XM Radio 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

historical data becomes available). Our subscriber arrangements are cancelable, without penalty. Payments

received from customers receiving our service under promotional offers are not included as revenue until the

promotional period has elapsed, as these customers are not obligated to continue receiving our service beyond

the promotional period. Advertising revenue consists of sales of spot announcements to national advertisers that

are recognized in the period in which the spot announcement is broadcast. Agency commissions are presented

as a reduction to revenue in the Consolidated Statement of Operations, which is consistent with industry practice.

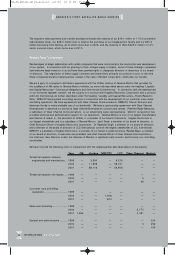

We recognized revenue of $533,000 from the date of launch through December 31, 2001. Total revenue included

$246,000 in subscriber revenue and $295,000 in advertising revenue less sales commissions of $43,000.

We expect revenue to increase during 2002 as we add subscribers and attract additional advertisers.

Broadcasting Operations. Broadcasting operations expense was $101.5 million in 2001, compared with $31.0

million in 2000, an increase of $7 0.5 million or 227%. Broadcasting operations expense consists of content/

programming expense, system operations and customer care and billing operations.

Content/ Programming – Content/ programming expense was $27 .9 million in 2001, compared with

$6.9 million in 2000, an increase of $21.0 million or 3 04%. This increase was the result of the cost

of content and headcount, third party programming fees, and estimates of royalties owed to performing

rights organizations. We expect content/ programming expense to increase during 2002 as we operate

the XM Radio system for a full year and as revenue increases.

System Operations – System operations expense was $67.6 million in 20 01, compared with $23.2 million

in 2000, an increase of $44.4 million or 1 91%. This increase primarily resulted from the operation of our

satellites and terrestrial repeater network and a charge of $2 6.3 million related to terrestrial repeater sites

no longer required. We expect this expense to increase during 20 02, exclusive of the $26 .3 million charge,

as our system operations continue to stabilize and we operate the system over the course of a full year.

Customer Care and Billing Operations – Customer care and billing operations expense was $6.0 million,

compared with $856,000 in 2000, an increase of $5.1 million or 567%. This increase resulted from our

commencement of commercial operations. Included in 2001 expense are $4.9 million of set-up and

pre-operating costs. We expect customer care and billing operations expense to increase during 2002,

exclusive of the $4.9 million in set-up and pre-operating costs, as we add subscribers.

Sales and Marketing. Sales and marketing expense was $99.8 million in 2001, compared with $16.1 million

in 2000, an increase of $83.7 million or 5 20%. Sales and marketing expense increased as a result of our

commencement of commercial operations and includes expenses related to our distribution partners, subscriber

acquisition costs, personnel, advertising creation and media costs and significant pre-operations costs.

We expect sales and marketing expense to increase during 2002 as we add subscribers.

General and Administrative. General and administrative expense was $24 .6 million in 2001, compared with

$16.6 million in 2000, an increase of $8.0 million or 4 8%. The increase reflects additional headcount, facilities

and the commencement of commercial operations. We anticipate general and administrative expense to remain

relatively stable during 2002.

Research and Development. Research and development expense was $14.3 million (including depreciation of

$0.5 million) in 2001, compared with $1 2.7 million (including depreciation of $0.3 million) in 2000, an increase

of $1.6 million or 13%. The increase in research and development expense primarily resulted from increased

activity relating to our system technology development, including chipset design and uplink technology, in 2001.

We expect research and development expense to increase during 2002 as we work toward developing our

second generation chipset technology.

Depreciation and Amortization. Depreciation and amortization expense was $42.0 million in 2001, compared

with $3 .1 million in 2000, an increase of $38.9 million or 1,255%. The increase in depreciation and amortization

expense primarily resulted from our taking delivery of major components of our system during 2001, including

our two satellites and terrestrial repeater network. We expect depreciation and amortization expense to

increase during 20 02 to reflect a full year's depreciation of our satellites and other components of our system.

However, we will cease to amortize goodwill, our DARS license, and other intangibles in accordance with new

accounting standards, as further described under the heading “Recent Accounting Pronouncements.”

Interest Income. Interest income was $15 .2 million in 2001, compared with $27.6 million in 2000, a decrease

of $12.4 million or 45%. The decrease was the result of lower average balances of cash and cash equivalents

in 2001 as well as lower yields on our investments due to market conditions.

22 XM SATELLiTE RADiO 2 0 0 1 Annual Report

AMERiCA’S FiRST SATELLiTE RADiO SERViCE

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 4