Westjet 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 13

Caribbean markets. The new WestJet Vacations reservation

system, implemented during the third quarter of 2009, will

allow WestJet Vacations to successfully expand its sales and

distribution channels. WestJet Vacations has been instrumental

to our growth and will be a key contributor to the future success

of our airline.

Ancillary revenues, which include service fees, onboard sales

and partner and program revenue, provide an opportunity to

maximize our profi ts through the sale of higher-margin goods

and services, while also enhancing our overall guest experience.

For 2009, ancillary revenues were $91.7 million, representing a

decrease of 4.2 per cent from 2008. Ancillary revenue per guest

decreased by 3.5 per cent to $6.66 per guest in 2009, from $6.90

in 2008. These declines were attributable mainly to lower revenue

due to the termination of our tri-branded BMO Mosaik AIR MILES

MasterCard credit card partnership on July 31, 2008, as well as

a decrease in certain fee revenues. Subsequent to the cutover

For 2009, charter and other revenues decreased by 14.1 per cent

to $213.3 million, from $248.2 million in 2008. This decline was

driven mainly by the termination of our charter agreement with

Transat, effective May 10, 2009. Due to our expanded destination

base, these declines were partially offset by an increase in

WestJet Vacations non-air revenue. On January 11, 2010, we

announced the signing of a cargo sales and service relationship

with EXP-AIR Cargo that offers an expanded range of products

and services for cargo customers throughout Canada, the U.S.,

Mexico and the Caribbean.

WestJet Vacations had another great year in 2009, driven largely

by the strength of our Las Vegas and Disney markets, as well

as the 11 destinations added as part of our winter schedule. In

only its third year of operations, WestJet Vacations has become

a signifi cant player in the Canadian tour operator industry. It

is the number one Canadian provider of hotel rooms into Las

Vegas and has been successful in the popular Mexico and

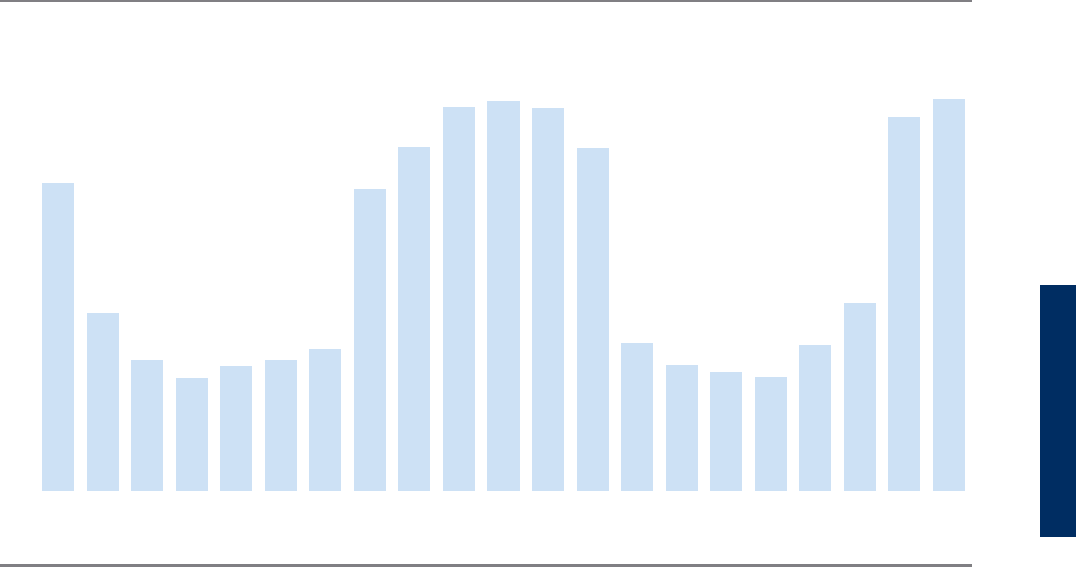

Charter and scheduled transborder and international as a percentage of total ASMs

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

Apr. 08

May 08

Jun. 08

Jul. 08

Aug. 08

Sep. 08

Oct. 08

Nov. 08

Dec. 08

Jan. 09

Feb. 09

Mar. 09

Apr. 09

May 09

Jun. 09

Jul. 09

Aug. 09

Sep. 09

Oct. 09

Nov. 09

Dec. 09