XM Radio 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 XM SATELLiTE RADiO 2 0 0 1 Annual Report

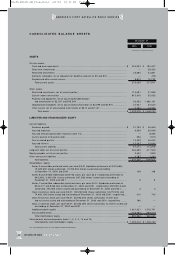

The long-term debt payments due in 2006 and beyond include the maturity of our $ 79.1 million of 7.75% conver tible

subordinated notes, our $29.0 million loan to finance the purchase of our headquarters facility and our $35.0

million borrowing from Boeing, all of which come due in 2006, and the maturity of XM's $325.0 million of 14%

senior secured notes, which come due in 2010.

Related Party Transactions

We developed strategic relationships with certain companies that were instrumental in the construction and development

of our system. In connection with our granting to them of large supply contracts, some of these strategic companies

have become large investors in us and have been granted rights to designate directors or observers to our board

of directors. The negotiation of these supply contracts and investments primarily occurred at or prior to the time

these companies became related parties, except in the case of Motient Corporation, which was our founder.

We are a party to a long-term distribution agreement with the OnStar division of General Motors that provides for

the installation of XM radios in General Motors vehicles, as more fully described above under the heading “Liquidity

and Capital Resources—Contractual Obligations and Commercial Commitments.” In connection with the development

of our terrestrial repeater network, we are a party to a contract with Hughes Electronics Corporation and a contract

with LCC International, as further described under the heading “Liquidity and Capital Resources—Funds Raised to

Date.” DIRECTV has provided consulting services in connection with the development of our customer care center

and billing operations. We have agreements with Clear Channel Communications, DIRECTV, Telcom Ventures and

American Honda to make available use of our bandwidth. We have a sponsorship agreement with Clear Channel

Entertainment to advertise our service at Clear Channel Entertainment concerts and venues. Premiere Radio Networks,

a subsidiary of Clear Channel Communications, is our advertising sales representative. Motient Corporation has

provided technical and administrative support for our operations. General Motors is one of our largest shareholders

and Chester A. Huber Jr., the president of OnStar, is a member of our board of directors. Hughes Electronics is

our largest shareholder and is a subsidiary of General Motors. Jack Shaw, a member of our board of directors, is

Chief Executive Officer of Hughes Electronics Corporation. Dr. Rajendra Singh, a member of our board of directors

and a member of the board of directors of LCC International, controls the largest shareholder of LCC International.

DIRECTV, a subsidiary of Hughes Electronics, is a holder of our Series C preferred stock. Randall Mays, a member

of our board of directors, is executive vice president and chief financial officer of Clear Channel Communications.

Our chairman, Gary Parsons, is also the chairman of Motient, a significant early investor and formerly our controlling

stockholder.

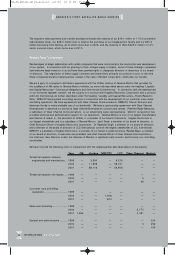

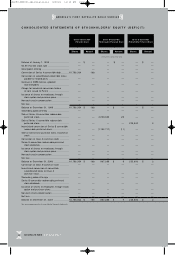

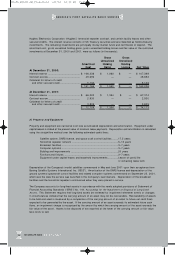

We have incurred the following costs in transactions with the related parties described above (in thousands):

Year GM Hughes DIRECTV LCC Clear Channel Motient

Terrestrial repeater network

engineering and manufacture .... 19 99 —3,500 —6,578 — —

2000 —11,858 —58,731 — —

2001 —88,116 —59,958 — —

Terrestrial repeater site leases..... 1999 — — —— ——

2000 — — —— 5—

2001 — — —— 36 —

Customer care and billing

operations .............................. 1999 — — —— ——

2000 — —1,008 — ——

2001 — —623 — ——

Sales and marketing.................... 1 999 — — —— ——

2000 — — —— 3,175 —

2001 1,264 — —— 4,351 —

General and administrative .......... 1999 — — —— —224

2000 — — —— 3 252

2001 — — —— —193

AMERiCA’S FiRST SATELLiTE RADiO SERViCE

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 10