Westjet 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 57

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

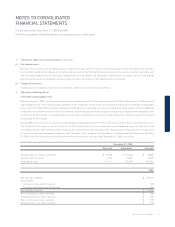

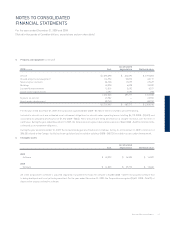

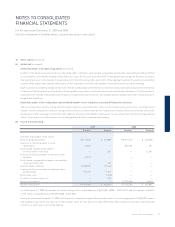

1. Summary of signifi cant accounting policies (continued)

(r) Per share amounts

Basic per share amounts are calculated using the weighted average number of shares outstanding during the year. Diluted per share amounts

are calculated based on the treasury stock method, which assumes that the total proceeds obtained on the exercise of options and share units

and the unamortized portion of stock-based compensation on stock options and share units would be used to purchase shares at the average

price during the period. The weighted average number of shares outstanding is then adjusted by the net change.

(s) Comparative amounts

Certain prior-period balances have been reclassifi ed to conform to current period’s presentation.

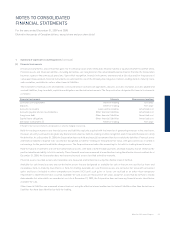

2. Change in accounting policies

(i) Goodwill and intangible assets

Effective January 1, 2009, the Corporation adopted the Canadian Institute of Chartered Accountants (CICA) Handbook Section 3064, Goodwill

and Intangible Assets. This section provides guidance on the recognition, measurement, presentation and disclosure for goodwill and intangible

assets, other than the initial recognition of goodwill or intangible assets acquired in a business combination. Upon adoption of Section 3064, the

Corporation reclassifi ed the net book value of purchased software that was previously recognized in property and equipment to intangible assets

as shown on the Corporation’s consolidated balance sheet. Prior period balances were reclassifi ed. There was no impact to current or prior year

net earnings for this change.

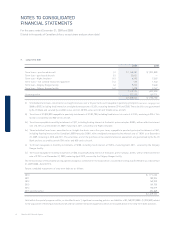

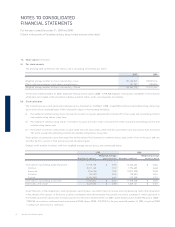

During 2009, the Corporation changed its accounting policy regarding the treatment of certain sales and distribution, and marketing costs.

The Corporation now expenses these costs as incurred. Previously these costs were deferred in prepaid expenses, deposits and other on the

consolidated balance sheet and expensed in the period the related revenue was recognized. This change in accounting policy has been accounted

for retrospectively with restatement of the prior year. The effect of this change to the Corporation’s consolidated balance sheet as at December

31, 2008, and to the Corporation’s consolidated statement of earnings for the year ended December 31, 2008, is as follows:

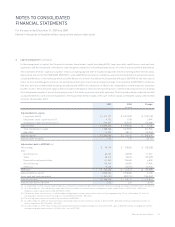

December 31, 2008

Reported Adjustment Restated

Prepaid expenses, deposits and other $ 67,693 $ (14,410) $ 53,283

Future income tax asset 4,196 4,263 8,459

Retained earnings 611,171 (10,147) 601,024

2008

Net earnings, reported $ 178,135

Adjustments:

Increase in sales and distribution (88)

Decrease in future income tax expense 459

Net earnings, restated $ 178,506

Basic earnings per share, reported $ 1.38

Diluted earnings per share, reported $ 1.37

Basic earnings per share, restated $ 1.39

Diluted earnings per share, restated $ 1.37