Air New Zealand 2016 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2016

32

AIR NEW ZEAL AND ANNUAL FINANCIAL RESULTS 2016

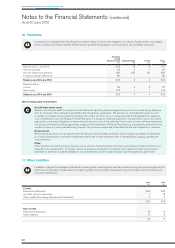

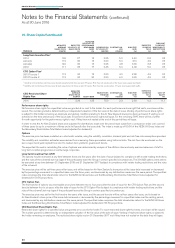

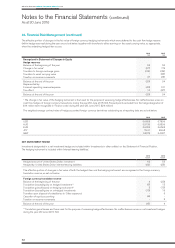

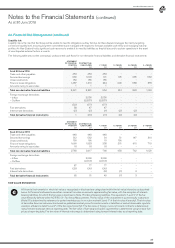

24. Financial Risk Management (continued)

The effective portion of changes in the fair value of foreign currency hedging instruments which were deferred to the cash flow hedge reserve

(within hedge reserves) during the year are set out below, together with transfers to either earnings or the asset carrying value, as appropriate,

when the underlying hedged item occurs.

2016

$M

2015

$M

Recognised in Statement of Changes in Equity

Hedge reserves

Balance at the beginning of the year

Change in fair value*

Transfers to foreign exchange gains

Transfers to asset carrying value

Taxation on reserve movements

94

(57)

(114 )

-

47

50

174

(89)

(26)

(15)

Balance at the end of the year

Represented by:

Forecast operating revenue/expense

Tax effect

(30)

(40)

10

94

131

(37)

Balance at the end of the year (30) 94

* The change in fair value of the hedging instrument is that used for the purpose of assessing hedge effectiveness. No ineffectiveness arose on

cash flow hedges of foreign currency transactions during the year (30 June 2015: Nil). Forward points excluded from the hedge designation of

$14 million were recognised in ‘Finance costs’ during the year (30 June 2015: $24 million).

The weighted average contract rates of hedge accounted foreign currency derivatives outstanding as at reporting date are set out below:

