Westjet 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

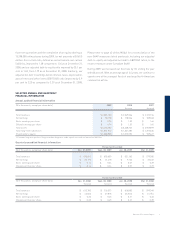

10 WestJet 2009 Annual Report

• Realized diluted earnings per share of $0.14 for the fourth

quarter of 2009, a decrease of 57.6 per cent compared to

the same period of 2008.

• Adjusted for the non-recurring net future income tax

reduction in the fourth quarter of 2009, we recorded a net

earnings decrease of 64.0 per cent to $15.1 million, from

$42.0 million in the fourth quarter of 2008, and a diluted

earnings per share decrease of 66.7 per cent to $0.11 from

$0.33 in the same period of 2008.

• Generated cash fl ows from operations of $64.6 million, a

decrease from $67.6 million in the fourth quarter of 2008.

Please refer to page 42 of this MD&A for a reconciliation of

non-GAAP measures, including CASM, excluding fuel and

employee profi t share, net earnings and diluted earnings per

share adjusted for the impact of the non-recurring net future

income tax reduction in the fourth quarter of 2009, to the nearest

measure under Canadian GAAP.

Reservation system

On October 17, 2009, WestJet and Sabre Airline Solutions

(Sabre) implemented our new SabreSonic reservation system,

representing a foundational step in achieving our future growth

objectives. This system will ensure we can properly support our

evolving business model, will enhance our ancillary revenue

opportunities and will improve our ability to partner with other

airlines, such as our expanded relationship with Air France and

KLM. We experienced several operational challenges in relation

to the new reservation system that impacted our award-winning

guest service during the period. In particular, our call centre

was negatively impacted as a result of the changeover, due to

technical issues and a relatively lower level of familiarity with

the new system. However, we have made considerable progress

in our call centre service levels since our reservation system

cutover in October. We believe we are well on our way back to

delivering the world-class guest experience our guests deserve

and have come to expect.

In the third quarter of 2009, we previously disclosed that we expected

to launch two new programs: the Frequent Guest program and a

co-branded credit card with RBC and MasterCard. As a result of

longer-than-expected queues in the call centre, we announced

our plans to delay the launch of these programs until March 2010.

Our business is seasonal in nature with varying levels of activity

throughout the year. We experience increased domestic travel

in the summer months (second and third quarters) and more

demand for sun destinations over the winter period (fourth

and first quarters). With our transborder and international

destinations, we have been able to partially alleviate the effects

of seasonality on our net earnings.

In the quarter ended December 31, 2009, our reported net

earnings of $20.2 million were positively impacted by a non-

recurring net future income tax reduction in the amount of

$5.1 million, or 3 cents per share. This was mainly due to the

enactment of corporate income tax rate reductions, offset

partially by revisions to the measurement of previously-

recognized future tax assets.

FOURTH QUARTER

The fourth quarter of 2009 was once again a profi table quarter

for WestJet. During our 19th consecutive quarter of positive net

earnings, we implemented a new reservation system and began

service to 11 new destinations.

Quarterly highlights

• Recognized total revenues of $570.0 million, a decrease of

7.4 per cent from the fourth quarter of 2008.

• Recorded RASM of 12.92 cents, down 10.0 per cent from the

comparable period of 2008. This differs from our previously-

disclosed guidance of an 11 to 13 per cent year-over-year

decline due to better-than-expected December revenue.

• Increased capacity by 2.9 per cent over the three months

ended December 31, 2008.

• Reduced CASM to 12.10 from 12.98 cents in the fourth

quarter of 2008, a decrease of 6.8 per cent.

• Realized CASM, excluding fuel and employee profi t share,

of 8.67 cents, down by 0.1 per cent over the three months

ended December 31, 2008.

• Recorded an EBT margin of 4.0 per cent, down 5.8 points

from the fourth quarter of 2008.

• Realized net earnings of $20.2 million, a decrease of 51.9

per cent from the three months ended December 31, 2008.