XM Radio 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 XM SATELLiTE RADiO 2 0 0 1 Annual Report

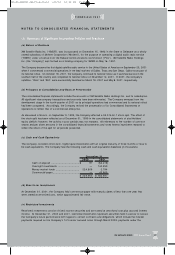

December 15, 2001, and interim periods within those fiscal years, with early application encouraged. We are

currently assessing the impact of the adoption of this standard and do not believe that SFAS 144 will have a

material effect on operations in 2002.

QUANTiTATiVE AND QUALiTATiVE DiSCLOSURES ABOUT MARKET RiSK

As of December 31 , 2001, we do not have any derivative financial instruments and do not intend to use derivatives.

We do not hold or issue any free-standing derivatives. We invest our cash in short-term commercial paper,

investment-grade corporate and government obligations and money market funds. Our long-term debt includes

fixed interest rates and the fair market value of the debt is sensitive to changes in interest rates. We run the

risk that market rates will decline and the required payments will exceed those based on current market rates.

Under our current policies, we do not use interest rate derivative instruments to manage our exposure to interest

rate fluctuations. The mortgage on our corporate headquarters has a variable interest rate that may not exceed

a ceiling rate of 14% or a floor of 8%. A change of one percentage point in the interest rate applicable to this

$29.0 million of variable rate debt at December 31 , 2001 would result in a fluctuation of approximately $0.3 million

in our annual interest expense. Additionally, we believe that our exposure to interest rate risk is not material to

our results of operations.

AMERiCA’S FiRST SATELLiTE RADiO SERViCE

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 12