Air New Zealand 2016 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2016

25

AIR NEW ZEALAND GROUP

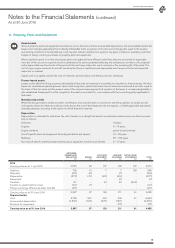

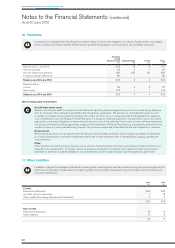

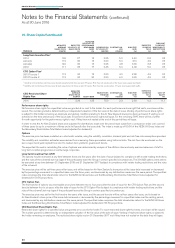

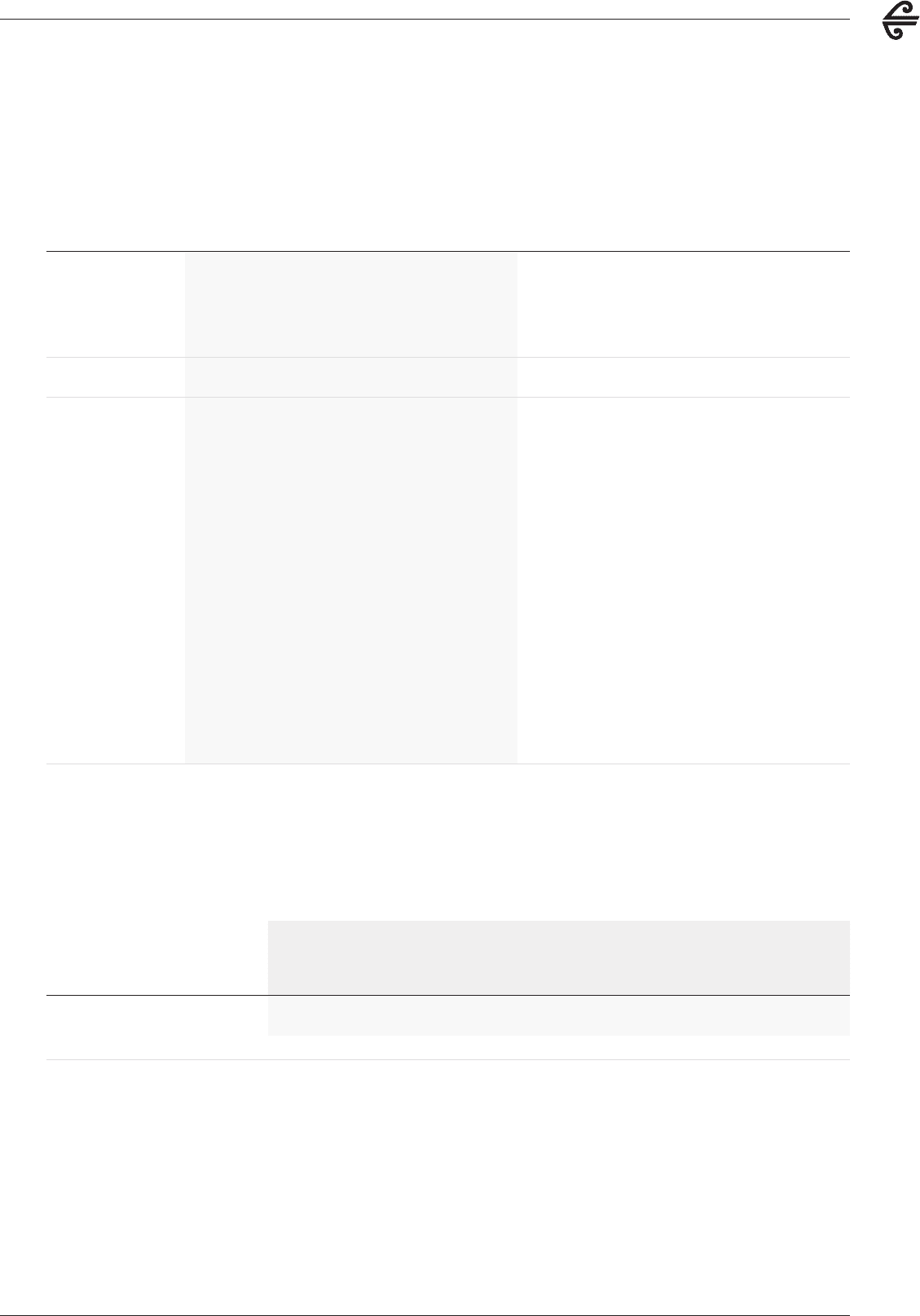

19. Share Capital (continued)

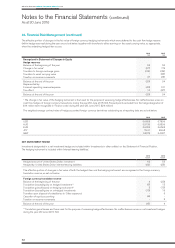

PERFORMANCE

SHARE

RIGHTS

2016

LONG-TERM

INCENTIVE

PLAN

2016

CEO

RESTRICTED

SHARE RIGHTS

2016

CFO

OPTION

PLAN

2016

PERFORMANCE

SHARE

RIGHTS

2015

LONG-TERM

INCENTIVE

PLAN

2015

CEO

OPTION

PLAN*

2015

CFO

OPTION

PLAN

2015

Number outstanding

Outstanding at

beginning of the year

Granted during year

Exercised during year

Forfeited during year

5,036,722

4,728,581

-

(495,407)

48,067,702

-

(28,326,556)

-

-

292,398

-

-

2,399,138

-

(1,142,857)

-

-

5,036,722

-

-

64,051,345

-

(15,983,643)

-

7,938,765

-

(7,938,765)

-

2,399,138

-

-

-

Outstanding at the

end of the year**

9,269,896

19,741,146

292,398

1,256,281

5,036,722

48,067,702

- 2,399,138

Exercisable as at end

of the year

Weighted average

exercise price:

- exercisable as at the

end of the year ($)

- exercised during the

year ($)

Weighted average:

- Share price at the

date of exercise ($)

- Remaining period

to contractual

maturity (years)

Fair value of rights

granted in year ($M)

Unamortised grant

date fair value ($M)

-

-

-

-

2.2

5.4

5.8

3,267,187

1.49

1.51

2.90

