XM Radio 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

XM SATELLiTE RADiO 2 001 Annual Report

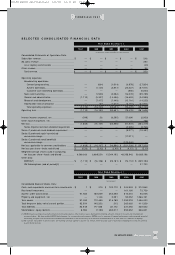

•We completed a follow-on offering of 11,500,000 shares of our Class A common stock, yielding net

proceeds of $126 .5 million;

•These issuances caused the conversion price of the Series C preferred stock to be adjusted to $22.17

and the exercise price of the warrants sold in March 20 00 to be adjusted to $45.27 and number of

warrant shares to be increased to 8.776 003 per warrant.

Uses of Funds. Of the approximately $1.5 billion of funds raised to date, as of December 31, 2001, we have

paid $1 .0 billion in capital expenditures, including approximately $9 0.0 million for our DARS license which has

been paid for in full, and incurred $40 9.6 million in operating expenses.

Satellite Contract. Under our satellite contract, Boeing Satellite Systems International, Inc. has delivered two

satellites in orbit and is to complete construction of a ground spare satellite. Boeing Satellite has also provided

ground equipment and software used in the XM Radio system and certain launch and operations support services.

The contract also provides for in-orbit incentives to be earned depending on the performance of the in-orbit satellites

over their useful lives. Such payments could total up to an additional $70.2 million over the useful lives of the

satellites. We have deferred $31.0 million of payments under this contract to December 2006 at an interest

rate of 8 percent. As of December 31 , 2001, we had paid approximately $470.4 million under our satellite

contract and have recognized an additional $741 ,000 in accrued milestone payments.

Launch Insurance. As of December 31, 2001, we had launched both of our satellites and paid $44.1 million

with respect to launch insurance, which has been capitalized to in-service satellites.

Terrestrial Repeater System. As of December 31, 2001, we incurred aggregate costs of approximately

$243.5 million for a terrestrial repeater system. These costs covered the capital cost of the design, development

and installation of a system of terrestrial repeaters to cover approximately 60 cities and metropolitan areas. In

August 1999, we signed a contract with LCC International, Inc., a related party, for engineering and site preparation.

As of December 31 , 2001, we had paid $109.9 million under this contract and accrued an additional $15.4 million.

We have also engaged other companies to perform site preparation services. We also entered into a contract

effective October 22, 1999, with Hughes Electronics Corporation for the design, development and manufacture

of the terrestrial repeaters. Payments under this contract are expected to be approximately $1 28.0 million.

As of December 31 , 2001, we had paid $95.8 million under this contract and accrued an additional $7.7 million.

Ground Segment. As of December 31, 20 01, we incurred aggregate ground segment costs of approximately

$110.9 million. These costs were related to the satellite control facilities, programming production studios and

various other equipment and facilities.

DARS License. In October 1997, we received one of two satellite radio licenses issued by the FCC. We have

paid approximately $90.0 million for this license, including the initial bid right. There are no further payments

required relating to the license.

Purchase of Building. In August 2 001, we acquired our corporate headquarters building for $3 4.0 million.

Operating Expenses. From inception through December 31 , 2001, we have incurred total operating expenses

of $409.6 million.

Joint Development Agreement Funding Requirements. We may require additional funds to pay license fees or

make contributions toward the development of the technologies used to develop a unified standard for satellite

radios under our joint development agreement with Sirius Radio. Each party is obligated to fund one half of the

development cost for such technologies. Each party will be entitled to license fees or a credit towards its one

half of the cost based upon the validity, value, use, importance and available alternatives of the technology it

contributes. In our discussions we have yet to agree on the validity, value, use, importance and available

alternatives of our respective technologies. If we fail to reach agreement, the fees or credits may be determined

through binding arbitration. We cannot predict at this time the amount of license fees or contribution payable by

us or Sirius Radio or the size of the credits to us and Sirius Radio from the use of the other’s technology. This

may require significant additional capital.

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 7