XM Radio 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

XM SATELLiTE RADiO 2 001 Annual Report

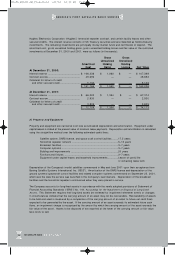

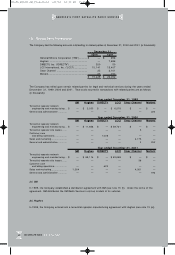

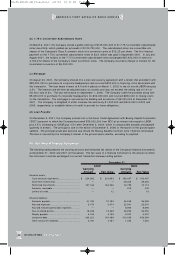

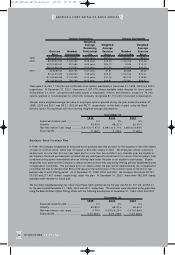

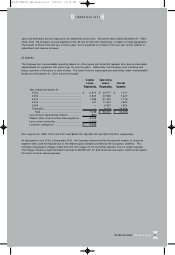

The carrying amounts shown in the table are included in the consolidated balance sheets under the indicated captions.

The following methods and assumptions were used to estimate the fair value of each class of financial instruments:

Cash and cash equivalents, short-term investments, accounts receivable, prepaid and other current assets,

other assets, accounts payable, accrued expenses, accrued network optimization expenses, due to related

parties, royalty payable and other non-current liabilities: The carrying amounts approximate fair value because

of the short maturity of these instruments.

Restricted investments: The fair values of debt securities (held-to-maturity investments) are based on quoted

market prices at the reporting date for those or similar investments.

Letters of credit: The value of the letters of credit is based on the fees paid to obtain the letters of credit.

Long-term debt: The fair value of the Company’s long-term debt is determined by either estimation by discounting

the future cash flows of each instrument at rates currently offered to the Company for similar debt instruments

of comparable maturities by the Company’s bankers or by quoted market prices at the reporting date for the

traded debt securities (the carrying value of XMSR’s 14% senior secured notes is significantly less than face

value because the notes were sold at a discount for value allocated to the related warrants).

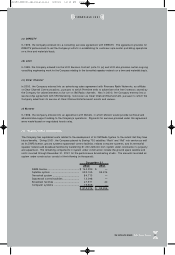

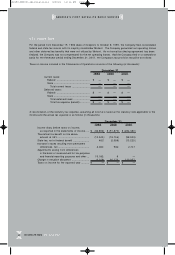

(10) Equity

(a) Recapitalization

Concurrent with the transaction discussed in note 6, the Company’s capital structure was reorganized.

The Company’s common stock was converted into the newly authorized Class B common stock, which has

three votes per share. The Company also authorized Class A common stock, which is entitled to one vote

per share, and non-voting Class C common stock.

The Company authorized 60,000,000 shares of preferred stock, of which 15,000 ,000 shares are designated

Series A convertible preferred stock, 3,000,000 shares are designated 8.25% Series B convertible redeemable

preferred stock, and 25 0,000 shares are designated 8.25% Series C convertible redeemable preferred stock,

which are all par value $0.01 per share. The Series A convertible preferred stock is convertible into Class A

common stock at the option of the holder. The Series A preferred stock is non-voting and receives dividends,

if declared, ratably with the common stock. The Series B and C convertible redeemable preferred stock are

convertible to Class A common stock at the option of the holder and are mandatorily redeemable in Class A

common stock. The Series B convertible redeemable preferred stock is non-voting. The Series C redeemable

preferred stock contains voting and certain veto rights.

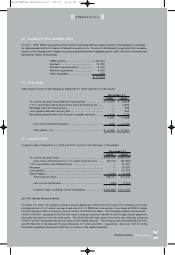

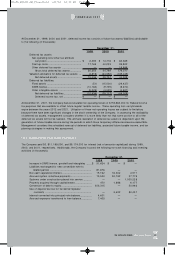

On January 15, 1999, the Company issued a convertible note to Motient for $21,419,000. This convertible

note bore interest at LIBOR plus 5% per annum and was due on December 31, 2004. The principal and interest

balances were convertible at prices of $16.35 and $9 .52, respectively, per Class B common share. Following

the transaction discussed in note 6, the Company issued a convertible note maturing December 31, 2004 to

Motient for $81,676,000 in exchange for the $54 ,536,000 subordinated convertible notes payable to a former

investor, $ 6,889,000 in demand notes to a former investor, $ 20,2 51,0 00 in accrued interest to a former

investor and all of the former investor’s outstanding options to acquire the Company’s common stock. This note

bore interest at LIBOR plus 5% per annum. The note was convertible at Motient’s option at $8.65 per Class B

common share. The Company took a one-time $5,520,000 charge to interest due to the beneficial conversion

feature of this note. These Motient convertible notes, along with $3,87 0,000 of accrued interest, were converted

into 11,182,926 shares of Class B common stock upon the initial public offering.

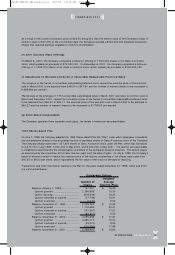

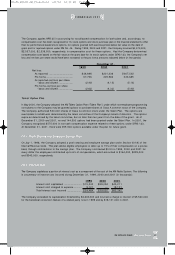

At the closing of the transaction discussed in note 6, the Company issued an aggregate $25 0.0 million of Series

A subordinated convertible notes to six new investors — GM, $50.0 million; Clear Channel Investments, Inc., $75.0

million; DIRECTV Enterprises, Inc., $5 0.0 million; and Columbia Capital, Telcom Ventures, L.L.C. and Madison

Dearborn Partners, $75.0 million. The Series A subordinated convertible notes issued by the Company were

convertible into shares of the Company’s Series A convertible preferred stock (in the case of notes held by General

Motors Corporation and DIRECTV) or Class A common stock (in the case of notes held by the other investors) at

the election of the holders or upon the occurrence of certain events, including an initial public offering of a prescribed

size. The conversion price was $9.52 aggregate principal amount of notes for each share of the Company’s

stock. These notes, along with $6,849,000 of accrued interest, were converted into 16,179,755 shares of

Class A common stock and 10,786,504 shares of Series A preferred stock upon the initial public offering.

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 29