XM Radio 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

XM SATELLiTE RADiO 2 001 Annual Report

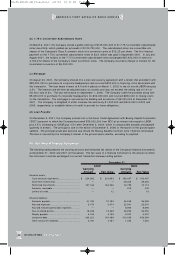

(m) Comprehensive Income

The Company has engaged in no transactions during the years ended December 31, 19 99, 2000 and 2001 that

would be classified as other comprehensive income.

(n) Accounting Estimates

The preparation of the Company’s financial statements in conformity with generally accepted accounting principles

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities

at the date of the financial statements and the reported amounts of expenses during the reporting period. The

estimates involve judgments with respect to, among other things, various future factors which are difficult to

predict and are beyond the control of the Company. Significant estimates include valuation of the Company’s

investment in the DARS license, the allowance for doubtful accounts, the valuation of goodwill and intangible

assets, the recoverability of the XM Radio System assets, the costs to terminate certain terrestrial repeater site

leases, the allocation of purchase price of assets acquired, the estimated life of a subscriber’s subscription, the

payments to be made to distributors and manufacturers for radios sold or activated, the amount of stock-based

compensation arrangements and the valuation allowances against deferred tax assets. Accordingly, actual

amounts could differ from these estimates.

(o) Reclassifications

Certain fiscal year 1999 and 200 0 amounts have been reclassified to conform to the current presentation.

(p) Derivative Instruments and Hedging Activities

In June 1998, the FASB issued SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities. In

June 200 0 the FASB issued SFAS No. 138, Accounting for Certain Derivative Instruments and Certain Hedging

Activity, an amendment of SFAS 133 . SFAS No. 133 and SFAS No. 138 require that all derivative instruments

be recorded on the balance sheet at their respective fair values. SFAS No. 13 3 and SFAS No. 138 are effective

for all fiscal quarters of all fiscal years beginning after June 30, 2000. The Company adopted SFAS No. 133 and

SFAS No. 138 on January 1, 2001. The Company has reviewed its contracts and has determined that it has no

stand alone derivative instruments and does not engage in hedging activities.

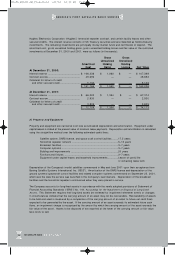

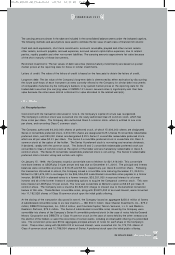

(2) Accumulated Deficit

The Company is devoting its efforts to market its digital audio radio service and to increase its subscriber base.

This effort involves substantial risk and future operating results will be subject to significant business, economic,

regulatory, technical, and competitive uncertainties and contingencies. These factors individually, or in the

aggregate, could have an adverse effect on the Company’s financial condition and future operating results and

create an uncertainty as to the Company’s ability to continue as a going concern. The consolidated financial

statements do not include any adjustments that might be necessary should the Company be unable to continue

as a going concern.

At the Company’s current stage of operations, economic uncertainties exist regarding the successful acquisition

of additional debt or equity financings and the attainment of positive cash flows from the XM Radio Service.

The Company has commenced commercial operations and will require substantial additional financing to market

and distribute the XM Radio Service. Failure to obtain the required long-term financing may prevent the Company

from continuing to provide its service. Management’s plan to fund operations and capital expansion includes

the sale of additional debt and equity securities through public and private sources. There are no assurances,

however, that such financing will be obtained.

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 23