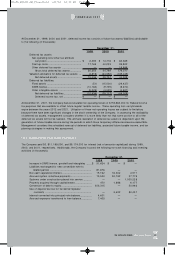

XM Radio 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 XM SATELLiTE RADiO 2 0 0 1 Annual Report

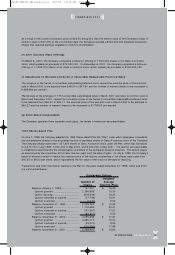

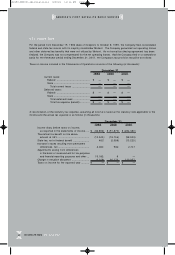

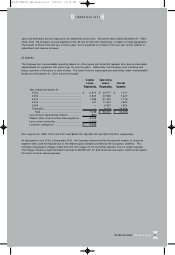

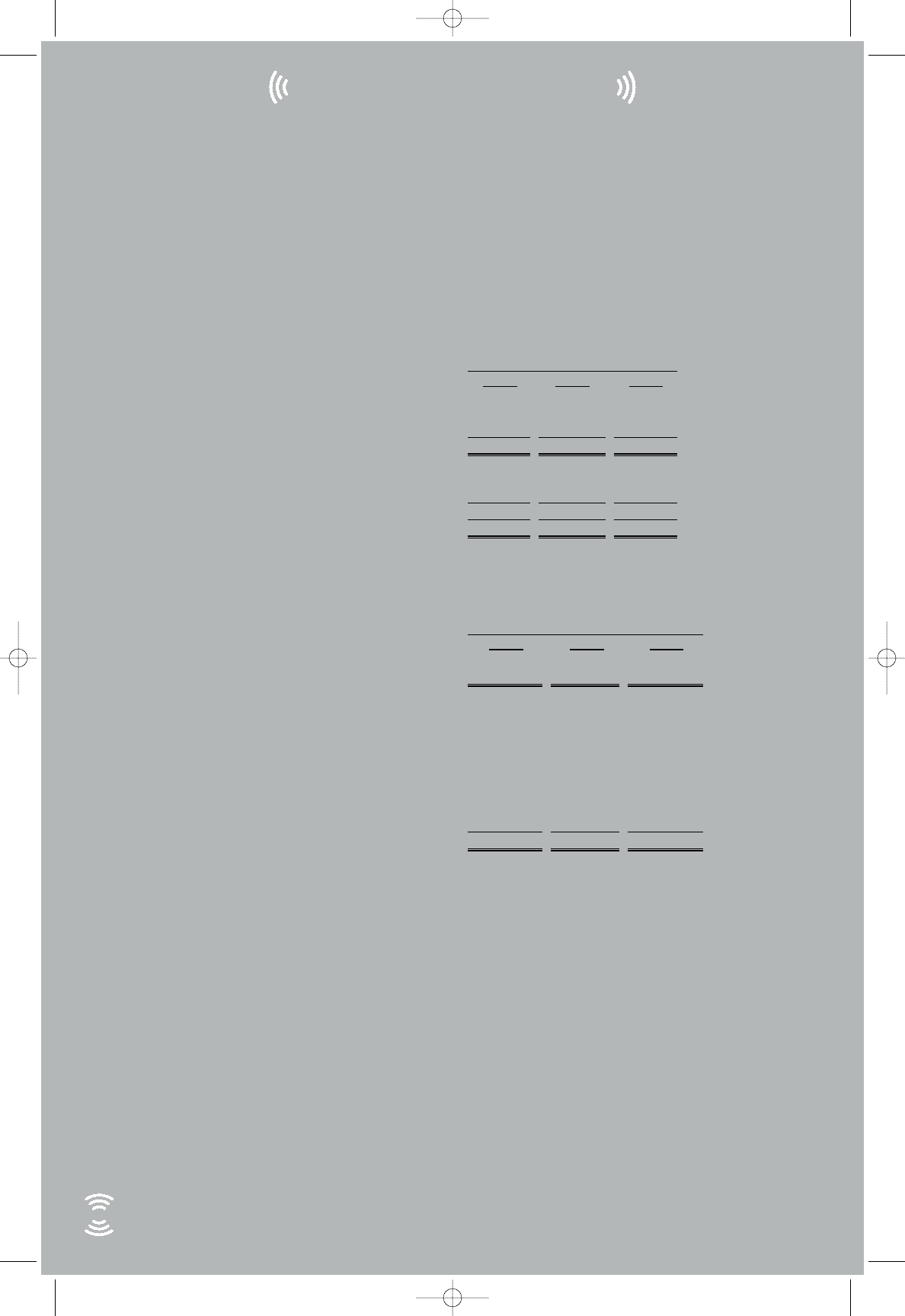

(13) Income Taxes

For the period from December 15, 1992 (date of inception) to October 8, 1999, the Company filed consolidated

federal and state tax returns with its majority stockholder Motient. The Company generated net operating losses

and other deferred tax benefits that were not utilized by Motient. As no formal tax sharing agreement has been

finalized, the Company was not compensated for the net operating losses. Had the Company filed on a stand-alone

basis for the three-year period ending December 31, 2001, the Company’s tax provision would be as follows:

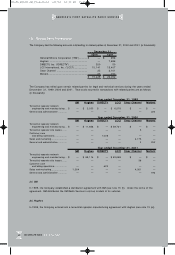

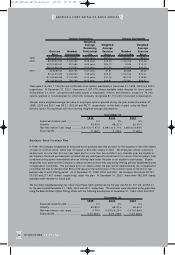

Taxes on income included in the Statements of Operations consists of the following (in thousands):

December 3 1,

1999 20 00 20 01

Current taxes:

Federal ........................................... $ —$ —$ —

State ............................................... — ——

Total current taxes ....................... — ——

Deferred taxes:

Federal ........................................... $ —$ —$ —

State ............................................... — ——

Total deferred taxes ..................... — ——

Total tax expense (benefit)............. $ —$ —$ —

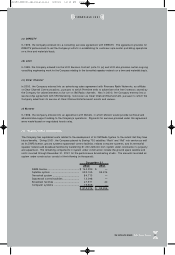

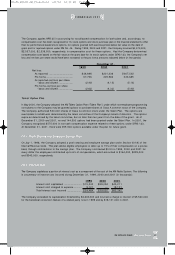

A reconciliation of the statutory tax expense, assuming all income is taxed at the statutory rate applicable to the

income and the actual tax expense is as follows (in thousands):

December 3 1,

1999 20 00 20 01

Income (loss) before taxes on income,

as reported in the statements of income ..... $ (36,896 ) $ (51,873) $ (284,380)

Theoretical tax benefit on the above

amount at 35% ......................................... (12,545) (18,156) (99,533)

State tax, net of federal benefit ..................... 462 (2,588) (13,225)

Increase in taxes resulting from permanent

differences, net ......................................... 2,060 562 2,701

Adjustments arising from differences

in the basis of measurement for tax purposes

and financial reporting purposes and other ... 13,182 9 —

Change in valuation allowance ....................... (3,159) 20,173 11 0,057

Taxes on income for the reported year ........... $ — $ —$—

AMERiCA’S FiRST SATELLiTE RADiO SERViCE

81690_XM2001_AR_Financials 4/9/02 12:33 PM Page 34