Westjet 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 71

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

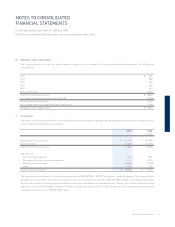

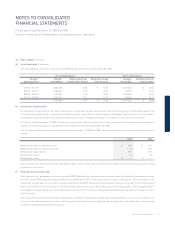

12. Commitments and contingencies (continued)

(e) Fuel facility corporations

The Corporation has entered into nine arrangements whereby it participates in fuel facility corporations, along with other airlines, to contract for

fuel services at major Canadian airports. The fuel facility corporations operate on a cost recovery basis. The purpose of these corporations is to

own and fi nance the system that distributes fuel to the contracting airlines, including the leasing of land rights, while providing the contracting

airlines with preferential service and pricing over non-participating entities. The operating costs, including debt service requirements, of the

fuel facility corporations are shared pro rata among the contracting airlines. The nine fuel facility corporations are considered variable interest

entities and have not been consolidated within the Corporation’s accounts. In the remote event that all other contracting airlines withdraw from

the arrangements and the Corporation remained as sole member, it would be responsible for the costs of the fuel facility corporations, including

debt service requirements. As at November 30, 2009, the nine fuel facility corporations have combined total assets of approximately $341,487

and debt of approximately $307,825.

(f) Contingencies

The Corporation is party to legal proceedings and claims that arise during the ordinary course of business. It is the opinion of management that

the ultimate outcome of these and any outstanding matters will not have a material effect upon the Corporation’s fi nancial position, results of

operations or cash fl ows.

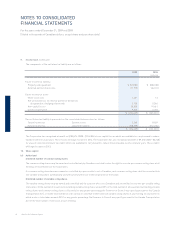

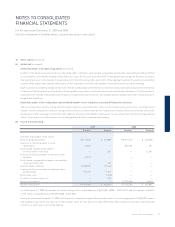

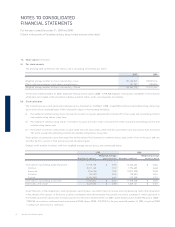

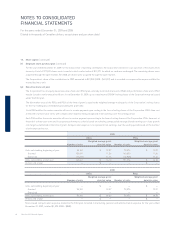

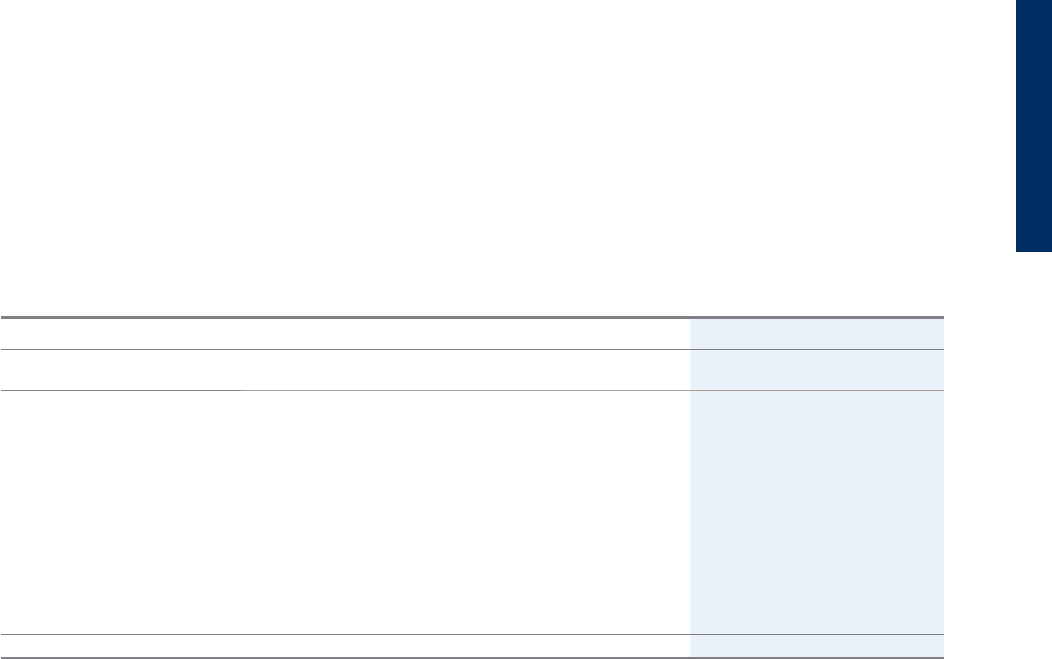

13. Financial instruments and risk management

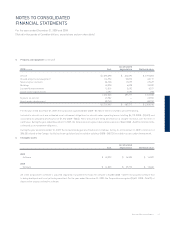

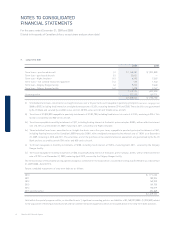

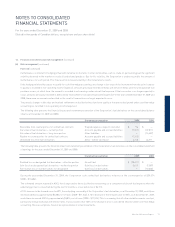

(a) Fair value of fi nancial assets and fi nancial liabilities

The Corporation’s fi nancial assets and liabilities consist primarily of cash and cash equivalents, accounts receivable, derivatives both designated

and not designated in an effective hedging relationship, deposits, accounts payable and accrued liabilities, long-term debt and capital lease

obligations. The following tables set out the Corporation’s classifi cation and the carrying amount, together with the fair value, for each type of its

fi nancial assets and liabilities as at December 31, 2009 and 2008:

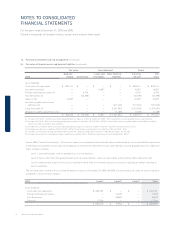

Fair value Amortized cost Totals

2009

Held-for-

trading Derivatives

Loans and

receivables

Other fi nancial

liabilities

Carrying

amount

Fair

value

Asset (liability)

Cash and cash equivalents $ 1,005,181 $ — $ — $ — $ 1,005,181 $ 1,005,181

Accounts receivable — — 27,654 — 27,654 27,654

Foreign exchange derivatives (i) — (1,249) — — (1,249) (1,249)

Fuel derivatives (ii) — (8,667) — — (8,667) (8,667)

Deposits (iii) 27,264 — — — 27,264 27,264

Accounts payable and accrued

liabilities (iv) —— — (221,208) (221,208) (221,208)

Long-term debt (v) — — — (1,219,777) (1,219,777) (1,323,120)

Obligations under capital leases (vi) — — — (4,102) (4,102) (4,102)

$ 1,032,445 $ (9,916) $ 27,654 $ (1,445,087) $ (394,904) $ (498,247)