XM Radio 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 XM SATELLiTE RADiO 2 0 0 1 Annual Report

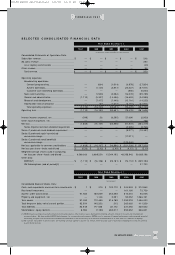

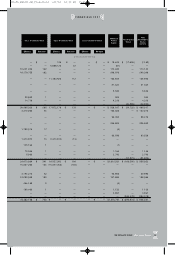

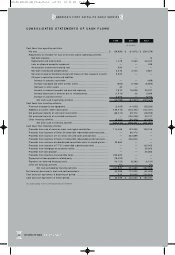

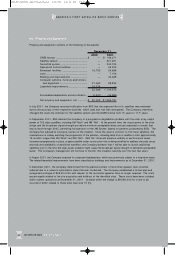

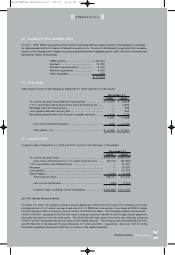

CONSOLiDATED STATEMENTS OF CASH FLOWS

(In thousands)

Cash flows from operating activities:

Net loss ....................................................................................................... $ (36,8 96 ) $ (51,8 73) $ (284,379 )

Adjustments to reconcile net loss to net cash used in operating activities:

Bad debt expense ...................................................................................... — — 10

Depreciation and amortization ..................................................................... 1 ,4 78 3,36 9 42 ,4 22

Loss on disposal computer equipment ........................................................ — — 435

Amortization of deferred financing fees ....................................................... 509 — —

Non-cash stock-based compensation ........................................................... 4 ,2 10 2,74 3 4 ,8 67

Non-cash charge for beneficial conversion feature of note issued to investor.. 5,520 — —

Changes in operating assets and liabilities:

Increase in accounts receivable .............................................................. — — (488 )

Increase in prepaid and other current assets ........................................... (905 ) (7,738 ) (6,90 5)

Decrease in other assets ....................................................................... 43 — —

Increase in accounts payable and accrued expenses ............................... 7,5 19 1 6,02 6 29 ,5 31

Increase (decrease) in amounts due to related parties ............................. (1,316 ) 26 2,69 6

Increase in accrued interest ................................................................... 3,053 — 8,7 63

Net cash used in operating activities ................................................... (16,785 ) (37,4 47 ) (203 ,0 48)

Cash flows from investing activities:

Purchase of property and equipment ............................................................... (2,008 ) (41,92 5) (58 ,5 20 )

Additions to system under construction ........................................................... (159 ,5 10 ) (424,342 ) (142,32 1)

Net purchase/ maturity of short-term investments ............................................. (69,472 ) 69,47 2 (28,355)

Net purchase/ maturity of restricted investments ............................................. — (106,3 38 ) 40,31 7

Other investing activities ................................................................................. (3,42 2 ) (56,2 68 ) (32 ,4 82)

Net cash used in investing activities..................................................... (234,412 ) (559,40 1) (221,36 1)

Cash flows from financing activities:

Proceeds from sale of common stock and capital contribution ......................... 114,428 133,235 199,21 9

Proceeds from issuance of Series B convertible redeemable preferred stock ..... — 96 ,4 72 —

Proceeds from issuance of 1 4% senior secured notes and warrants ................. — 322,889 —

Proceeds from issuance of Series C convertible redeemable preferred stock..... — 226,8 22 —

Proceeds from issuance of subordinated convertible notes to related parties ..... 2 2,96 6 — —

Proceeds from issuance of 7 .7 5% convertible subordinated notes .................... — — 125,000

Proceeds from mortgage on corporate facility ................................................ — — 29,000

Proceeds from loan payable............................................................................ — — 35 ,000

Proceeds from issuance of convertible notes ................................................... 25 0,00 0 — —

Repayment of loan payable to related party ..................................................... (75,00 0 ) — —

Payments for deferred financing costs............................................................. (10,725 ) (8,36 5) (6,124 )

Other net financing activities ........................................................................... (84 ) — (92)

Net cash provided by financing activities ............................................. 301,58 5 77 1,0 53 382,00 3

Net increase (decrease) in cash and cash equivalents........................................... 50,38 8 174,2 05 (4 2,40 6)

Cash and cash equivalents at beginning of period ............................................... 310 50,698 224,90 3

Cash and cash equivalents at end of period ......................................................... $ 50,698 $ 2 24 ,903 $ 182 ,4 97

See accompanying notes to consolidated financial statements.

200 1

200 0199 9

AMERiCA’S FiRST SATELLiTE RADiO SERViCE

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 18