Air New Zealand 2016 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2016 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

AIR NEW ZEAL AND ANNUAL FINANCIAL RESULTS 2016

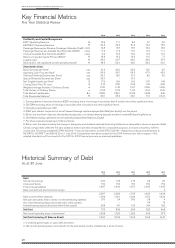

Key Financial Metrics

Five Year Statistical Review

2016 2015 2014 2013 2012

Profitability and Capital Management

EBIT1/Operating Revenue

EBITDRA2/Operating Revenue

Passenger Revenue per Revenue Passenger Kilometre (Yield)

Passenger Revenue per Available Seat Kilometre (RASK)

Cost per Available Seat Kilometre (CASK)3

Return on Invested Capital Pre-tax (ROIC)4

Liquidity ratio5

Gearing (incl. net capitalised aircraft operating leases)6

%

%

cents

cents

cents

%

%

%

15.9

29.5

13.5

11. 3

9.3

18.8

36.0

48.6

11.1

23.6

13.7

11. 6

10.6

16.2

29.7

52.4

8.4

21.6

13.7

11. 5

10.9

14.3

29.2

42.9

6.7

19.4

13.6

11. 4

11. 2

11. 6

29.9

39.3

3.5

15.9

13.5

11.1

11. 6

7.1

27.2

46.1

Shareholder Value

Basic Earnings per Share7

Operating Cash Flow per Share7

Ordinary Dividends Declared per Share7

Special Dividends Declared per Share7

Net Tangible Assets per Share7

Closing Share Price 30 June

Weighted Average Number of Ordinary Shares

Total Number of Ordinary Shares

Total Market Capitalisation

Total Shareholder Returns8

cps

cps

cps

cps

$

$

m

m

$m

%

41.3

95.6

20.0

25.0

1.76

2.10

1,122

1,123

2,352

20.0

29.2

98.1

16.0

-

1.66

2.55

1,118

1,122

2,861

25.6

23.9

65.5

10.0

10.0

1.60

2.08

1,101

1,114

2,318

24.0

16.5

67.9

8.0

-

1.57

1.49

1,096

1,104

1,639

11. 6

6.5

42.9

5.5

-

1.48

0.86

1,096

1,100

946

(16.1)

1. Earnings before interest and taxation (EBIT) excluding share of earnings of associates (net of taxation) and other significant items

2. EBITDRA excluding share of earnings of associates (net of taxation) and other significant items

3. Operating expenditure per ASK

4. (EBIT plus interest component of aircraft leases)/average capital employed (Net Debt plus Equity) over the period

5. (Bank and short-term deposits, interest-bearing deposits, non interest-bearing deposits and bank overdraft)/Operating Revenue

6. Net Debt (including capitalised aircraft operating leases)/(Net Debt plus Equity)

7. Per-share measures based upon Ordinary Shares

8. Return over five years including the change in share price and dividends received (assuming dividends are reinvested in shares on payment date)

Certain comparatives within the five year statistical review have been reclassified for comparative purposes, to ensure consistency with the

current year. The Group adopted NZ IFRS 9 (2010) - Financial Instruments and NZ IFRS 9 (2013) - Hedge Accounting and amendments to

NZ IFRS 9, NZ IFRS 7 and NZ IAS 39 on 1 July 2014. Comparatives have been restated for the 2014 financial year only in respect of the

adopted standards and the amounts for the 2012 to 2013 financial years are as previously published.

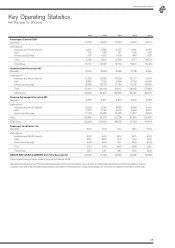

Historical Summary of Debt

As at 30 June

2016

$M

2015

$M

2014

$M

2013

$M

2012

$M

Debt

Secured borrowings

Unsecured bonds

Finance lease liabilities

Bank overdraft and short-term borrowings

930

150

1,487

-

512

150

1,660

-

213

150

1,370

-

84

150

1,395

-

97

150

1,445

2

Bank and short-term deposits

Net open derivatives held in relation to interest-bearing liabilities1

Non interest-bearing deposit (included within Other assets)

Interest-bearing deposits (included within Other assets)

2,567

1,594

(17)

-

288

2,322

1,321

24

-

141

1,733

1,234

(10)

-

125

1,629

1,150

28

44

184

1,694

1,029

4

13

180

Net Debt 702 836 384 223 468

Net aircraft operating lease commitments2 1,288 1,323 1,022 945 973

Net Debt (including off Balance Sheet) 1,990 2,159 1,406 1,168 1,441

1. Unrealised gains/losses on open debt derivatives

2. Net aircraft operating lease commitments for the next twelve months, multiplied by a factor of seven