Westjet 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 WestJet 2009 Annual Report

The decrease in yield was attributable to aggressive pricing by

the airline industry to stimulate air travel, and, to a lesser extent,

the absence of the fuel surcharge in place during a portion

of 2008.

During 2009, we reduced our aircraft utilization to optimize our

schedule to better match the weakened demand environment.

As such, average aircraft utilization decreased by 36 minutes to

11.7 operating hours per day, compared to 12.3 operating hours

per day in 2008. The fl exibility of our fl eet-deployment strategy

allows us to react to demand changes by adjusting our schedule

for more profi table fl ying. During the year, we continued with

tactical adjustments to our schedule in favour of transborder

and international markets, as depicted in the following graph.

Additionally, we eliminated certain red-eye fl ights and reduced

frequency of fl ights into a number of less profi table markets

during the year. Our lower aircraft utilization negatively impacts

CASM and revenue.

Income taxes

Our effective consolidated income tax rate for the three months

ended December 31, 2009 was 12.4 per cent, as compared to 30.1

per cent for the same period in 2008. The signifi cant decrease

in our effective tax rate for the three-month period ended

December 31, 2009, was primarily due to a corporate income

tax rate reduction enacted by the Ontario provincial government,

offset partially by revisions to the measurement of previously

recognized future tax assets. Excluding this net $5.1 million

favourable reduction of future income tax expense, our effective

consolidated income tax rate for the quarter would have been

34.3 per cent, which is higher than expected due to the portion

of non-deductible matching contributions under our Employee

Share Purchase Plan (ESPP) realized in the fourth quarter.

During 2009, total revenues decreased by 10.5 per cent

to $2,281.1 million from $2,549.5 million in 2008, largely

attributable to a decline in guest revenues from our scheduled

fl ight operations. Guest revenues decreased in 2009 by 10.1 per

cent to $2,067.9 million, as compared to $2,301.3 million in 2008,

mainly due to the weak economy, and, to a lesser extent, the

elimination of the fuel surcharge that was implemented in the

second quarter of 2008. For 2009, we saw increased seat sales

and fare discounts in order to stimulate demand amid the weak

economic environment. This decrease was offset somewhat by

growth in WestJet Vacations air revenue.

One of our key revenue measurements is RASM, as it takes into

consideration load factor and yield. Our RASM decreased by 12.8

per cent to 12.97 cents for 2009, compared to 14.88 cents in

2008. This change was primarily due to a decline in yield of 11.2

per cent for 2009, as well as a slightly lower 2009 load factor.

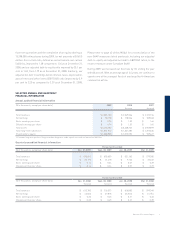

RESULTS OF OPERATIONS

Revenue

Three months ended December 31 Twelve months ended December 31

($ in thousands) 2009 2008 Change 2009 2008 Change

Guest revenues $ 528,104 $ 561,514 (5.9%) $ 2,067,860 $ 2,301,301 (10.1%)

Charter and other revenues 41,938 54,269 (22.7%) 213,260 248,205 (14.1%)

$ 570,042 $ 615,783 (7.4%) $ 2,281,120 $ 2,549,506 (10.5%)

RASM (cents) 12.92 14.36 (10.0%) 12.97 14.88 (12.8%)