Air New Zealand 2016 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEAL AND ANNUAL FINANCIAL RESULTS 2016

Notes to the Financial Statements (continued)

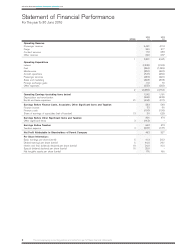

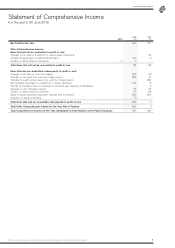

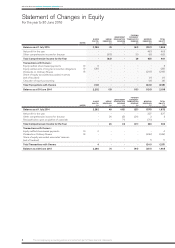

For the year to 30 June 2016

10

AIR NEW ZEAL AND ANNUAL FINANCIAL RESULTS 2016

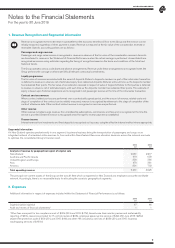

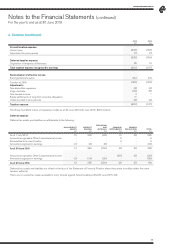

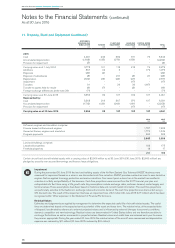

3. Other Significant Items

Other significant items are items of revenue or expenditure which due to their size and nature warrant separate disclosure to assist

with the understanding of the financial performance of the Group.

Upon loss of significant influence over an associated company, the Group measures the retained interest at fair value. At the

date of cessation of equity accounting, the difference between the carrying amount of the equity accounted investment and the

fair value of the investment, together with amounts previously recognised in equity reserves are recognised as a gain or loss on

cessation of equity accounting in the Statement of Financial Performance.

2016

$M

2015

$M

Virgin Australia partial divestment:

- Fair value movement on sold interest (including disposal costs)

- Fair value movement on 2.5% retained interest

- Loss on cessation of equity accounting of associate

(63)

(21)

(2)

-

-

-

Settlement of legal claim (including associated legal costs)

(86)

(57)

-

-

(143) -

With effect from 30 March 2016, the Company announced that it was exploring options with respect to its shareholding in Virgin Australia,

including a possible sale, and the Group’s representative on the Virgin Australia Board of Directors resigned. The Group no longer had the

ability to exercise significant influence over Virgin Australia due to the change in composition of other shareholdings, lack of representation

on the Board and as a result of the commencement of a sales process, and ceased to apply the equity method of accounting to the

investment from that date. From 30 March 2016 the investment was classified as an Investment in quoted equity instruments and was stated

at fair value with changes in fair value being recognised through profit or loss. In June 2016, the Company sold the majority of its shareholding

(of 810,613,877 shares for A$0.33 per share) with a residual interest of 2.5% (or 102,889,331 shares valued at A$0.205) being held at

30 June 2016 (refer Note 9).

On 7 May 2016 the Group agreed to settle a class action compensation claim in the United States made in respect of allegations of

anti-competitive conduct against many airlines for pricing in the air cargo business. Air New Zealand does not admit to being part of the

alleged conspiracy. The settlement was reached due to the deemed unacceptable risk on the Group’s financial position arising from the

calculation of potential damages awarded under the United States class action system which trebles damages for anti-competitive liabilities.

The negotiated settlement amount was for US$35 million. In 2011 the Group successfully defended its position with the United States

Department of Justice and was released from the criminal investigation with no prosecutions having been commenced.

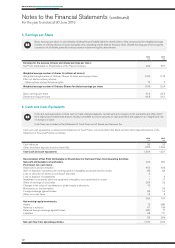

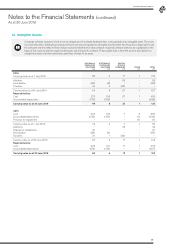

4. Taxation

Current and deferred taxation are calculated on the basis of tax rates enacted or substantively enacted at reporting date, and are

recognised in the income statement except when the tax relates to items charged or credited to other comprehensive income, in

which case the tax is also recognised in other comprehensive income.

Deferred income taxation is recognised in respect of temporary differences arising between the tax bases of assets and liabilities

and their carrying amounts in the financial statements.

Deferred income tax assets and unused tax losses are only recognised to the extent that it is probable that future taxable amounts

will be available against which to utilise those temporary differences and losses.

Judgements are required about the application of income tax legislation. These judgements and assumptions are subject to risk

and uncertainty, hence there is a possibility that changes in circumstances will alter expectations, which may impact the amount of

current and deferred tax assets and liabilities recognised in the Statement of Financial Position and the amount of other tax losses

and temporary differences not yet recognised. In such circumstances, some or all of the carrying amounts of recognised tax assets

and liabilities may require adjustment, resulting in a corresponding credit or charge to the Statement of Financial Performance.