Air New Zealand 2016 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2016

17

AIR NEW ZEALAND GROUP

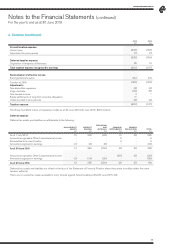

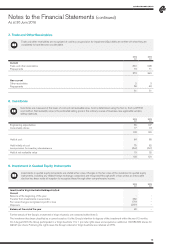

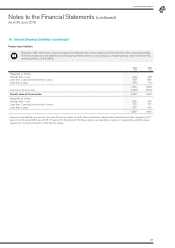

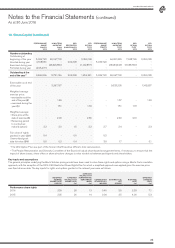

12. Intangible Assets

Computer software acquired, which is not an integral part of a related hardware item, is recognised as an intangible asset. The costs

incurred internally in developing computer software are also recognised as intangible assets where the Group has a legal right to use

the software and the ability to obtain future economic benefits from that software. Acquired software licences are capitalised on the

basis of the costs incurred to acquire and bring to use the specific software. These assets have a finite life and are amortised on a

straight-line basis over their estimated useful lives of three to six years.

INTE RNALLY

DEVELOPED

SOFTWARE

$M

EXTERN ALLY

PURCHASED

SOFTWARE

$M

CAPITAL

WORK IN

PROGRESS

$M

OTHER

$M

TOTAL

$M

2016

Carrying value as at 1 July 2015

80 4

17 1

102

Additions

Amortisation

Transfers

-

(26)

40

-

(2)

3

53

-

(43)

-

-

-

53

(28)

-

Carrying value as at 30 June 2016

Represented by:

Cost

Accumulated depreciation

94

273

(179)

5

158

(153)

27

27

-

1

1

-

127

459

(332)

Carrying value as at 30 June 2016 94 527 1127

2015

Cost

Accumulated depreciation

Provision for impairment

205

(133)

-

165

(159)

-

7

-

-

3

(1)

(1)

380

(293)

(1)

Carrying value as at 1 July 2014

Additions

Disposal of subsidiaries

Amortisation

Transfers

72

-

(1)

(22)

31

6

-

-

(3)

1

7

42

-

-

(32)

1

-

-

-

-

86

42

(1)

(25)

-

Carrying value as at 30 June 2015

Represented by:

Cost

Accumulated depreciation

80

234

(154)

4

157

(153)

17

17

-

1

1

-

102

409

(307)

Carrying value as at 30 June 2015 80 417 1102