XM Radio 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

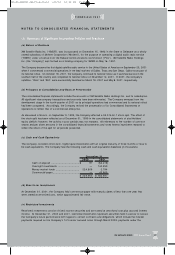

38 XM SATELLiTE RADiO 2 0 0 1 Annual Report

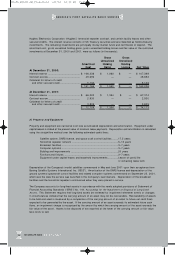

Hughes Electronics Corporation (“Hughes”) terrestrial repeater contract, and certain facility leases and other

secured credits. The interest reserve consists of US Treasury securities and are classified as held-to-maturity

investments. The remaining investments are principally money market funds and certificates of deposit. The

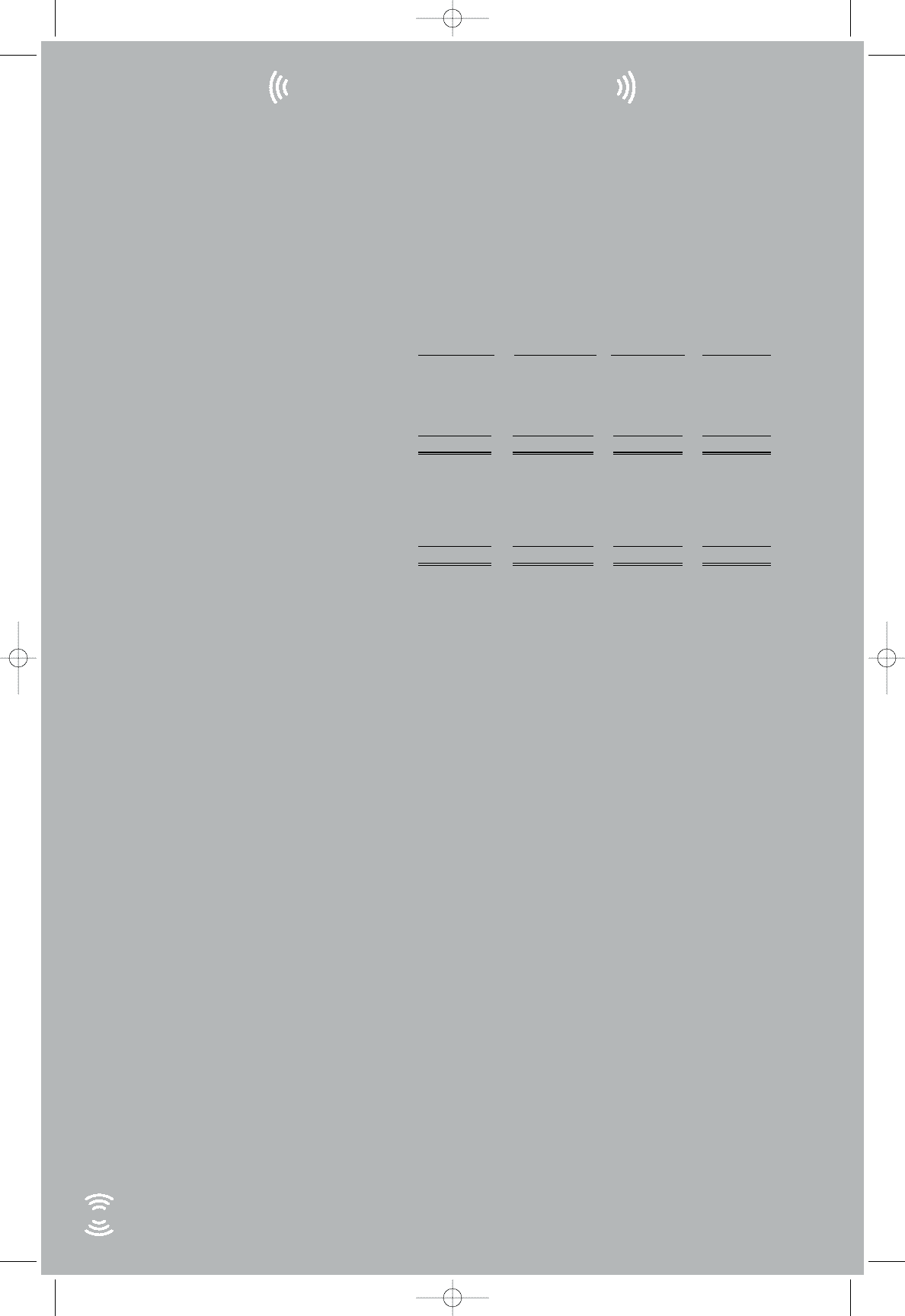

amortized cost, gross unrealized holding gains, gross unrealized holding losses and fair value of the restricted

