Westjet 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 WestJet 2009 Annual Report

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

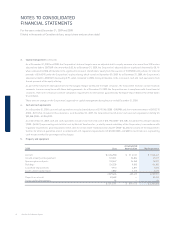

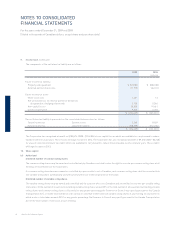

3. Capital management (continued)

As at December 31, 2009 and 2008, the Corporation’s internal targets were an adjusted debt-to-equity measure of no more than 3.00 and an

adjusted net debt to EBITDAR of no more than 3.00. As at December 31, 2009, the Corporation’s adjusted debt-to-equity ratio improved by 20.1%

when compared to 2008, attributable to the signifi cant increase in shareholders’ equity from the issuance of 15,398,500 voting shares for total net

proceeds of $164,995 under the Corporation’s equity offering, which closed on September 30, 2009. As at December 31, 2009, the Corporation’s

adjusted net debt to EBITDAR improved by 3.9% when compared to 2008, mainly attributable to the increase in cash and cash equivalents from

the net proceeds of the equity offering.

As part of the long-term debt agreements for the Calgary Hangar facility and the fl ight simulator, the Corporation monitors certain fi nancial

covenants to ensure compliance with these debt agreements. As at December 31, 2009, the Corporation was in compliance with these fi nancial

covenants. There are no fi nancial covenant compliance requirements for the facilities guaranteed by the Export-Import Bank of the United States

(Ex-Im Bank).

There were no changes in the Corporation’s approach to capital management during the year ended December 31, 2009.

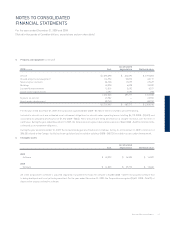

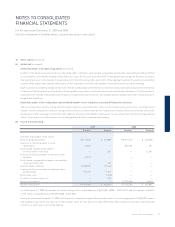

4. Cash and cash equivalents

As at December 31, 2009, cash and cash equivalents includes bank balances of $191,966 (2008 – $98,998) and short-term investments of $813,215

(2008 – $721,216). Included in these balances, as at December 31, 2009, the Corporation has US-dollar cash and cash equivalents totalling US

$32,858 (2008 – US $56,920).

As at December 31, 2009, cash and cash equivalents includes total restricted cash of $10,192 (2008 – $10,748). Included in this amount is $4,564

(2008 – $6,062), representing cash held in trust by WestJet Vacations Inc., a wholly owned subsidiary of the Corporation, in accordance with

regulatory requirements governing advance ticket sales for certain travel-related activities; $4,491 (2008 – $4,222) for security on the Corporation’s

facilities for letters of guarantee; and, in accordance with U.S. regulatory requirements, US $1,082 (2008 – US $381) in restricted cash, representing

cash not yet remitted for passenger facility charges.

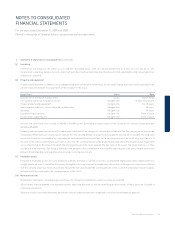

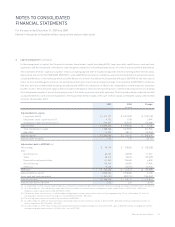

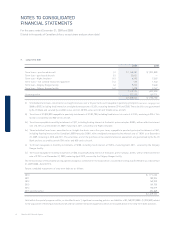

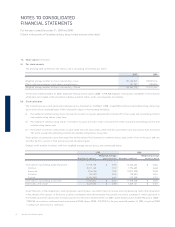

5. Property and equipment

2009 Cost

Accumulated

depreciation Net book value

Aircraft $ 2,456,988 $ 513,521 $ 1,943,467

Ground property and equipment 120,031 52,804 67,227

Spare engines and parts 100,567 24,360 76,207

Buildings 136,228 9,843 126,385

Leasehold improvements 9,910 2,877 7,033

Assets under capital leases 5,882 2,210 3,672

2,829,606 605,615 2,223,991

Deposits on aircraft 83,489 — 83,489

Assets under development 86 — 86

$ 2,913,181 $ 605,615 $ 2,307,566