Westjet 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 51

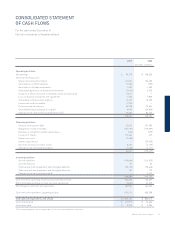

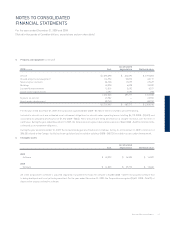

CONSOLIDATED STATEMENT

OF CASH FLOWS

For the years ended December 31

(Stated in thousands of Canadian dollars)

2009 2008

Restated – see note 2

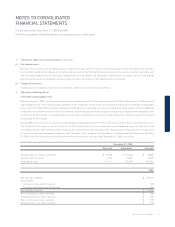

Operating activities:

Net earnings $ 98,178 $ 178,506

Items not involving cash:

Depreciation and amortization 141,303 136,485

Amortization of other liabilities (7,595) (937)

Amortization of hedge settlements 1,400 1,400

Unrealized (gain) loss on derivative instruments (2,406) 6,725

Issuance of shares pursuant to employee share purchase plan 11,071 —

Loss on disposal of property and equipment 1,504 1,809

Stock-based compensation expense 13,440 13,485

Income tax credit receivable (1,952) —

Future income tax expense 35,928 73,694

Unrealized foreign exchange loss (gain) 8,440 (34,823)

Change in non-cash working capital (note 14(b)) 19,350 84,242

318,661 460,586

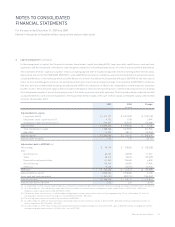

Financing activities:

Increase in long-term debt 33,855 101,782

Repayment of long-term debt (165,757) (179,397)

Decrease in obligations under capital leases (406) (375)

Issuance of shares 172,463 227

Share issue costs (7,468) —

Shares repurchased — (29,420)

Decrease (increase) in other assets 3,427 (4,135)

Change in non-cash working capital (1,463) (4,111)

34,651 (115,429)

Investing activities:

Aircraft additions (118,686) (114,470)

Aircraft disposals 27 84

Other property and equipment and intangible additions (48,155) (90,663)

Other property and equipment and intangible disposals 134 172

Change in non-cash working capital — 5,147

(166,680) (199,730)

Cash fl ow from operating, fi nancing and investing activities 186,632 145,427

Effect of foreign exchange on cash and cash equivalents (1,665) 21,229

Net change in cash and cash equivalents 184,967 166,656

Cash and cash equivalents, beginning of year 820,214 653,558

Cash and cash equivalents, end of year $ 1,005,181 $ 820,214

Cash interest paid $ 67,973 $ 76,604

Cash taxes paid $ 3,369 $ 2,305

The accompanying notes are an integral part of the consolidated fi nancial statements.