XM Radio 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 XM SATELLiTE RADiO 2 0 0 1 Annual Report

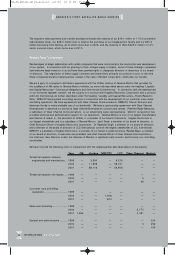

Liquidity and Capital Resources

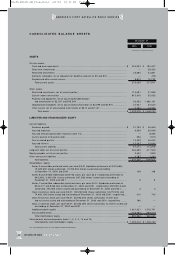

At December 31, 2001, we had a total of cash, cash equivalents and short-term investments of $210.9 million,

which excludes $72.8 million of restricted investments, and working capital of $157.0 million, compared with cash,

cash equivalents and short-term investments of $224.9 million, which excludes $161.2 million of restricted

investments, and working capital of $212.1 million at December 31, 2000. The decreases in the respective balances

are due primarily to the increasing capital expenditures and operating expenses for the year ended December

31, 2001, which were partially offset by funds raised from financing activities in the amount of $382.0 million.

For the year ended December 31, 2001 we had an operating loss of $281.6 million compared to $79.5 million for the

year ended December 31, 20 00. At December 31, 2001, we had total assets of approximately $1.5 billion and total

liabilities of $529.6 million, compared with total assets of $1.3 billion and total liabilities of $337.3 million at

December 31, 2000. At December 31, 2001, we had $411.5 million of long-term debt outstanding (net of current

portion), compared with $262.7 million at December 31, 2000.

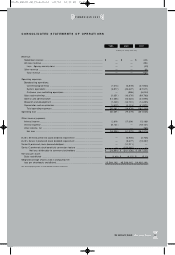

Non-Cash Stock-Based Expense

We incurred non-cash compensation charges of approximately $4.9 million and $2.7 million in 2001 and 200 0,

respectively. These charges relate to stock options granted to employees and non-employees and warrants

granted to Sony and CNBC. Additional compensation charges may result depending upon the market value

of our Class A common stock at each balance sheet date.

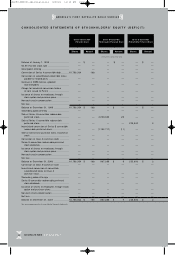

Funds Raised to Date

Since inception, we have raised an aggregate of $1.5 billion net of expenses, interest reserve and repayment of

debt. These funds are expected to be sufficient, in the absence of additional financing, to cover funding needs

into the fourth quarter of 2002 based on our current business plan and as further described under the heading

“Funds Required in 2002 and Beyond.” These funds have been used to acquire our DARS license, make

required payments for our system, including the satellites, terrestrial repeater system, and ground networks,

and for working capital and operating expenses.

Sources of Funds. Prior to our initial public offering, we raised approximately $167.0 million through the

issuance of equity to, and receipt of loans from, Motient Corporation and a former stockholder from 19 97

through January 1999. In July 19 99, we issued $250.0 million of Series A subordinated convertible notes to six

strategic and financial investors—General Motors, $50.0 million; Clear Channel Communications, $75.0 million;

DIRECTV, $50.0 million; and Columbia Capital, Telcom Ventures, L.L.C. and Madison Dearborn Partners, $75.0

million in the aggregate. Using part of the proceeds from the issuance of the Series A subordinated convertible

notes, we paid a former stockholder $75.0 million in July 1999 to redeem an outstanding loan. In October

1999, we completed our initial public offering, which yielded net proceeds of $114.1 million. In January 200 0,

we completed a follow-on offering of our Class A common stock, which yielded net proceeds of $132.1 million,

and an offering of our Series B convertible redeemable preferred stock, which yielded net proceeds of $96.5

million. In March 2000, we completed a private placement of units consisting of $1,000 principal amount of

XM’s 14% senior secured notes due 2010 and a warrant to purchase 8.024815 shares of our Class A common

stock at $49.50 per share, which yielded net proceeds of $1 91.5 million excluding $123.0 million for an interest

reserve. In August 2 000, we completed a private placement of our Series C convertible redeemable preferred

stock, which yielded net proceeds of $226.8 million.

During the fiscal year ended December 31, 2001:

•We completed a follow-on offering of 7,500,000 shares of Class A common stock, which yielded net

proceeds of $72.0 million, and a concurrent offering of 7.7 5% convertible subordinated notes due 2006,

convertible into shares of our Class A common stock at $12.23 per share, which yielded net proceeds

of $120.7 million;

•We closed a $66.0 million financing package with subsidiaries of The Boeing Company, which includes a

$35.0 million loan and deferral of $31.0 million of obligations to Boeing, our satellite manufacturer;

•We entered into a loan and security agreement with a lender that provided $ 29.0 million to purchase our

corporate headquarters and incurred $0.5 million in financing costs;

AMERiCA’S FiRST SATELLiTE RADiO SERViCE

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 6