Westjet 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

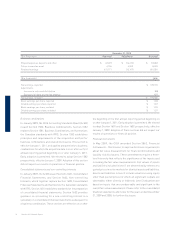

40 WestJet 2009 Annual Report

capacity is expected to increase between nine and 10 per

cent over 2009, dependent on fl eet utilization. These capacity

increases come from the five new aircraft delivered in the

fourth quarter of 2009 and a further fi ve aircraft to be delivered

throughout 2010.

Due to the stabilization of jet fuel prices, we do not expect to

see the same substantial relief on costs in 2010 as we did in

2009. We expect fuel costs for the fi rst quarter of 2010, excluding

hedging, to range between $0.67 and $0.69 per litre. For the fi rst

quarter of 2010, we have hedged approximately 22 per cent of

our anticipated fuel requirements. The fi xed swap agreements

represent approximately 25 per cent of the total volume hedged

for the fi rst quarter and are at an average of CAD $105 per barrel.

The costless collar structures represent the remaining 75 per

cent and have a weighted average call price of CAD $111 per

barrel and a weighted average put price of CAD $78 per barrel.

The settlements of these hedging contracts are anticipated to

add between $0.01 and $0.02 per litre to our cost of fuel.

For 2010, we anticipate total capital expenditures of $65 to $75

million, with the majority of the spending related to aircraft

deposits and rotables.

As we move forward into 2010, it is unclear whether or not the

initial indications of economic improvement are here to stay. We

believe that we will continue to see pressure on yield in the fi rst

quarter, with fi rst quarter RASM tracking to an anticipated year-

over-year decline of less than fi ve per cent on strong loads.

We further believe that 2009 demonstrated our ability to survive

extreme challenges. Our strong balance sheet and low-cost

structure should help us successfully navigate through 2010,

much as we did in 2009. The recent improvements in economic

trends are encouraging; however, if the recovery is long and

drawn out, we are prepared. Regardless of the challenges that

may lie ahead, we have every confi dence that our WestJetters are

committed to the continued growth and success of our airline. It

is their dedication that brought us through 2009 profi tably, and

we know they will make the best of 2010.

OUTLOOK

Throughout 2009, businesses were forced to deal with the

continuous challenges of a deep and damaging recession. Facing

a severe drop in demand, the airline industry was forced to slash

both pricing and capacity. The additional pressures stemming

from H1N1, rising fuel prices and enhanced security measures

imposed by the U.S. made the year extremely difficult. Our

ability to succeed in the face of all these obstacles speaks to the

strength of our business and our people.

We will approach 2010 the same way we approached 2009 –

prepared for a challenging year and ready to work hard to control

costs and maintain profi tability while building value. 2009 was

a foundational year that centred on enhancing our capabilities

for future growth. Focusing on our cost structure, strengthening

our balance sheet, expanding WestJet Vacations, implementing

two new reservation systems and laying the groundwork for our

airline partnerships and frequent guest and credit card programs

were all key initiatives. As we head into 2010, we plan to leverage

some of these initiatives, beginning with the expected launch of

our frequent guest and credit card programs in the fi rst quarter

of 2010.

We believe that the enhanced capabilities of our new reservation

system will allow us to implement additional seamless strategic

partnerships with other airlines. Our implementation plans for

code-sharing with Southwest Airlines may extend beyond the

late 2010 date previously announced; however, exact timing is

not currently defi ned. We also expect our new reservation system

to increase our opportunities for ancillary revenues and allow us

to better serve the business traveller market.

Our fi nancial results for the fi rst quarter of 2010 should benefi t

from our recent expansion in the transborder and international

market. Between the months of December 2009 and January

2010 we launched 52 new city pairs – the majority of which

belong to our transborder and international schedule. This is

a signifi cant accomplishment for an airline of our size and is

supported by the strength we have seen in our southern markets.

The demand for WestJet Vacations continues to exceed our

expectations and forward bookings continue to be strong.

We expect our fi rst-quarter capacity to increase approximately

seven per cent from the fi rst quarter of 2009, and full-year