Air New Zealand 2016 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2016

16

AIR NEW ZEAL AND ANNUAL FINANCIAL RESULTS 2016

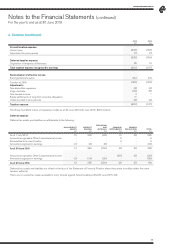

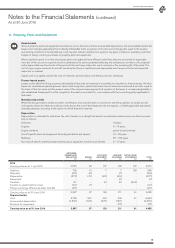

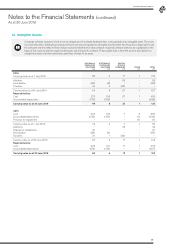

11. Property, Plant and Equipment (continued)

AIRFRAMES,

ENGINES AND

SIMULATORS

$M

SPARES

$M

PLANT AND

EQUIPMENT

$M

LAND AND

BUILDINGS

$M

CAPITAL WORK

IN PROGRESS

$M

TOTAL

$M

2015

Cost

Accumulated depreciation

Provision for impairment

4,481

(1,698)

(5)

236

(135)

-

382

(270)

-

371

(159)

-

76

-

-

5,546

(2,262)

(5)

Carrying value as at 1 July 2014

Additions

Disposals

Disposal of subsidiaries

Depreciation

Impairment

Transfers

Transfer to assets held for resale

Foreign exchange differences (refer note 24)

2,778

867

(30)

(8)

(309)

-

91

(9)

176

101

24

(4)

-

(15)

-

-

(7)

-

112

6

-

(11)

(26)

-

26

-

-

212

-

-

(3)

(27)

(17)

30

(3)

-

76

179

-

(1)

-

-

(147)

-

-

3,279

1,076

(34)

(23)

(377)

(17)

-

(19)

176

Carrying value as at 30 June 2015

Represented by:

Cost

Accumulated depreciation

Provision for impairment

3,556

5,268

(1,712)

-

99

219

(120)

-

107

367

(260)

-

192

370

(161)

(17)

107

107

-

-

4,061

6,331

(2,253)

(17)

Carrying value as at 30 June 2015 3,556 99 107 192 107 4,061

2016

$M

2015

$M

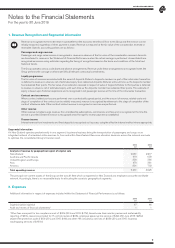

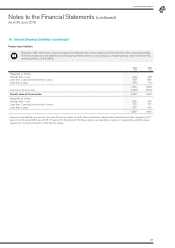

Airframes, engines and simulators comprise:

Finance leased airframes and engines

Owned airframes, engines and simulators

Progress payments

1,797

1,770

420

1,982

1,049

525

3,987 3,556

Land and buildings comprise:

Leasehold properties

Freehold properties

193

18

175

17

211 192

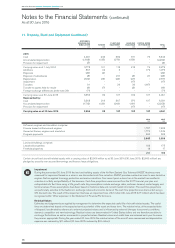

Certain aircraft and aircraft related assets with a carrying value of $2,906 million as at 30 June 2016 (30 June 2015: $2,600 million) are

pledged as security over secured borrowings and finance lease obligations.

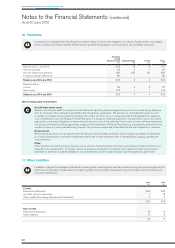

Impairment

During the year ended 30 June 2016 the land and building assets of the Air New Zealand Gas Turbines (ANZGT) business were

assessed for impairment based on a value in use discounted cash flow valuation. ANZGT provides overhaul services to aero derivative

engines that are applied to energy production and marine industries. Over recent years a down turn in the market has resulted in

a decline in activity and profitability of the business. Cash flow projections were sourced from the 2017 financial year plan and

extrapolated into the future using a 2% growth rate. Key assumptions include exchange rates, customer demand, market supply and

terminal values. These assumptions have been based on historical data and current market information. The cash flow projections

are particularly sensitive to fluctuations in exchange rates and economic demand. The cash flow projections are discounted using a

9% discount rate. The result of this impairment test was an impairment loss of $1 million (30 June 2015: $17 million) which has been

recognised within ‘Other expenses’ in the Statement of Financial Performance.

Residual Values

Estimates and judgements are applied by management to determine the expected useful life of aircraft related assets. The useful

lives are determined based on the expected service potential of the asset and lease term. The residual value, at the expected date

of disposal, is estimated by reference to external projected values and is influenced by external changes to economic conditions,

demand, competition and new technology. Residual values are denominated in United States dollars and are therefore sensitive to

exchange fluctuations as well as movements in projected values. Residual values and useful lives are reviewed each year to ensure

they remain appropriate. During the year ended 30 June 2016 the residual values of the aircraft were reassessed and depreciation

expense was reduced by $11 million (30 June 2015: reduced by $10 million).