Westjet 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 17

cent of our total fl eet. At the end of 2008, we had a total of 24

aircraft under operating leases, representing approximately 32 per

cent of our total registered fl eet.

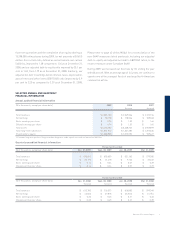

Our aircraft leasing costs per ASM increased by 18.0 per cent

in 2009 to 0.59 cents, from 0.50 cents in 2008. The majority of

this variance related to incremental leasing costs on the leased

aircraft delivered since the end of 2008, as well as a full period

of aircraft leasing costs for three leased aircraft delivered during

2008. Additionally, unfavourable foreign exchange movements

contributed to approximately 30 per cent of the year-over-year

increase. We also have an active foreign exchange hedging

program to offset our US-dollar-denominated aircraft lease

payments on a portion of our leased aircraft. Please refer to

Results of Operations – Foreign Exchange on page 19 of this

MD&A for further information.

Maintenance

Our maintenance costs per ASM were 0.55 cents in 2009,

representing an increase of 10.0 per cent from 0.50 cents in

2008. For 2009, approximately 20 per cent of this increase was

attributable to the weaker Canadian dollar, as approximately

40 per cent of our maintenance costs were denominated in US

dollars. The remainder of this increase related to incremental

scheduled maintenance visits as a result of our growing fl eet,

as well as the increased number of aircraft off warranty. As at

December 31, 2009, 51 out of 86 aircraft, or 59.3 per cent, were

off warranty, compared to 36 out of 76 aircraft, or 47.4 per cent,

as at December 31, 2008. We anticipate our unit maintenance

costs will continue to increase as our fl eet ages.

Compensation

Our compensation philosophy is designed to align corporate

and personal success. We have designed a compensation plan

whereby a portion of our expenses are variable and are tied to

our fi nancial results. Our compensation strategy encourages

employees to become owners in WestJet, which inherently

creates a personal vested interest in our financial results

and accomplishments.

During the year ended December 31, 2009, we cash-settled

fuel derivatives in favour of the counterparties of $29.6 million

(2008 – $10.6 million).

The fair value of the fuel derivatives designated in an effective

hedging relationship is determined using inputs, including

quoted forward prices for commodities, foreign exchange rates

and interest rates, which can be observed or corroborated in

the marketplace. The fair value of the fi xed swap agreements is

estimated by discounting the difference between the contractual

strike price and the current forward price. The fair value of the

costless collar structures is estimated by the use of a standard

option valuation technique. As at December 31, 2009, for the

period that we are hedged, the closing forward curve for crude

oil ranged from approximately US $79 to US $84 (2008 – US $45

to US $67) with the average forward foreign exchange rate used

in determining the fair value being 1.0536 US dollars to Canadian

dollars (2008 – 1.2136).

The estimated amount reported in AOCL that is expected to

be reclassifi ed to net earnings as a component of aircraft fuel

expense when the underlying jet fuel is consumed during the

next 12 months is a loss before tax of $6.7 million.

For 2010, excluding the impact of fuel hedging, we estimate our

sensitivity to changes in crude oil to be approximately $6 million

annually to our fuel costs for every one US-dollar change per

barrel of WTI crude oil. Additionally, we estimate our sensitivity

to changes in fuel pricing to be approximately $9 million for every

one-cent change per litre of fuel.

Aircraft leasing

Our most signifi cant infrastructure cost is our aircraft. To support

our growth initiatives, we investigate various alternatives for

fi nancing, with the intention of achieving optimal balance sheet

fl exibility while realizing the benefi ts of low-cost fi nancing. Leasing

is often an attractive alternative to debt-fi nanced aircraft for reasons

such as alleviation of obsolescence risk and the significantly

reduced upfront cash outlay required for deposits on purchased

aircraft. During the year ended December 31, 2009, we assumed

delivery of seven leased 737-700 aircraft and three leased 737-800

aircraft. One of the leased 737-800s was subsequently purchased

from the lessor during the year. As at December 31, 2009, we had

a total of 33 leased aircraft. This represents approximately 38 per