XM Radio 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

XM SATELLiTE RADiO 2 001 Annual Report

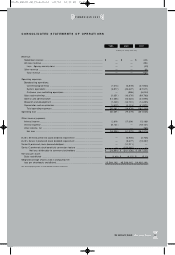

Interest Expense. We incurred interest costs of $6 3.3 million, including a $6.5 million charge due to the

incentivized conversion of Holdings’ 7.7 5% convertible notes, and $39.1 million in 2001 and 2000, respectively.

We capitalized interest costs of $45.2 million and $39.1 million associated with our DARS license and the XM

Radio system and expensed $18.1 million and $0 in 2001 and 2000, respectively, as the interest capitalization

threshold was exceeded.

Net Loss. Net loss for 2001 was $284.4 million, compared with $51.9 million in 2000, an increase of $232.5

million or 4 48%. The increase primarily reflects increases in broadcasting operations expense, sales and marketing

expense, depreciation and amortization expense and general and administrative expense in connection with our

commencement of commercial operations.

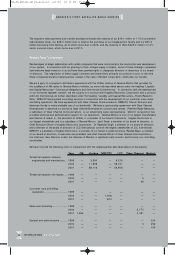

Year Ended December 31, 2000 Compared to Year Ended December 31, 1999

Revenue. We had no revenue during 2000 and 199 9 because we had not yet commenced commercial operations.

Broadcasting Operations. Broadcasting operations expense was $31.0 million in 2000, compared with $3.9

million in 1999, an increase of $2 7.1 million or 695%. This increase reflects preparation for commercial operations,

including increased expense for headcount, facilities and services.

Sales and Marketing. Sales and marketing expense was $16.1 million in 2000, compared with $3.4 million in

1999, an increase of $12.7 million or 374%. This increase reflects preparation for commercial operations,

including increased expense for headcount, facilities and services.

General and Administrative. General and administrative expense was $16.6 million in 2000, compared with

$14.5 million in 1999, an increase of $2.1 million or 1 4%. The increase reflects increased expense for headcount,

facilities and services.

Research and Development. Research and development expense was $12.7 million (including depreciation of

$0.3 million) in 2000, compared with $7 .4 million in 1999, an increase of $5.3 million or 72%. The increase in

research and development expense primarily resulted from increased activity relating to our system technology

development, including chipset design and uplink technology, in 2000.

Depreciation and Amortization. Depreciation and amortization expense was $3.1 million, compared with

approximately $1.5 million in 1999, an increase of $1.6 million or 1 07%. During 2000, we commenced the

amortization of our goodwill and intangibles.

Interest Income. Interest income was $27.6 million in 20 00, compared with $2.9 million in 1999, an increase

of $24.7 million or 852%. The increase was the result of higher average balances of cash and cash equivalents

in 2000 due to the proceeds from the private placement of 14% senior secured notes and warrants, the public

offerings of Class A common stock and Series B convertible redeemable preferred stock and the private placement

of Series C convertible redeemable preferred stock, all in the first nine months of 2000, which exceeded expenditures

for satellite and launch vehicle construction, other capital expenditures and operating expenses.

Interest Expense. We incurred interest costs of $39.1 million and $24.4 million in 2000 and 1999, respectively.

We capitalized interest costs of $39.1 million and $15.3 million associated with our DARS license and the XM Radio

system and expensed $0 and $9.1 million in 2000 and 199 9, respectively. The increase in interest costs was the

result of the incurrence of new debt during the first quarter of 2000, which exceeded the reduction in interest due

to the conversion of all debt into equity in the fourth quarter of 1999 . Further, the interest capitalization threshold

was exceeded in 1999.

Net Loss. Net loss for 2000 was $51.9 million, compared with $36.9 million for 1999 , an increase of $15.0

million or 4 1%. The increase in net loss reflects increases in research and development and additional general and

administrative expense, primarily due to increased expense for headcount, facilities and services in preparation for

commercial operations and the amortization of goodwill and intangibles.

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 5