XM Radio 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

XM SATELLiTE RADiO 2 001 Annual Report

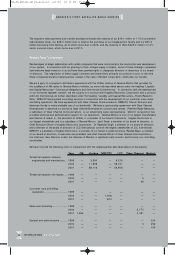

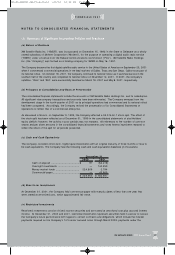

Critical Accounting Policies

The consolidated financial statements are prepared in accordance with accounting principles generally accepted in

the United States of America, which require that we make estimates and assumptions. Our significant accounting

policies are described in Note 1 to our consolidated financial statements. In accordance with recent Securities and

Exchange Commission guidance, we have identified the following policies as possibly involving a higher degree of

judgment and complexity.

•Revenue Recognition – Revenue from subscribers consists of our monthly subscription fee, which is

recognized as the service is provided, and a non-refundable activation fee, which is recognized on a

pro-rata basis over an estimated term of the subscriber relationship, which was based upon market

studies and management’s judgment. We expect to refine this estimate as more data becomes available.

Payments from customers receiving our service under promotional offers are not recognized as revenue

until the promotional period has elapsed, as described above under the heading “Results of Operations.”

• Useful Life of Satellites – The expected life of our satellites was extended from 1 5 years, the initial

design life, to 17.5 years based upon updated technical estimates we received from our satellite provider

following our satellite launches. We are currently evaluating the possible effect of a progressive

degradation problem with the solar array output power of our satellites, as described above under the

heading “Liquidity and Capital Resources—Funds Required in 2002 and Beyond.” We currently do not

have sufficient information regarding the anomaly to make specific conclusions with regard to the

performance of our satellites. We continue to monitor the situation and may need to adjust the life

of our satellites based upon future information.

•Accrued Network Optimization Expenses – As a result of the planned reduction of the number of

terrestrial repeater sites, we recognized a charge of $2 6.3 million in 2001. This expense includes

$17.7 million of site specific capitalized costs that were written off and a lease termination accrual of

$8.6 million for 646 terrestrial repeater site leases. The contractual lease payments for the sites are

$35.1 million. The accrual represents an estimate of the costs to terminate existing leases based on

management’s judgment, advice of lease consultants, and early negotiations with landlords. The accrual

also includes the estimated costs to deconstruct the existing sites, which are based upon quotes from

contractors. This accrual could vary significantly from the actual amount incurred, which will be primarily

based on our ability to negotiate lease termination settlements.

Recent Accounting Pronouncements

On July 20, 2001, the Financial Accounting Standards Board (“FASB”) issued Statement No. 1 41 (“SFAS 141”),

Business Combinations, and Statement No. 1 42 (“SFAS 142”), Goodwill and Other Intangible Assets. SFAS 141

addresses the accounting for acquisitions of businesses and is effective for acquisitions occurring on or after

July 1, 2001. SFAS 142 addresses the method of identifying and measuring goodwill and other intangible

assets acquired in a business combination, eliminates further amortization of goodwill and other intangibles

with indefinite lives, and requires periodic evaluations of impairment of goodwill and other intangible balances.

SFAS 142 became effective on January 1, 2002. We are currently assessing the impacts of the adoption of

these standards and believe that SFAS 141 will not have an impact on our current operations, but that SFAS

142 will have a material effect on operations in 2002 . As of the date of adoption of SFAS No. 142, we expect

to have unamortized goodwill in the amount of $11.5 million and unamortized identifiable intangible assets in the

amount of $155.2 million, all of which will be subject to the transition provisions of SFAS No. 142. Amortization

expense related to goodwill and identifiable intangible assets was $1.2 million, $1.4 million and $3.6 million for

the years ended December 31, 19 99, 2000, and 2001, respectively.

In August 2001, the FASB issued Statement No. 144, (“SFAS 144”), Accounting for the Impairment or Disposal

of Long-Lived Assets. SFAS 14 4 supersedes FASB Statement No. 121, Accounting for the Impairment of Long-

Lived Assets and for Long-Lived Assets to be Disposed of, and the accounting and reporting provisions of APB

Opinion No. 30, Reporting the Results of Operations-Reporting the Effects of Disposal of a Segment of a

Business, and 25 Extraordinary, Unusual and Infrequently Occurring Events and Transactions, for the disposal of

a segment of a business (as previously defined in that Opinion). This Statement also amends ARB No. 51,

Consolidated Financial Statements, to eliminate the exception to consolidation for a subsidiary for which control

is likely to be temporary. SFAS 144 is effective for financial statements issued for fiscal years beginning after

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 11