Westjet 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 WestJet 2009 Annual Report

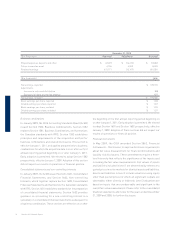

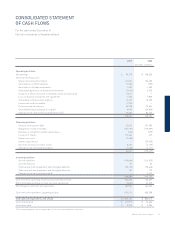

($ in thousands, except ratio amounts) 2009 2008 Change

Restated

Adjusted debt-to-equity:

Long-term debt (i) $ 1,219,777 $ 1,351,903 $ (132,126)

Obligations under capital leases (ii) 4,102 1,108 2,994

Off-balance-sheet aircraft leases (iii) 779,655 645,375 134,280

Adjusted debt $ 2,003,534 $ 1,998,386 $ 5,148

Total shareholders’ equity 1,388,928 1,075,990 312,938

Add: AOCL 14,852 38,112 (23,260)

Adjusted equity $ 1,403,780 $ 1,114,102 $ 289,678

Adjusted debt-to-equity 1.43 1.79 (20.1%)

Adjusted net debt to EBITDAR: (iv)

Net earnings $ 98,178 $ 178,506 $ (80,328)

Add:

Net interest (v) 62,105 50,593 11,512

Taxes 38,618 76,243 (37,625)

Depreciation and amortization 141,303 136,485 4,818

Aircraft leasing 103,954 86,050 17,904

Other (vi) 10,478 (13,256) 23,734

EBITDAR $ 454,636 $ 514,621 $ (59,985)

Adjusted debt (as above) 2,003,534 1,998,386 5,148

Less: cash and cash equivalents (1,005,181) (820,214) (184,967)

Adjusted net debt $ 998,353 $ 1,178,172 $ (179,819)

Adjusted net debt to EBITDAR 2.20 2.29 (3.9%)

(i) As at December 31, 2009, long-term debt includes the current portion of long-term debt of $171,223 (2008 – $165,721) and long-term debt of $1,048,554

(2008 – $1,186,182).

(ii) As at December 31, 2009, obligations under capital leases includes the current portion of obligations under capital leases of $744 (2008 – $395) and obligations under

capital leases of $3,358 (2008 – $713).

(iii) Off-balance-sheet aircraft leases is calculated by multiplying the trailing twelve months of aircraft leasing expense by 7.5. As at December 31, 2009, the trailing twelve

months of aircraft leasing costs totalled $103,954 (2008 – $86,050).

(iv) The trailing twelve months are used in the calculation of EBITDAR.

(v) As at December 31, 2009, net interest includes the trailing twelve months of interest income of $5,601 (2008 – $25,485) and the trailing twelve months of interest expense of

$67,706 (2008 – $76,078).

(vi) As at December 31, 2009, other includes the trailing twelve months foreign exchange loss of $12,306 (2008 – gain of $30,587) and the trailing twelve months non-operating

gain on derivatives of $1,828 (2008 – loss of $17,331).

Reconciliation of non-GAAP measures to GAAP