2016 2015

USD

AUD

EUR

JPY

GBP

0.6658

0.9139

0.6025

76.41

0.4572

0.7896

0.9396

0.6562

89.68

0.4997

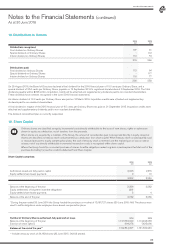

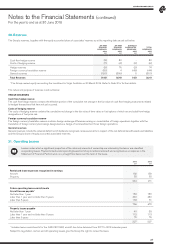

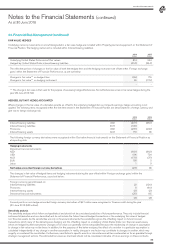

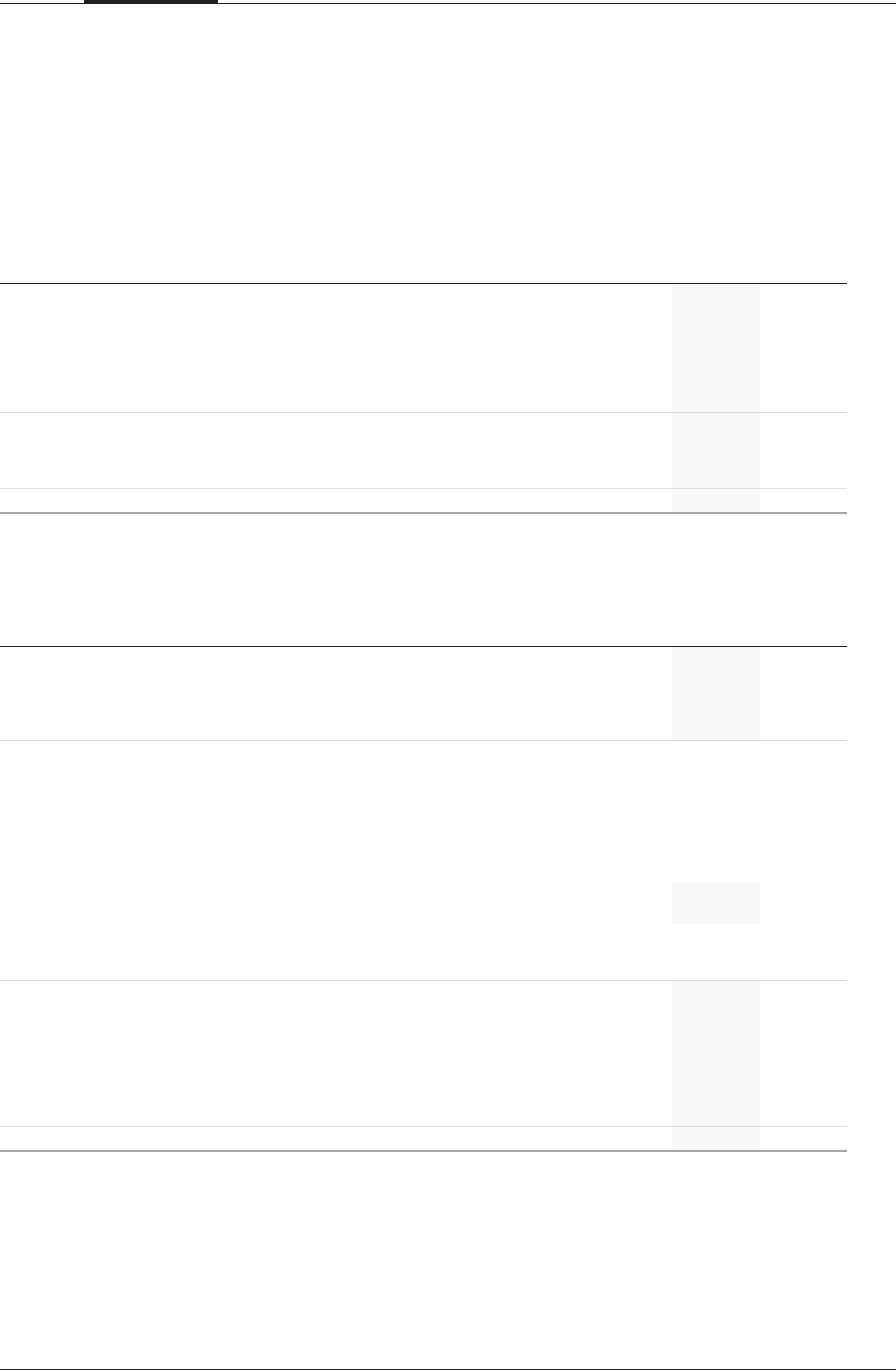

NET INVESTMENT HEDGE

Investments designated in a net investment hedge are included within ‘Investments in other entities’ on the Statement of Financial Position.

The hedging instrument is included within ‘Interest-bearing liabilities’.

2016

NZ$M

2015

NZ$M

Hedged amount of United States Dollar investment

Hedged by: United States Dollar interest-bearing liabilities

62

(62)

55

(55)

The effective portion of changes in fair value of both the hedged item and the hedging instrument are recognised in the foreign currency

translation reserve, as set out below.

Foreign currency translation reserve

Balance at the beginning of the year

Translation (losses)/gains on hedged investment**

Translation gains/(losses) on hedging instrument**

Translation (losses)/gains on unhedged investments

Transfers upon disposal of subsidiaries to ‘Other expenses’

Cessation of equity accounting

Taxation on reserve movements

4

(2)

2

(13)

-

(6)

-

(23)

12

(12)

19

5

-

3

Balance at the end of the year (15) 4

** Translation gains/losses are those used for the purpose of assessing hedge effectiveness. No ineffectiveness arose on net investment hedges

during the year (30 June 2015: Nil).