Air New Zealand 2016 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements (continued)

As at 30 June 2016

34

AIR NEW ZEAL AND ANNUAL FINANCIAL RESULTS 2016

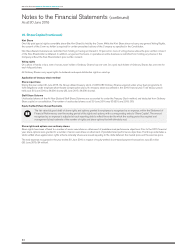

24. Financial Risk Management (continued)

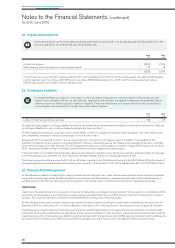

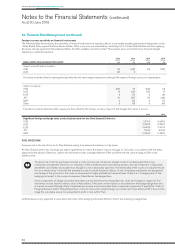

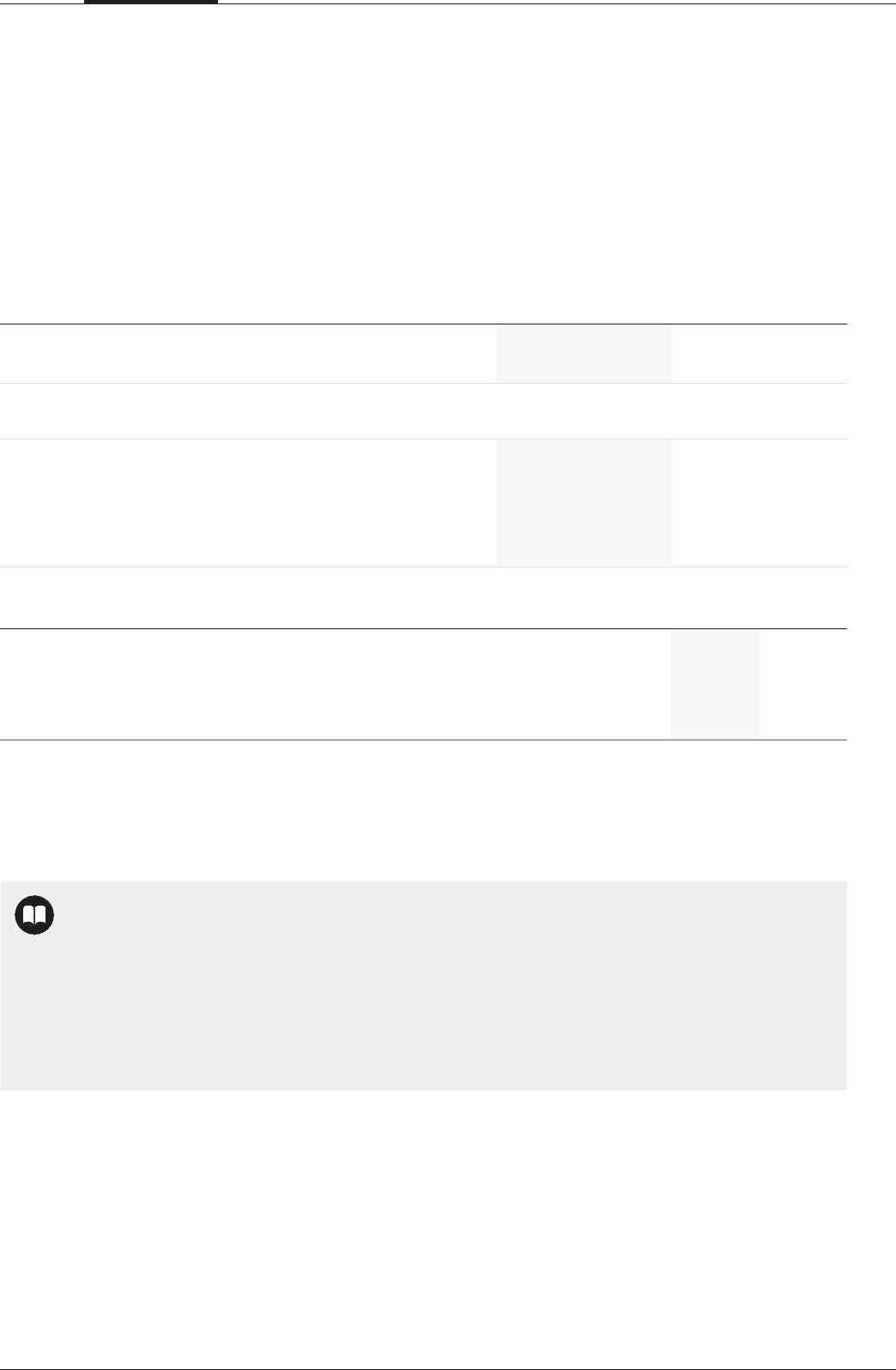

Foreign currency sensitivity on financial instruments

The following table demonstrates the sensitivity of financial instruments at reporting date to a reasonably possible appreciation/depreciation in the

