Rite Aid 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Transactions

In February 2012, $404.8 million aggregate principal amount of the outstanding 8.625% notes were

tendered and repurchased by us. We redeemed the remaining 8.625% notes in March 2012 for

$55.6 million, which included the call premium and interest through the redemption date. The

refinancing resulted in an aggregate loss on debt retirement of $16.1 million recorded in the fourth

quarter of fiscal 2012.

During August 2011, we repurchased $41.0 million of our 8.625% notes, $5.0 million of our

9.375% notes and $4.5 million of our 6.875% debentures. These repurchases resulted in a gain for the

period of $5.0 million.

Off-Balance Sheet Arrangements

As of March 1, 2014, we had no material off balance sheet arrangements, other than operating

leases as included in the table below.

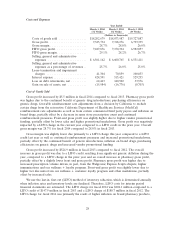

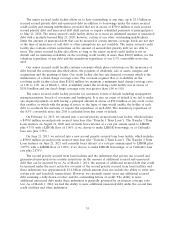

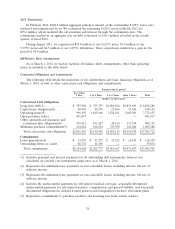

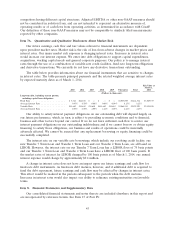

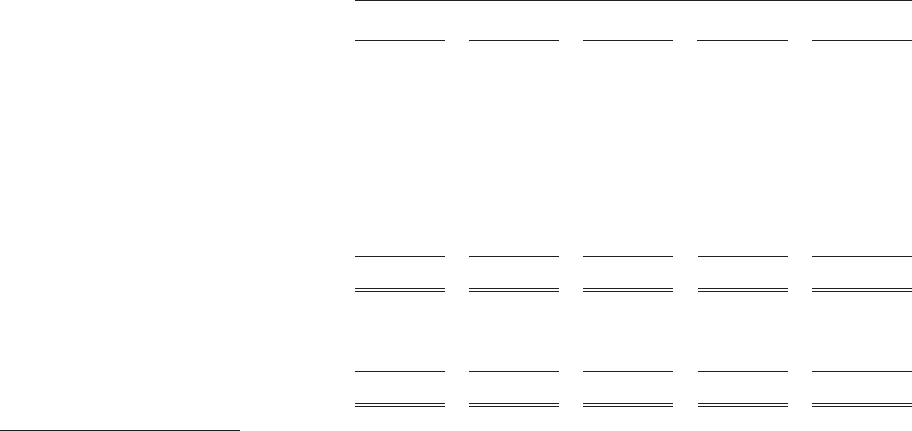

Contractual Obligations and Commitments

The following table details the maturities of our indebtedness and lease financing obligations as of

March 1, 2014, as well as other contractual cash obligations and commitments.

Payment due by period

Less Than

1 Year 1 to 3 Years 3 to 5 Years After 5 Years Total

(Dollars in thousands)

Contractual Cash Obligations

Long term debt(1) .............. $ 355,894 $ 755,735 $1,086,962 $5,839,689 $ 8,038,280

Capital lease obligations(2) ........ 40,030 40,558 25,866 33,656 140,110

Operating leases(3) ............. 996,495 1,845,868 1,524,181 3,405,091 7,771,635

Open purchase orders ........... 401,817 — — — 401,817

Other, primarily self insurance and

retirement plan obligations(4) .... 102,411 142,427 48,156 115,198 408,192

Minimum purchase commitments(5) . 164,844 364,854 333,950 162,040 1,025,688

Total contractual cash obligations . $2,061,491 $3,149,442 $3,019,115 $9,555,674 $17,785,722

Commitments

Lease guarantees(6) ............. $ 24,339 $ 45,235 $ 32,352 $ 16,183 $ 118,109

Outstanding letters of credit ....... 68,774 11,100 — — 79,874

Total commitments ............ $2,154,604 $3,205,777 $3,051,467 $9,571,857 $17,983,705

(1) Includes principal and interest payments for all outstanding debt instruments. Interest was

calculated on variable rate instruments using rates as of March 1, 2014.

(2) Represents the minimum lease payments on non-cancelable leases, including interest, but net of

sublease income.

(3) Represents the minimum lease payments on non-cancelable leases, including interest, but net of

sublease income.

(4) Includes the undiscounted payments for self-insured medical coverage, actuarially determined

undiscounted payments for self-insured workers’ compensation and general liability, and actuarially

determined obligations for defined benefit pension and nonqualified executive retirement plans.

(5) Represents commitments to purchase products and licensing fees from certain vendors.

38