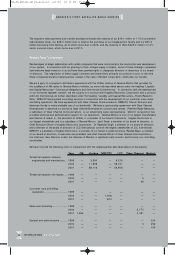

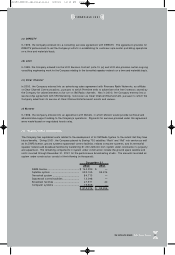

investments at December 31 , 2000 and 2001, were as follows (in thousands):

Gross Gross

Unrealized Unrealized

Amortized Holding Holding

Cost Gains Losses Fair Value

At December 31, 200 0:

Interest reserve .......................................... $ 106,3 38 $ 1,060 $ —$ 107,398

Contract escrow.......................................... 49,6 92 — —49,692

Collateral for letters of credit

and other secured credit .......................... 5,13 6 — —5,136

$ 161,166 $ 1,060 $ —$ 162,226

At December 31, 200 1:

Interest reserve .......................................... $ 66,020 $ 1,3 54 $ —$ 67,374

Contract escrow.......................................... 2,930 — —2,9 30

Collateral for letters of credit

and other secured credit .......................... 3,80 9 — —3,809

$ 72,759 $ 1,354 $ —$ 74,113

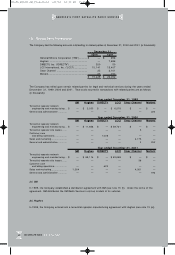

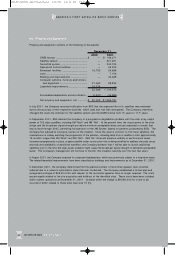

(f) Property and Equipment

Property and equipment are carried at cost less accumulated depreciation and amortization. Equipment under

capital leases is stated at the present value of minimum lease payments. Depreciation and amortization is calculated

using the straight-line method over the following estimated useful lives:

Satellite system, DARS license, and space craft control facilities ........17.5 years

Terrestrial repeater network ............................................................5–1 0 years

Broadcast facilities ..........................................................................3–7 years

Computer systems ..........................................................................3–7 years

Building and improvements ..............................................................20 years

Furniture and fixtures ......................................................................3–7 years

Equipment under capital leases and leasehold improvements..............Lesser of useful life

or remaining lease term

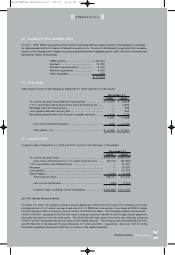

Depreciation of the Company’s in-orbit satellites commenced in May and June 2001 upon their acceptance from

Boeing Satellite Systems International, Inc. (“BSS”). Amortization of the DARS license and depreciation of the

ground systems/ spacecraft control facilities and related computer systems commenced on September 25, 2001,

which was the date the service was launched in the Company’s lead markets. Depreciation of the broadcast

facilities and the terrestrial repeaters commenced when they were placed in service.

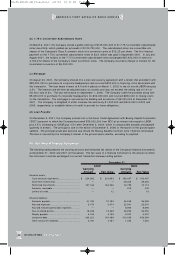

The Company accounts for long-lived assets in accordance with the newly adopted provisions of Statement of

Financial Accounting Standards (“SFAS”) No. 1 44, Accounting for the Impairment or Disposal of Long-Lived

Assets. This Statement requires that long-lived assets be reviewed for impairment whenever events or changes

in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets

to be held and used is measured by a comparison of the carrying amount of an asset to future net cash flows

expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated future cash

flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds the

fair value of the asset. Assets to be disposed of are reported at the lower of the carrying amount or fair value

less costs to sell.

AMERiCA’S FiRST SATELLiTE RADiO SERViCE

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 20