Air New Zealand 2016 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

For the year to and as at 30 June 2016

11

AIR NEW ZEALAND GROUPAIR NEW ZEALAND GROUP

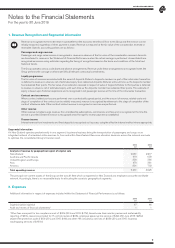

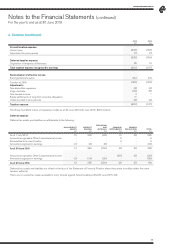

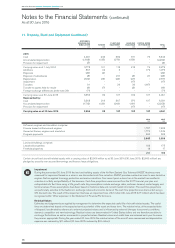

4. Taxation (continued)

Deferred taxation

Deferred tax assets and liabilities are attributable to the following:

NON-AIRCRAFT

ASSETS

$M

AIRCRAFT

REL ATED

$M

PROVISIONS

AND

ACCRUALS

$M

FINANCIAL

INSTRUMENTS

$M

PENSION

OBLIGATIONS

$M

TOTAL

$M

As at 1 July 2014

Amounts recognised in Other Comprehensive Income

Reclassified to Income Taxation

Amounts recognised in earnings

15

-

-

(1)

302

-

-

(3)

(98)

-

-

(8)

12

9

2

-

(2)

-

-

-

229

9

2

(12)

As at 30 June 2015 14 299 (106) 23 (2) 228

Amounts recognised in Other Comprehensive Income

Amounts recognised in earnings

-

(1)

-

(14)

-

(20)

(26)

-

(3)

-

(29)

(35)

As at 30 June 2016 13 285 (126) (3) (5) 164

Deferred tax assets and liabilities are offset on the face of the Statement of Financial Position where they relate to entities within the same

taxation authority.

There are no unused tax losses available to carry forward against future taxable profits (30 June 2015: Nil).

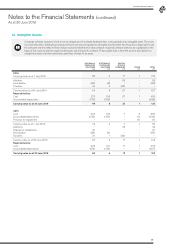

2016

$M

2015

$M

Current taxation expense

Current year

Adjustment for prior periods

(234)

(1)

(158)

(1)

Deferred taxation expense

Origination of temporary differences

(235)

35

(159)

12

Total taxation expense recognised in earnings (200) (147)

Reconciliation of effective tax rate

Earnings before taxation 663 474

Taxation at 28%

Adjustments

Non-deductible expenses

Virgin Australia

Non-taxable income

Equity settlements of long-term incentive obligations

Under provided in prior periods

(185)

(3)

(24)

4

11

(3)

(133)

(3)

(8)

1

-

(4)

Taxation expense (200) (147)

The Group has $344 million of imputation credits as at 30 June 2016 (30 June 2015: $200 million).