Westjet 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 69

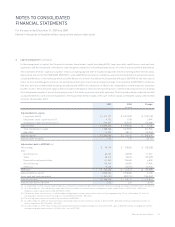

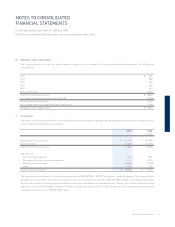

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

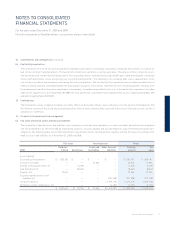

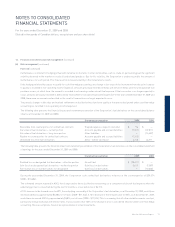

10. Share capital (continued)

(h) 2007 restricted share units

The Corporation has a cash-settled RSU plan, whereby RSUs may be issued to executive offi cers of the Corporation. Each RSU entitles a participant

to receive cash equal to the market value of the equivalent number of shares of the Corporation. Compensation expense is accrued over the vesting

period of the RSU. Fluctuations in the market value are recognized in the period in which the fl uctuations occur. For the year ended December 31,

2009, $181 of expense (2008 – $75 recovery) was included in marketing, general and administration expense. During the year ended December

31, 2009, the Corporation settled 6,376 RSUs for a total cash payment of $78 (2008 – $nil). As at December 31, 2009, 61,682 RSUs (2008 – 68,058)

are outstanding, all of which vest in January 2010.

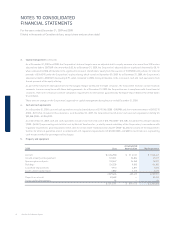

(i) Deferred share units

The Corporation has a cash-settled deferred share unit (DSU) plan as an alternative form of compensation for independent Board of Directors.

Each DSU entitles a participant to receive cash equal to the market value of the equivalent number of shares of the Corporation. The number of

DSUs granted is determined based on the closing price of the Corporation’s common shares on the trading day immediately prior to the date of

grant. Total compensation expense is recognized at the time of grant. Fluctuations in the market value are recognized in the period in which the

fl uctuations occur. For the year ended December 31, 2009, 24,324 DSUs were granted (2008 – 15,192), with $288 of expense (2008 – $180) included

in marketing, general and administration expense. During the year ended December 31, 2009, the Corporation settled 1,392 DSUs for a total cash

payment of $16 (2008 – $nil). As at December 31, 2009, 40,423 DSUs (2008 – 17,491) are vested and outstanding. DSUs are redeemable upon the

Director’s retirement from the Board.

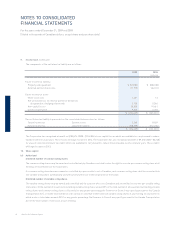

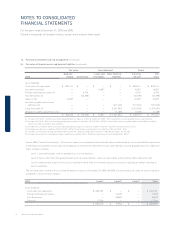

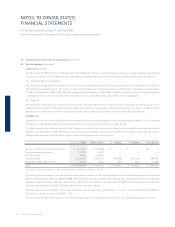

11. Related-party transactions

The Corporation has debt fi nancing and investments in short-term deposits with a fi nancial institution that is related through two common directors,

one of whom is also the president of the fi nancial institution. As at December 31, 2009, total long-term debt includes an amount of $6,392 (2008 –

$7,265) due to the fi nancial institution. See note 7, long-term debt, for further disclosure. Included in cash and cash equivalents, as at December

31, 2009, are short-term investments of $143,332 (2008 – $96,500) owing from the fi nancial institution. In 2008, the Corporation signed a three-

year revolving operating line of credit agreement with a banking syndicate, of which one of the members is the related-party fi nancial institution.

See note 12, commitments and contingencies, for further information. These transactions occurred in the normal course of operations on terms

consistent with those offered to arm’s-length parties and are measured at the exchange amount.

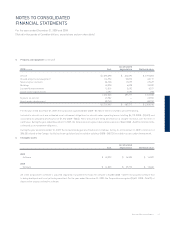

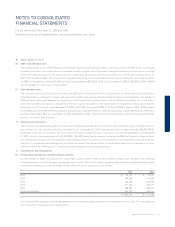

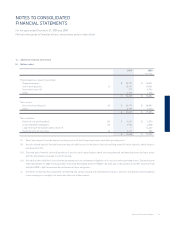

12. Commitments and contingencies

(a) Purchased aircraft and live satellite television systems

As at December 31, 2009, the Corporation is committed to purchase 38 737-700 aircraft for delivery between 2011 and 2016. The remaining

estimated amounts to be paid in deposits and purchase prices for the 38 aircraft, as well as amounts to be paid for live satellite television systems

on purchased and leased aircraft in Canadian dollars and the US-dollar equivalents, are as follows:

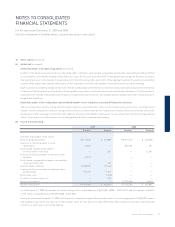

The Corporation has yet to pursue fi nancing agreements for the remaining 38 purchased aircraft included in the above totals. The next purchased

aircraft delivery is not expected until January 2011.

USD CAD

2010 $ 28,282 $ 29,724

2011 109,265 114,834

2012 256,420 269,490

2013 271,633 285,479

2014 288,887 303,612

2015 and thereafter 709,972 746,161

$ 1,664,459 $ 1,749,300