Westjet 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 63

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

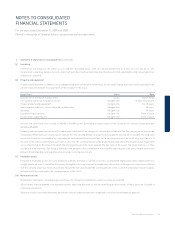

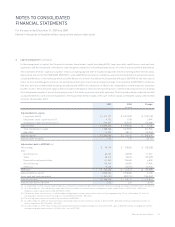

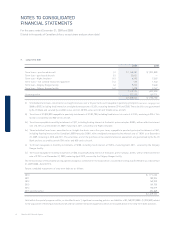

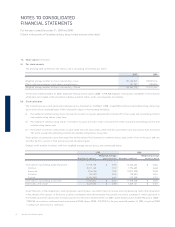

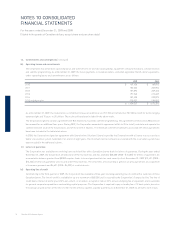

8. Obligations under capital leases

The Corporation has entered into capital leases relating to a fuel storage facility and ground handling equipment. The obligations

are as follows:

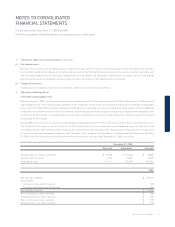

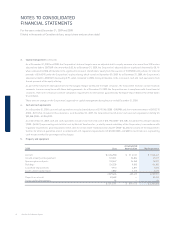

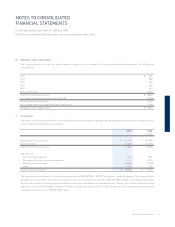

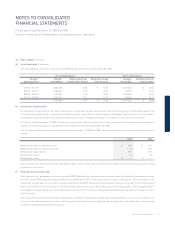

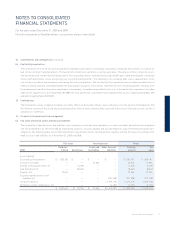

9. Income taxes

The provision for income taxes differs from that which would be expected by applying the combined federal and provincial statutory rates.

A reconciliation of the difference is as follows:

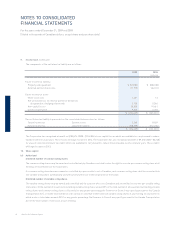

The Corporation has included in its reconciliation an amount of $18,206 (2008 – $9,970) for the effect of tax rate changes. This amount refl ects

the impact of certain federal and provincial corporate income tax rate reductions enacted in 2009 and 2008, changes to the timing around when

the Corporation expects certain temporary differences to reverse, and differences between current statutory rates used in the reconciliation

and future rates at which the future income tax liability is recorded. Included in other for 2009 are revisions to the measurement of previously-

recognized future tax assets of $5,700 (2008 - $nil).

2010 $ 943

2011 282

2012 245

2013 245

2014 245

2015 and thereafter 4,862

Total minimum lease payments $ 6,822

Less weighted average imputed interest at 5.28% (2,720)

Net minimum lease payments 4,102

Less current portion of obligations under capital leases (744)

Obligations under capital leases $ 3,358

2009 2008

Restated

Earnings before income taxes $ 136,796 $ 254,749

Income tax rate 30.62% 31.30%

Expected income tax provision 41,887 79,736

Add (deduct):

Non-deductible expenses 5,545 2,097

Non-deductible stock-based compensation 4,112 4,218

Effect of tax rate changes (18,206) (9,970)

Other 5,280 162

Actual income tax provision $ 38,618 $ 76,243