XM Radio 2001 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 XM SATELLiTE RADiO 2 0 0 1 Annual Report

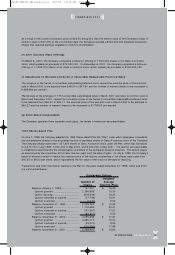

(b) 7.75% Convertible Subordinated Notes

On March 6, 2001, the Company closed a public offering of $125,000,000 of its 7.7 5% convertible subordinated

notes due 2006, which yielded net proceeds of $120,700,000. The subordinated notes are convertible into

shares of the Company’s Class A common stock at a conversion price of $12.23 per share. The first interest

payment on the 7.75% convertible subordinated notes of $3 .0 million was paid in September 2001. In July and

August 2001, the holders of the 7.75% convertible subordinated notes exchanged $45,900,000 of notes for

4,194,272 shares of the Company’s Class A common stock. The Company incurred a charge to interest for the

incentivized conversion of $6,500,000.

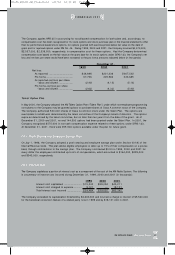

(c) Mortgage

On August 24, 20 01, the Company entered into a loan and security agreement with a lender that provided it with

$29,000,000 to purchase its corporate headquarters and incurred $500,000 in financing costs associated with

the transaction. The loan bears interest at 8% until it adjusts on March 1, 2002 to the six month LIBOR rate plus

3.5%. The interest rate will then be adjusted every six months and may not exceed the ceiling rate of 14% or

the floor rate of 8%. The loan will mature on September 1, 2006. The Company used the proceeds along with

$5,000,000 to purchase its corporate headquarters for $34,00 0,000 and incurred $800,000 in closing costs

on the transaction. The mortgage is secured by the building and an escrow of $2 ,000,000 at December 31,

2001. The Company is obligated to either increase the escrow by $1,000,00 0 and $500,000 in 2002 and

2003, respectively, or establish letters of credit to provide for these obligations.

(d) Loan Payable

On December 5, 2001, the Company entered into a Customer Credit Agreement with Boeing Capital Corporation

(“BCC”) pursuant to which the Company borrowed $35,0 00,0 00 from BCC at an interest rate equal to LIBOR

plus 3.5%, increasing to LIBOR plus 4 .5% after December 5, 2003, which is compounded annually and payable

quarterly in arrears. The principal is due on the earlier of December 5, 2006 or the launch of the ground spare

satellite. The principal would also become due should the Boeing Satellite Contract (note 15(d)) be terminated.

The loan is secured by the Company’s interest in the ground spare satellite, excluding its payload.

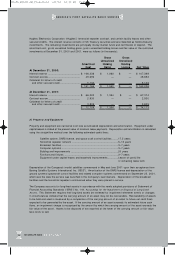

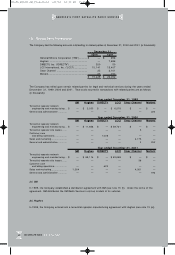

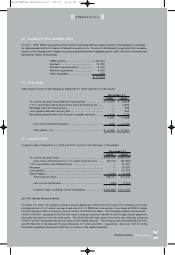

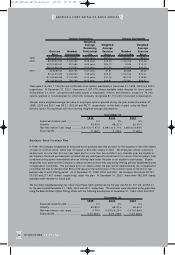

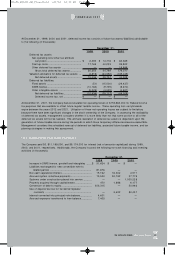

(9) Fair Value of Financial Instruments

The following table presents the carrying amounts and estimated fair values of the Company’s financial instruments

at December 31, 2000 and 2001 (in thousands). The fair value of a financial instrument is the amount at which

the instrument could be exchanged in a current transaction between willing parties.

December 31,

2000 20 01

Carrying Carrying

Amount Fair Value Amount Fair Value

Financial assets:

Cash and cash equivalents……………….. ........ $ 22 4,90 3 $ 224,9 03 $ 182,49 7 $ 1 82 ,4 97

Short-term investments…………………... ........ — —28,3 55 28,35 5

Restricted investments…………………… ........ 161,16 6 162,2 26 72,75 9 74,113

Accounts receivable… … … … … … … … ... .......... — —478 478

Letters of credit………………………….. .......... —12 —1 3

Financial liabilities:

Accounts payable………………………... .......... 31,793 31,793 3 6,55 9 36,55 9

Accrued expenses………………………... ........ 3,47 4 3,474 22 ,5 41 22,541

Accrued network optimization expenses…........ — —8,595 8,595

Due to related parties……………………. ........ 1 5,42 9 15 ,4 29 2 6,05 2 26,05 2

Royalty payable………………………….. .......... 5,165 5,165 5,3 57 5,357

Long-term debt…………………………... .......... 263,2 21 181 ,4 86 413,43 0 456,2 94

Other non-current liabilities……………... .......... 4,7 87 4,787 1,3 54 1,354

AMERiCA’S FiRST SATELLiTE RADiO SERViCE

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 28