XM Radio 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

XM SATELLiTE RADiO 2 001 Annual Report

Programming Agreements. We have also entered into various programming agreements. Under the terms of

these agreements, we are obligated to provide payments and commissions to other entities that may include

fixed payments, advertising commitments and revenue sharing arrangements. The amount of these costs related

to these agreements cannot be estimated, but are expected to be substantial future costs. During the years

ended December 31, 19 99, 2000, 2001, we incurred expenses of $0, $0 and $7.2 million, respectively, in

relation to these agreements. The amount of these costs will vary in future years, but is expected to increase

in the next year as the number of subscribers and revenue increase.

General Motors Distribution Agreement. We have significant payment obligations under our distribution agreement

with General Motors. We will pay an aggregate of approximately $35 million through 2004. After that, through

2009, we will have additional fixed annual payments ranging from less than $35 million to approximately $130 million,

aggregating approximately $400 million. In order to encourage the broad installation of XM radios, we have agreed

to subsidize a portion of the cost of XM radios and to make incentive payments to General Motors when the owners

of General Motors vehicles with installed XM radios become subscribers for the XM Radio service. We must also

share with General Motors a percentage of the subscription revenue attributable to General Motors vehicles with

installed XM radios. This percentage increases until there are more than eight million General Motors vehicles

with installed XM radios. This agreement is subject to renegotiation if General Motors does not achieve and maintain

specified installation levels, starting with 1.24 million units after four years and thereafter increasing by the lesser

of 600,000 units per year and amounts proportionate to our share of the satellite digital radio market. There

can be no assurances as to the outcome of any such renegotiations. General Motors’ exclusivity obligations will

discontinue if, four years after we commence commercial operations and at two-year intervals thereafter, we fail to

achieve and maintain specified minimum market share levels in the satellite digital radio service market. Prior to

2001, we had not incurred any costs under the contract and in 2001 we incurred $1.3 million.

Long-term debt. In March 2000 , XM issued $325.0 million aggregate principal amount of 14% senior secured

notes due 2010. In connection with this financing, an interest reserve of $123.0 million was established to cover

the first six interest payments, of which three have been made. Principal on the senior secured notes is payable

at maturity, while interest is payable semi-annually. In March 2001, we issued $125.0 million aggregate principal

amount of 7.75% convertible subordinated notes due 2006. In July and August 2001, holders of convertible

subordinated notes exchanged $45.9 million of notes for 4,194,272 shares of our Class A common stock.

Principal on the convertible subordinated notes is payable at maturity, while interest is payable semi-annually.

In August 2001, we borrowed $29.0 million to finance the purchase of our headquarters facility. This loan is

for a term of five years and bears interest at a rate based on the London Interbank Offer Rate plus an indicated

spread. We make monthly payments of principal and interest on this loan. In December 2001, we borrowed

$35.0 million from a subsidiary of The Boeing Company. This loan is for a term of five years and bears interest

at a rate based on the London Interbank Offer Rate plus an indicated spread. Principal is payable at maturity,

while interest is payable quarterly.

Lease obligations. We have noncancelable operating leases for office space and terrestrial repeater sites and

noncancelable capital leases for equipment that expire over the next ten years. As discussed below, in December

2001, we determined that the planned number of terrestrial repeater sites could be reduced due to the relative

signal strength provided by our satellites. We recognized a charge of $26.3 million with respect to terrestrial

repeater sites no longer required. This charge includes a lease termination accrual of $8.6 million for 646

terrestrial repeater site leases, which would reduce the future minimum lease payments.

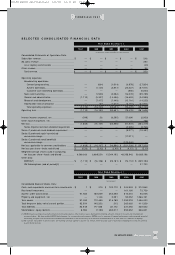

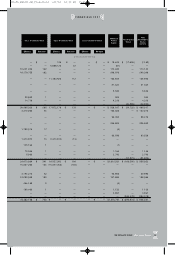

Payments Due By Period,

(In thousands)

Contractual Obligations 2002 2003 & 200 4 2005 2006 & Beyond Total

GM Distribution Agreement ............ $ 3,000 $ 29,400 $ 33,500 $ 37 2,400 $ 438,300

Long-term debt ............................ 380 874 492 466,220 467,966

Capital Lease Obligations .............. 1,530 4,487 141 —6,158

Operating Lease Obligations .......... 20,471 42,389 17,351 16,126 96,337

Total .................................... $ 25,381 $ 77,150 $ 51,484 $ 854,746 $ 1,008,7 61

The above amounts do not include interest, which in some cases is variable in amount.

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 9