XM Radio 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

XM SATELLiTE RADiO 2 001 Annual Report

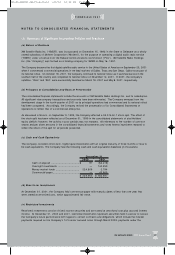

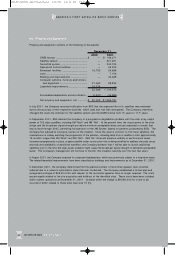

(g) Goodwill and Other Intangible Assets

Goodwill, which represents the excess of purchase price over fair value of net assets acquired, is amortized on

a straight-line basis over the expected periods to be benefited, generally 15 years. Other intangible assets are

amortized over 10 years. The Company assesses the recoverability of its intangible assets by determining

whether the amortization of the goodwill and intangible assets balance over its remaining life can be recovered

through undiscounted future operating cash flows. The amount of goodwill and intangible assets impairment, if

any, is measured by the amount by which the carrying amount of the assets exceed the fair value of the assets.

The assessment of the recoverability of goodwill will be impacted if estimated future operating cash flows are

not achieved.

In June 2001, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 141, Business Combinations,

(“SFAS No. 141”) and SFAS No. 142, Goodwill and Other Intangible Assets (“SFAS No. 142”). SFAS No. 141

requires that the purchase method of accounting be used for all business combinations. SFAS No. 14 1 specifies

criteria that intangible assets acquired in a business combination must meet to be recognized and reported separately

from goodwill. SFAS No. 142 will require that goodwill and intangible assets with indefinite useful lives no longer

be amortized, but instead tested for impairment at least annually in accordance with the provisions of SFAS No. 142.

SFAS No. 142 also requires that intangible assets with estimable useful lives be amortized over their respective

estimated useful lives to their estimated residual values, and reviewed for impairment in accordance with SFAS

No. 144 after its adoption.

Upon adoption of SFAS No. 142 in the first quarter of 2002, the Company is required to evaluate its existing

acquired intangible assets and goodwill, and to make any necessary reclassifications in order to conform with

the new classification criteria in SFAS No. 141 for recognition separate from goodwill. The Company will be

required to reassess the useful lives and residual values of all intangible assets acquired, and make any necessary

amortization period adjustments by the end of the first quarter of 2002. If an intangible asset is identified as having

an indefinite useful life, the Company will be required to test the intangible asset for impairment in accordance with

the provisions of SFAS No. 142 within the first interim period. Impairment is measured as the excess of carrying

value over the fair value of an intangible asset with an indefinite life. Any impairment loss will be measured as of

the date of adoption and recognized as the cumulative effect of a change in accounting principle.

In connection with SFAS No. 142’s transitional goodwill impairment evaluation, the Statement requires the Company

to perform an assessment of whether there is an indication that goodwill is impaired as of the date of adoption.

To accomplish this, the Company must identify its reporting units and determine the carrying value of each

reporting unit by assigning the assets and liabilities, including the existing goodwill and intangible assets, to

those reporting units as of January 1, 2002. The Company will then have up to six months from January 1, 2002

to determine the fair value of each reporting unit and compare it to the carrying amount of the reporting unit. To

the extent the carrying amount of a reporting unit exceeds the fair value of the reporting unit, an indication exists

that the reporting unit goodwill may be impaired and the Company must perform the second step of the transitional

impairment test. The Company has determined that it only has one reporting unit as defined by the Standard.

The second step is required to be completed as soon as possible, but no later than the end of the year of

adoption. In the second step, the Company must compare the implied fair value of the reporting unit goodwill with

the carrying amount of the reporting unit goodwill, both of which would be measured as of the date of adoption.

The implied fair value of goodwill is determined by allocating the fair value of the reporting unit to all of the

assets (recognized and unrecognized) and liabilities of the reporting unit in a manner similar to a purchase price

allocation, in accordance with SFAS No. 141. The residual fair value after this allocation is the implied fair value

of the reporting unit goodwill. Any transitional impairment loss will be recognized as the cumulative effect of a

change in accounting principle in the Company’s statement of income.

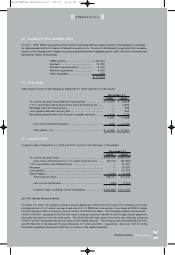

As of the date of adoption of SFAS No. 142, the Company expects to have unamortized goodwill in the amount

of $11,461,000 and unamortized identifiable intangible assets in the amount of $155,207 ,000, all of which will

be subject to the transition provisions of SFAS No. 142. Amortization expense related to goodwill and other

intangible assets was $1,220,000, $1 ,379,000 and $3,604,000 for the years ended December 31, 1999,

2000, and 2001, respectively. Although the Company has not yet finalized its analysis of the adoption of SFAS

No. 141 and No. 142, the Company does not expect to recognize any transitional impairment losses as the

cumulative effect of a change in accounting principle.

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 21