Air New Zealand 2016 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2016

33

AIR NEW ZEALAND GROUP

24. Financial Risk Management (continued)

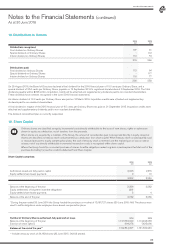

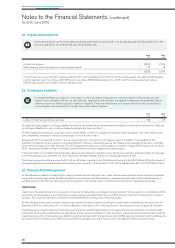

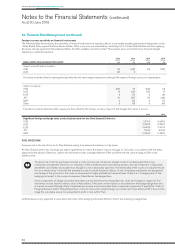

FAIR VALUE HEDGES

Underlying currency movements on aircraft designated in a fair value hedge are included within ‘Property, plant and equipment’ on the Statement of

Financial Position. The hedging instrument is included within ‘Interest-bearing liabilities’.

2016

NZ$M

2015

NZ$M

Underlying United States Dollar aircraft fair values

Hedged by: United States Dollar interest-bearing liabilities

814

(814)

944

(944)

The effective portion of changes in the fair value of both the hedged item and the hedging instrument are offset within ‘Foreign exchange

gains’ within the Statement of Financial Performance, as set out below:

Changes in fair value*** on hedged item

Changes in fair value*** on hedging instrument

(26)

26

176

(176)

- -

*** The change in fair value is that used for the purpose of assessing hedge effectiveness. No ineffectiveness arose on fair value hedges during the

year (30 June 2015: Nil).

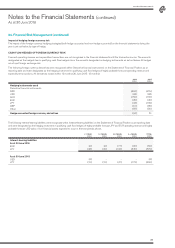

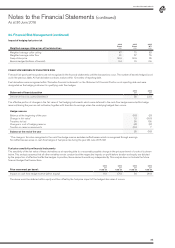

HEDGED, BUT NOT HEDGE ACCOUNTED

Where changes in the fair value of a derivative provide an offset to the underlying hedged item as it impacts earnings, hedge accounting is not

applied. The following items recognised within the line item shown in the Statement of Financial Position are denominated in a foreign currency and

give rise to foreign exchange risk.

2016

NZ$M

2015

NZ$M

Interest-bearing liabilities

Interest-bearing liabilities

Provisions

Interest-bearing assets

USD

EUR

USD

AUD

(497)

(125)

(281)

172

(556)

-

(242)

36

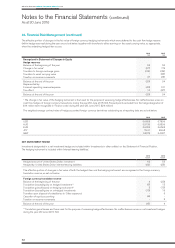

The following foreign currency derivatives were recognised within ‘Derivative financial instruments’ on the Statement of Financial Position as

at reporting date.

Hedging instruments

Derivative financial instruments

NZD

USD

AUD

EUR

Other

(681)

696

(172)

128

1

(662)

724

(37)

2

9

Not hedge accounted foreign currency derivatives (28) 36

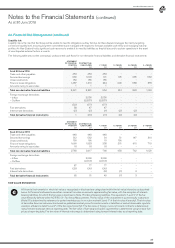

The changes in fair value of hedged items and hedging instruments during the year offset within ‘Foreign exchange gains’ within the

Statement of Financial Performance, as set out below:

Foreign currency gains/(losses) on:

Interest-bearing liabilities

Provisions

Interest-bearing assets

Derivative financial instruments

22

8

(8)

(25)

(120)

(46)

(2)

165

(3) (3)

Forward points on non-hedge accounted foreign currency derivatives of $21 million were recognised in ‘Finance costs’ during the year

(30 June 2015: $23 million).

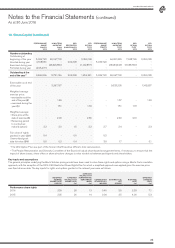

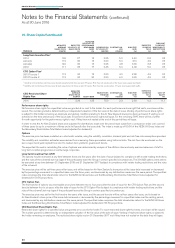

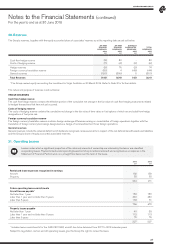

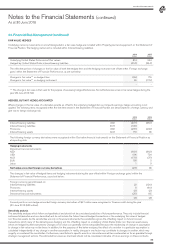

Sensitivity analysis

The sensitivity analyses which follow are hypothetical and should not be considered predictive of future performance. They only include financial

instruments (derivative and non-derivative) and do not include the future forecast hedged transactions or the underlying fair value of hedged

non-financial assets. As the sensitivities are only on financial instruments, the sensitivities ignore the offsetting impact on future forecast

transactions which many of the derivatives are hedging and the offsetting impact on underlying United States Dollar non-financial asset values,

which are hedged by debt instruments. Changes in fair value can generally not be extrapolated because the relationship of change in assumption

to change in fair value may not be linear. In addition, for the purposes of the below analyses, the effect of a variation in a particular assumption is

calculated independently of any change in another assumption. In reality, changes in one factor may contribute to changes in another, which may

magnify or counteract the sensitivities. Furthermore, sensitivities to specific events or circumstances will be counteracted as far as possible through

strategic management actions. The estimated fair values as disclosed should not be considered indicative of future earnings on these contracts.