United States Dollar against the New Zealand Dollar. Other currencies are evaluated by converting first to United States Dollars and then applying

the above change against the New Zealand Dollar. All other variables are held constant. This analysis does not include future forecast hedged

operating or capital transactions.

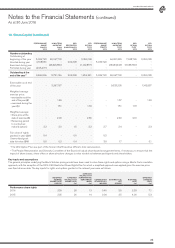

Appreciation/depreciation (US cents):

2016

NZ$M

+5c

2016

NZ$M

-5c

2015

NZ$M

+5c

2015

NZ$M

-5c

Impact on profit before taxation:

USD

AUD

59

(2)

(68)

2

69

-

(80)

-

The above would be offset in earnings through either the fair value hedge mechanism or through the impact of foreign currency on depreciation.

Impact on equity:

USD

AUD

EUR

JPY

GBP

Other

(66)

10

6

41

4

5

76

(12)

(7)

(47)

(5)

(5)

(59)

(13)

3

29

6

5

68

15

(4)

(34)

(7)

(6)

The above would be deferred within equity and then offset by the foreign currency impact of the hedged item when it occurs.

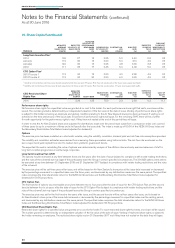

2016 2015

Significant foreign exchange rates used at balance date for one New Zealand Dollar are:

USD

AUD

EUR

JPY

GBP

0 .7110

0.9550

0.6400

73.20

0.5290

0.6850

0.8920

0.6100

83.90

0.4350

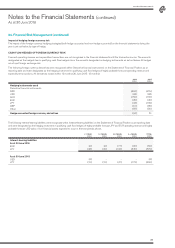

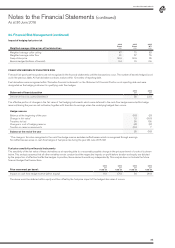

FUEL PRICE RISK

Fuel price risk is the risk of loss to Air New Zealand arising from adverse fluctuations in fuel prices.

Air New Zealand enters into fuel swap and option agreements to reduce the impact of price changes on fuel costs in accordance with the policy

approved by the Board of Directors. Uplift in the first three months is hedged between 50% and 80% with the volume falling to 20% in the

twelfth month.

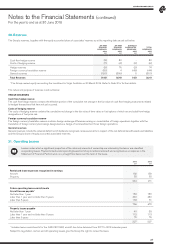

The price risk of jet fuel purchases includes a crude oil price risk component, despite crude oil not being specified in any

contractual arrangement. Based on an evaluation of the market structure and refining process, this risk component is separately

identifiable and reliably measurable even though it is not contractually specified. The relationship of the crude oil component to jet

fuel as a whole varies in line with the published crude oil and jet fuel price indices. Crude oil hedging instruments are designated

as a hedge of the price risk in the crude oil component of highly probable jet fuel purchases. There is a 1:1 hedging ratio of the

hedging instrument to the crude oil component identified as the hedged item.

Some components of hedge accounted derivatives are excluded from the designated risk. Cash flow hedges in respect of fuel

derivatives include only the intrinsic value of fuel options. Time value on fuel options is excluded from the hedge designation and

is marked to market through Other Comprehensive Income and accumulated within a separate component of equity (the ‘Costs of

Hedging Reserve’ within ‘Hedge Reserves’), until such time as the related hedge accounted cash flows affect profit or loss. At this

stage the cumulative amount is reclassified to profit or loss within ‘Fuel’.

Ineffectiveness is only expected to arise where the index of the hedging instrument differs to that of the underlying hedged item.