Westjet 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 WestJet 2009 Annual Report

Contingencies

We are party to certain legal proceedings that arise during the

ordinary course of business. It is the opinion of management that

the ultimate outcome of these matters will not have a material

effect upon our financial position, results of operations or

cash fl ows.

Share capital

Our issued and outstanding voting shares, along with voting

shares potentially issuable, are as follows:

Commencing in the third quarter of 2009, we have available a

three-year revolving operating line of credit with a syndicate of

three Canadian banks. The line of credit is available for up to a

maximum of $85 million and is secured by our Campus facility.

The line of credit bears interest at prime plus 0.50 per cent per

annum, or a bankers acceptance rate at 2.0 per cent annual

stamping fee, and is available for general corporate expenditures

and working capital purposes. We are required to pay a standby

fee of 15 basis points, based on the average unused portion of

the line of credit for the previous quarter, payable quarterly. As at

December 31, 2009, no amounts were drawn on this facility.

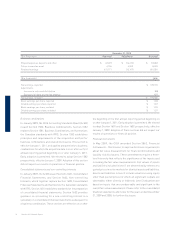

Series

600s 700s 800s Total fl eet

Leased Owned Total Leased Owned Total Leased Owned Total Leased Owned Total

Fleet at December 31, 2008 — 13

13 18 38 56 6 1 7 24 52 76

Fleet at December 31, 2009 — 13

13 25 38 63 8 2 10 33 53 86

Commitments:

2010 — —

— 2 — 2 3 — 3 5 — 5

2011 — —

— 4 2* 6 1 — 1 5 2 7

2012 — —

— — 6* 6 1 — 1 1 6 7

2013 — —

— — 6* 6 — — — — 6 6

2014 — —

— — 6* 6 — — — — 6 6

2015 — —

— — 10* 10 — — — — 10 10

2016 — —

— — 8* 8 — — — — 8 8

Total commitments — — — 6 38 44 5 — 5 11 38 49

Committed fl eet as of 2016 — 13 13 31 76 107 13 2 15 44 91 135

*We have an option to convert any of these future aircraft to 737-800s.

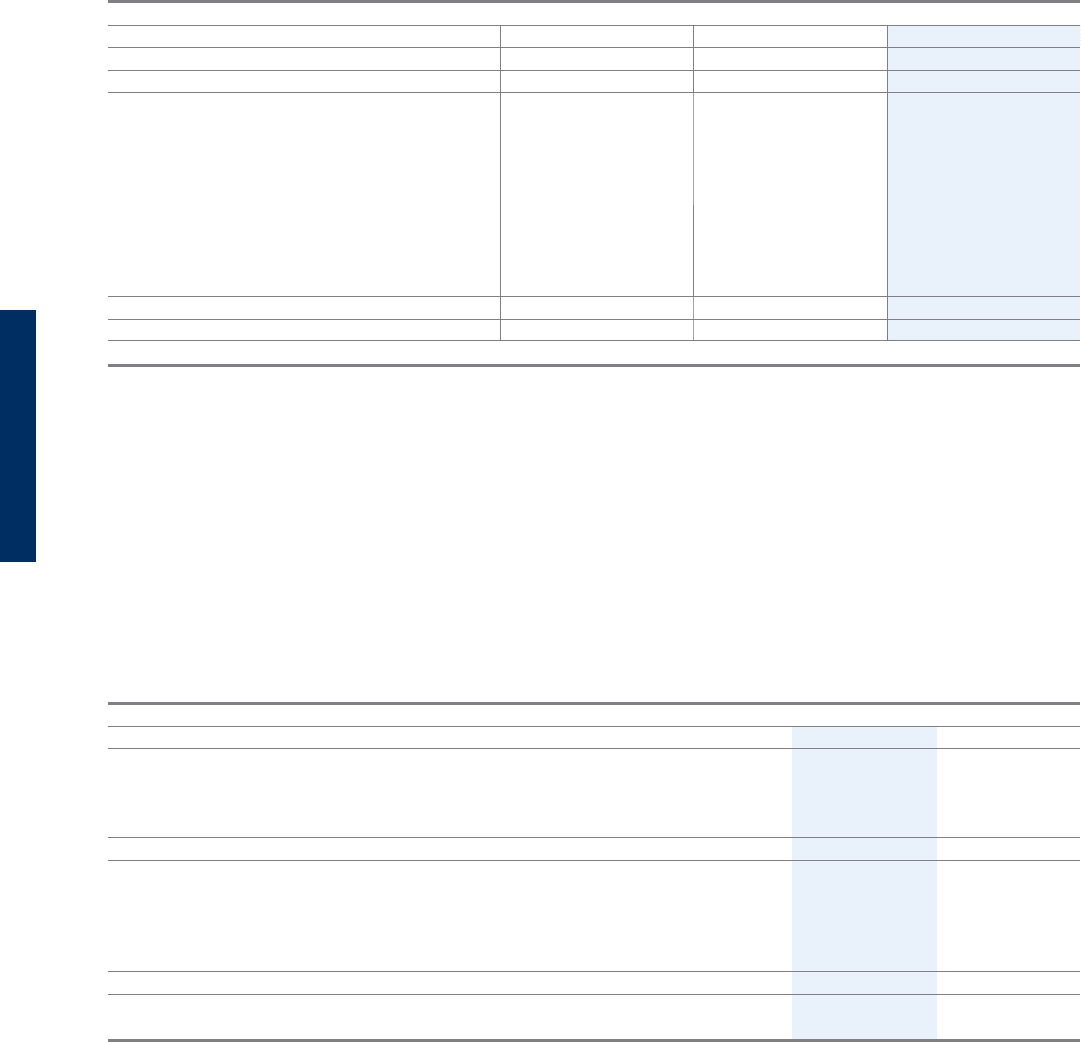

Number of shares

February 12, 2010 December 31, 2009

Issued and outstanding:

Common voting shares 138,479,680 138,763,891

Variable voting shares 6,086,864 5,595,492

Total common shares issued and outstanding 144,566,544 144,359,383

Common shares potentially issuable:

Stock options 9,761,463 11,521,844

RSUs 143,461 143,461

PSUs 191,276 191,276

Total common shares potentially issuable 10,096,200 11,856,581

Total outstanding and potentially issuable common shares 154,662,744 156,215,964