoopers.

The decision by NZXR of 3 December 2007 noted that an independent expert’s opinion had confirmed that the approach suggested by

PricewaterhouseCoopers would create economic neutrality for the option holders and all other Air New Zealand shareholders.

2. A waiver from NZSX Listing Rule 8.1.7 to allow Air New Zealand to amend the terms of the Long-Term Incentive Plan and Chief Executive

Officer Option Incentive Plan to provide that instead of purchasing / issuing a share for each option exercised, Air New Zealand would only

purchase / issue a number of shares with a value (based on current market prices) equal to the delta between the aggregate of the market

share price and the exercise price of the options exercised.

The decision by NZXMS of 31 August 2012 noted that the amendment will not affect the economic position of either the participant or

Air New Zealand and will reduce the dilutionary effect on shareholders of the exercise of options.

3. A waiver from NZSX Listing Rule 8.1.3 to allow Air New Zealand to issue options under the Executive Officer Option Incentive Plan to

the Chief Executive Officer of Air New Zealand with an exercise price which may be less than 90% of the Average Market Price of

Air New Zealand’s ordinary shares at the date of issue of the shares.

The decision by NZXR of 31 October 2007 noted that Air New Zealand did not expect the percentage of shares to be issued under the

Plan to be more than 1.1% of total shares on issue and that dilution of voting rights would be negligible.

General Information

1. In 1989, the Crown issued a Notice that arises through its holding of special rights Convertible Share, the “Kiwi Share” and the power of the Kiwi Shareholder

under the Constitution. Full details of the rights pertaining to these shares are set out in the Company’s Constitution. The Kiwi Share does not confer any right

on its holder to vote at a shareholder’s meeting unless the Kiwi Share has been converted into an Ordinary Share by its holder. The Kiwi Share is not listed on

any stock exchange.