Westjet 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 67

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

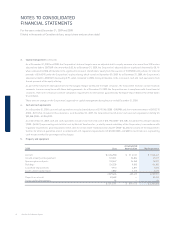

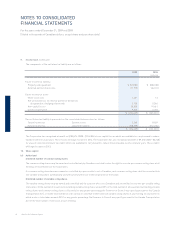

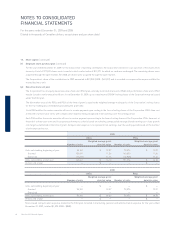

The Corporation has not incorporated an estimated forfeiture rate for stock options that will not vest. Rather, the Corporation accounts for actual

forfeitures as they occur.

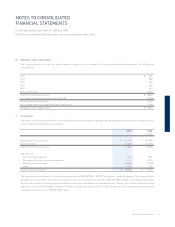

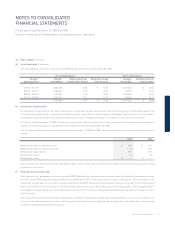

(f) Employee share purchase plan

The Corporation has an employee share purchase plan (ESPP) whereby the Corporation matches every dollar contributed by each employee. Under

the terms of the ESPP, employees may contribute up to a maximum of 20% of their gross pay and acquire voting shares of the Corporation at the

current fair market value of such shares. Shares acquired for the ESPP are restricted for one year. Employees may offer to sell shares, which

have not been held for at least one year to the Corporation, four times per year. The purchase price of the voting shares shall be equal to 50% of

the weighted average trading price of the Corporation’s voting shares for the fi ve trading days immediately preceding the employee’s notice to

the Corporation.

The Corporation has the option to acquire voting shares on behalf of employees through open market purchases or to issue new shares from

treasury at the current market price, which is determined based on the volume weighted average trading price of the Corporation’s voting shares

for the fi ve trading days preceding the issuance.

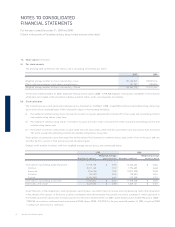

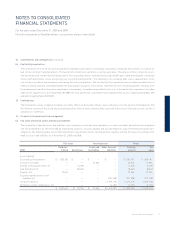

(e) Stock option compensation

As new options are granted, the fair value of the options is expensed over the vesting period, with an offsetting entry to contributed surplus. The

fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model. Upon the exercise of stock options,

consideration received, together with amounts previously recorded in contributed surplus, is recorded as an increase to share capital.

For the year ended December 31, 2009, stock-based compensation expense related to stock options included in fl ight operations and navigational

charges, and marketing, general and administration expenses totalled $12,045 (2008 – $12,597).

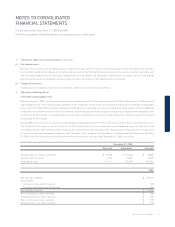

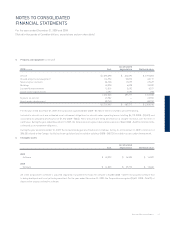

The fair value of options granted during the year ended December 31, 2009 and 2008, and the assumptions used in their determination are as

follows:

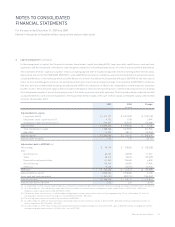

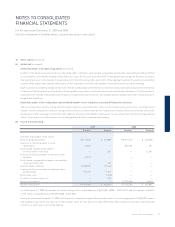

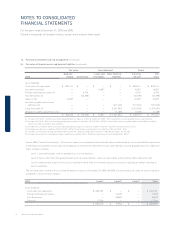

10. Share capital (continued)

(d) Stock option plan (continued)

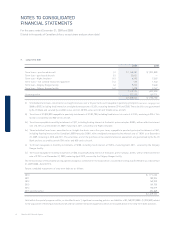

The following table summarizes the options outstanding and exercisable as at December 31, 2009:

Outstanding options Exercisable options

Range of

exercise prices

Number

outstanding

Weighted average

remaining life (years)

Weighted average

exercise price

Number

exercisable

Weighted average

exercise price

$ 9.00 – $11.99 5,084,673 0.38 $ 11.81 5,023,365 $ 11.82

$12.00 – $14.99 2,987,619 3.29 12.49 82,918 12.40

$15.00 – $16.50 1,529,041 1.35 16.41 1,522,602 16.42

$16.51 – $19.99 1,920,511 2.34 16.72 18,640 19.12

11,521,844 1.59 $ 13.42 6,647,525 $ 12.90

2009 2008

Weighted average fair value per option $ 3.82 $ 5.24

Weighted average risk-free interest rate 1.7% 3.0%

Weighted average volatility 39% 37%

Expected life (years) 3.6 3.6

Dividends per share $ — $ —