XM Radio 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

XM SATELLiTE RADiO 2 001 Annual Report

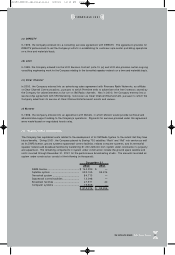

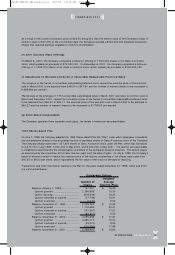

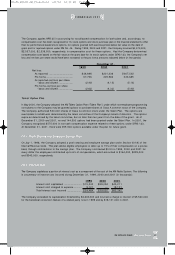

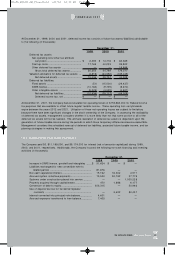

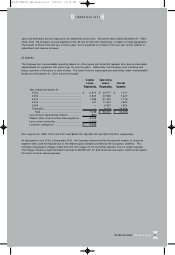

At December 31, 1999, 2000 and 2001, deferred income tax consists of future tax assets/ (liabilities) attributable

to the following (in thousands):

December 3 1,

1999 20 00 20 01

Deferred tax assets:

Net operating loss/ other tax attribute

carryovers ............................................. $ 2,490 $ 14,71 6 $ 60 ,369

Start-up costs ........................................... 17,765 40 ,033 99,822

Other deferred tax assets ......................... — — 18,886

Gross total deferred tax assets ............... 20 ,255 54,749 179,077

Valuation allowance for deferred tax assets ... (4,81 9) (24,992) (135,049)

Net deferred assets ............................... 15,436 29,757 44,028

Deferred tax liabilities:

Fixed assets ............................................. (51) (15,500) (29,437)

DARS license............................................. (10,160) (9,735) (9,67 0)

Other intangible assets ............................. (5,225) (4,522) (4,921)

Net deferred tax liabilities ....................... (15,436) (29,757) (44,028)

Deferred income tax, net ....................... $ — $ — $ —

At December 31, 2001, the Company had accumulated net operating losses of $150,884,000 for Federal income

tax purposes that are available to offset future regular taxable income. These operating loss carryforwards

expire between the years 2012 and 2021. Utilization of these net operating losses are subject to limitations

because there have been significant changes in the stock ownership of the Company. In assessing the realizability

of deferred tax assets, management considers whether it is more likely than not that some portion or all of the

deferred tax assets will not be realized. The ultimate realization of deferred tax assets is dependent upon the

generation of future taxable income during the periods in which those temporary differences become deductible.

Management considers the scheduled reversal of deferred tax liabilities, projected future taxable income, and tax

planning strategies in making this assessment.

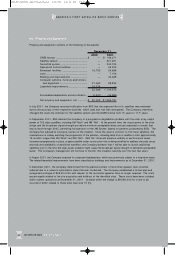

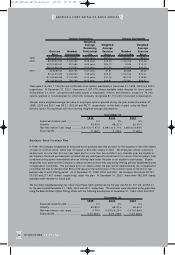

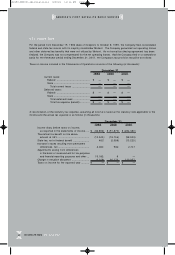

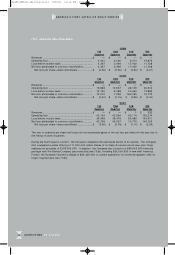

(14) Supplemental Cash Flows Disclosures

The Company paid $0, $11,198,000, and $9,1 74,000 for interest (net of amounts capitalized) during 1999,

2000, and 2001, respectively. Additionally, the Company incurred the following non-cash financing and investing

activities (in thousands):

December 3 1,

1999 20 00 20 01

Increase in DARS license, goodwill and intangibles ...... $ 51,624 $ —$—

Liabilities exchanged for new convertible note to

related parties ...................................................... 8 1,676 — —

Non-cash capitalized interest ....................................... 15,162 16,302 4,571

Accrued system milestone payments ........................... 15 ,500 30 ,192 37,775

Systems under construction placed into service .......... — — 1,000,228

Property acquired through capital leases ..................... 470 1,688 6,177

Conversion of debt to equity ....................................... 353,315 — 50,992

Use of deposit/ escrow for terrestrial repeater

contracts ............................................................ — 3,422 80,4 31

Interest converted into principal note balance............... 4,601 — —

Accrued expenses transferred to loan balance ............. 7,405 — —

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:33 PM Page 35