XM Radio 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

XM SATELLiTE RADiO 2 001 Annual Report

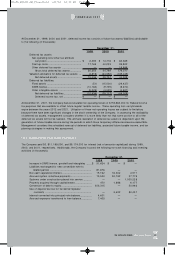

As a result of the current conversion price of $26.50 being less than the market value of the Company’s Class A

common stock of $ 40.3 75 on the commitment date, the Company recorded a $123,000,000 beneficial conversion

charge that reduced earnings available to common stockholders.

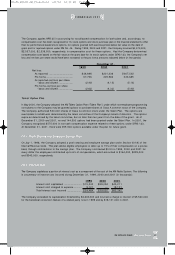

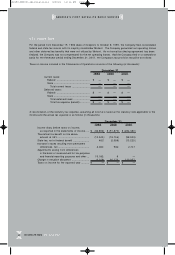

(e) 2001 Common Stock Offerings

On March 6, 2001, the Company completed a follow-on offering of 7,500 ,000 shares of its Class A common

stock, which yielded net proceeds of $72,000,0 00. On December 6, 2001, the Company completed a follow-on

offering of 11,50 0,000 shares of its Class A common stock, which yielded net proceeds of $126,5 00,0 00.

(f) Adjustments To Warrants and Series C Convertible Redeemable Preferred Stock

The issuance of the Series C convertible redeemable preferred stock caused the exercise price of the warrants

sold in March 2000 to be adjusted from $49.50 to $47.94 and the number of warrant shares to be increased to

8.285948 per warrant.

The closings of the offerings of 7.75% convertible subordinated notes in March 2001 and Class A common stock in

March and December 2001 caused the conversion price of the Series C convertible redeemable preferred stock

to be adjusted from $26.50 to $22.17, the exercise price of the warrants sold in March 2000 to be adjusted to

$45.27 and the number of warrant shares to be increased to 8 .776003 per warrant.

(g) Stock-Based Compensation

The Company operates three separate stock plans, the details of which are described below.

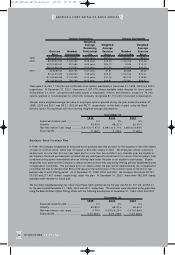

1998 Shares Award Plan

On June 1, 1998, the Company adopted the 1998 Shares Award Plan (the “Plan”) under which employees, consultants,

and non-employee directors may be granted options to purchase shares of Class A common stock of the Company.

The Company initially authorized 1,3 37,850 shares of Class A common stock under the Plan, which was increased

to 2,675,700 in July 1999, 5,000,000 in May 2000, and 8,0 00,000 in May 2001. The options are exercisable

in installments determined by the compensation committee of the Company’s board of directors. The options expire

as determined by the committee, but no later than ten years from the date of grant. On July 8, 1999, the Company’s

board of directors voted to reduce the exercise price of the options outstanding in the shares award plan from

$16.35 to $9.52 per share, which represented the fair value of the stock on the date of repricing.

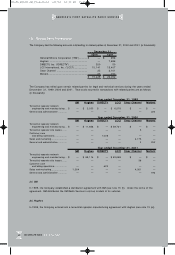

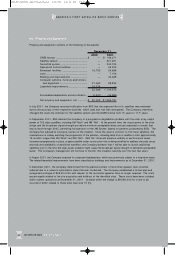

Transactions and other information relating to the Plan for the years ended December 31 , 1999, 2000 and 2001

are summarized below:

Outstanding Options

Weighted-

Number of Average

Shares Exercise Price

Balance, January 1, 1999 ....................... 787,297 $ 16.35

Options granted ................................. 2,188,9 88 10.50

Option repricing ................................... (818,339) 16.35

Options canceled or expired................. (57,786) 13.91

Options exercised ............................... (1,0 71) 9.52

Balance, December 31 , 1999 ................. 2,0 99,0 89 $ 10.32

Options granted ................................. 1,176,6 83 30.21

Options canceled or expired................. (131,267) 17.01

Options exercised ............................... (48,817) 9 .52

Balance, December 31 , 2000 ................. 3,0 95,6 88 $ 17.61

Options granted ................................. 2,680,4 15 15.54

Options canceled or expired................. (23,570) 9.55

Options exercised ............................... (253,593 ) 17.8 8

Balance, December 31 , 2001 ................. 5,4 98,9 40 $ 16.62

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 31