XM Radio 2001 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

XM SATELLiTE RADiO 2 001 Annual Report

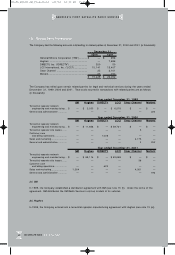

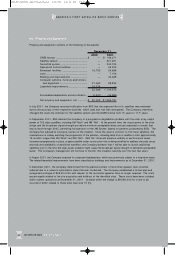

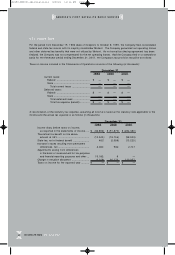

(6) Goodwill and Other Intangible Assets

On July 7, 1999, Motient acquired a former investor’s remaining debt and equity interests in the Company in exchange

for approximately 8,600,000 shares of Motient’s common stock. Concurrent with Motient’s acquisition of the remaining

interest in the Company, the Company recognized goodwill and other intangible assets of $51,6 24,0 00, which has been

allocated as follows (in thousands):

DARS License ................................... $ 25,024

Goodwill ........................................... 13,738

Programming agreements ................. 8,000

Receiver agreements ....................... 4,600

Other intangibles............................... 262

$ 51,624

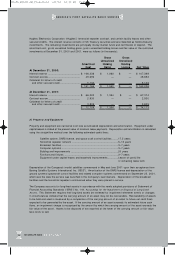

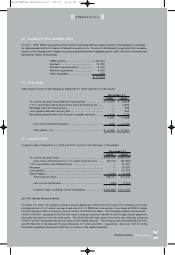

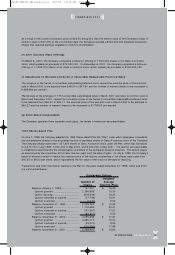

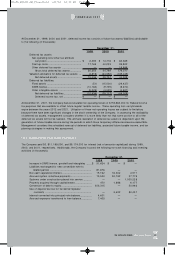

(7) Other Assets

Other assets consist of the following at December 31, 2000 and 2001 (in thousands):

December 3 1,

2000 2001

14% senior secured notes deferred financing fees ...................... $ 8 ,493 $ 8,858

7.75% convertible subordinated notes deferred financing fee ...... — 2,665

Mortgage deferred financing fees ............................................... — 496

Loan payable deferred financing fees ......................................... — 943

Refundable deposits and other long-term prepaid expenses .......... 1,44 4 1,726

9,937 14,688

Less accumulated amortization ............................................ (672) (2,167)

Other assets, net.................................................................. $ 9,26 5 $ 12,52 1

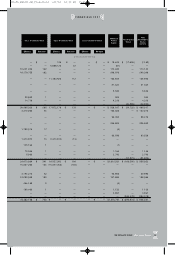

(8) Long-Term Debt

Long-term debt at December 31 , 2000 and 2001 consist of the following (in thousands):

December 3 1,

2000 20 01

14% senior secured notes ......................................................... $ 325,0 00 $ 325,000

Less unamortized discount on 14% senior secured notes ....... (63,702) (60,694)

7.75% convertible subordinated notes ....................................... — 79,057

Mortgage ................................................................................. — 28,90 9

Loan payable............................................................................. — 35,000

Capital leases............................................................................ 1,923 6,158

Total long-term debt.............................................................. 263,221 413,4 30

Less current installments ...................................................... (556) (1,91 0)

Long-term debt, excluding current installments ...................... $ 262,665 $ 411,520

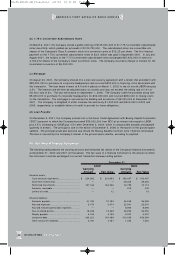

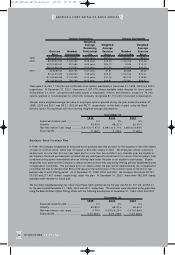

(a) 14% Senior Secured Notes

On March 15, 2000, the Company closed a private placement of 325,0 00 units, each unit consisting of $1,000

principal amount of 14% senior secured notes due 2010 of XMSR and one warrant to purchase 8.024815 shares

of the Company’s Class A common stock at a price of $49.50 per share. The Company realized net proceeds

of $191,500,000, excluding $123,000,000 used to acquire securities that will be used to pay interest payments

due under the notes for the first three years. The $32 5,000,000 face value of the notes was offset by a discount

of $65,746,000 associated with the fair value of the related warrants. The Company had amortized $2 ,044,000

and $5,052,000 of the discount through December 31 , 2000 and 2001, respectively. See note 10(f) for further

discussion regarding adjustments that have occurred to the related warrants.

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 27