2.0

-

0.2

-

-

-

-

1.5

0.6

0.4

-

-

1.34

2.86

2.2

-

-

-

-

-

-

2.7

5.2

3.8

9,033,205

1.57

1.51

2.49

2.4

-

1.7

-

-

1.18

2.19

-

-

-

1,142,857

1.34

-

-

2.3

-

0.1

* The CEO Option Plan was part of the former Chief Executive Officer’s total remuneration.

** The People Remuneration and Diversity Committee of the Board will adjust share-based arrangement terms, if necessary, to ensure that the

impact of share issues, share offers or share structure changes is value neutral as between participants and shareholders.

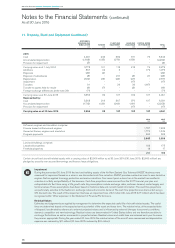

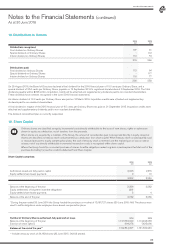

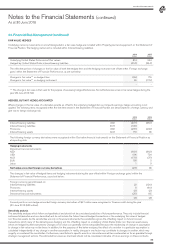

Key inputs and assumptions

The general principles underlying the Black Scholes pricing model have been used to value these rights and options using a Monte Carlo simulation

approach, with the exception of the 2016 CEO Restricted Share Rights Plan for which a simplified approach was applied given the exercise price

was fixed at issue date. The key inputs for rights and options granted in the relevant year were as follows:

WEIGHTED

AVERAGE

SHARE PRICE

(CENTS)

EXPECTED

VOLATILITY OF

SHARE PRICE

(%)

EXPECTED

VOLATILITY OF

PERFORMANCE

BENCHMARK

INDEX

(%)

CORRELATION

OF VOLATILITY

INDICES

CONTRACTUAL

LIFE

(YEARS)

RISK FREE

RATE

(%)

EXPECTED

DIVIDEND

YIELD

(%)

Performance share rights

2016 239 28 13 0.40 3.5 2.53 7.1

2015 205 26 14 0.34 3.5 4.00 5.3