Rite Aid 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

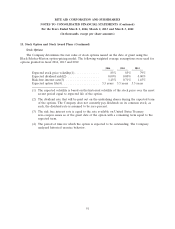

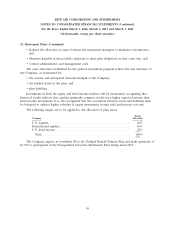

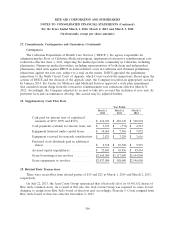

15. Retirement Plans (Continued)

Defined Benefit Plans

The Company and its subsidiaries also sponsor a qualified defined benefit pension plan that

requires benefits to be paid to eligible associates based upon years of service and, in some cases,

eligible compensation. The Company’s funding policy for The Rite Aid Pension Plan (The ‘‘Defined

Benefit Pension Plan’’) is to contribute the minimum amount required by the Employee Retirement

Income Security Act of 1974. However, the Company may, at its sole discretion, contribute additional

funds to the plan. The Company made contributions of $8,000 in fiscal 2014, $5,583 in fiscal 2013 and

$14,878 in fiscal 2012.

The Company also maintains a nonqualified executive retirement plan for certain former

employees who, pursuant to their employment agreements, did not participate in the SERP. The

Company no longer enrolls new participants into this plan. These participants generally receive an

annual benefit payable monthly over fifteen years. This nonqualified defined benefit plan is unfunded.

Net periodic pension expense and other changes recognized in other comprehensive income for the

defined benefit pension plans and the nonqualified executive retirement plan included the following

components:

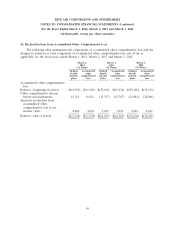

Nonqualified Executive

Defined Benefit Pension Plan Retirement Plan

2014 2013 2012 2014 2013 2012

Service cost ......................... $ 3,341 $ 2,908 $ 2,988 $ — $ — $ 21

Interest cost ......................... 6,120 6,128 6,501 541 616 771

Expected return on plan assets ........... (6,738) (6,719) (6,192) — — —

Amortization of unrecognized prior service

cost ............................. 240 240 639 — — —

Amortization of unrecognized net loss (gain) . 4,935 3,926 2,435 (351) 866 (582)

Net pension expense(income) ........... $ 7,898 $ 6,483 $ 6,371 $ 190 $1,482 $ 210

Other changes recognized in other

comprehensive loss:

Unrecognized net (gain) loss arising during

period .......................... $(18,860) $12,901 $24,664 $(351) $ 866 $ 595

Prior service cost arising during period .... — — (275) — — —

Amortization of unrecognized prior service

costs ........................... (240) (240) (639) — — —

Amortization of unrecognized net (loss)

gain ........................... (4,935) (3,926) (2,435) 351 (866) 582

Net amount recognized in other

comprehensive loss .................. (24,035) 8,735 21,315 — — 1,177

Net amount recognized in pension expense

and other comprehensive loss ........... $(16,137) $15,218 $27,686 $ 190 $1,482 $1,387

96