Rite Aid 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 1, 2014, March 2, 2013 and March 3, 2012

(In thousands, except per share amounts)

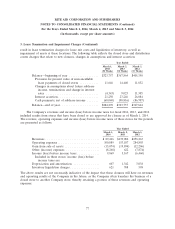

1. Summary of Significant Accounting Policies (Continued)

Sales Tax Collected

Sales taxes collected from customers and remitted to various governmental agencies are presented

on a net basis (excluded from revenues) in the Company’s statement of operations.

Use of Estimates

The preparation of the financial statements in conformity with accounting principles generally

accepted in the United States of America requires management to make estimates and assumptions

that affect the amounts reported in the financial statements and accompanying notes. Actual results

could differ from those estimates.

Significant Concentrations

The Company’s pharmacy sales were primarily to customers covered by health plan contracts,

which typically contract with a third party payor that agrees to pay for all or a portion of a customer’s

eligible prescription purchases. During fiscal 2014, the top five third party payors accounted for

approximately 65.8% of the Company’s pharmacy sales. The largest third party payor, Express Scripts,

represented 31.6% and 35.3% of pharmacy sales during fiscal 2014 and 2013, respectively. The largest

third party payor during fiscal 2012, Medco Health Solutions, represented 22.9% of pharmacy sales.

Third party payors are entities such as an insurance company, governmental agency, health

maintenance organization or other managed care provider, and typically represent several health care

contracts and customers.

During fiscal 2014, state sponsored Medicaid agencies and related managed care Medicaid payors

accounted for approximately 13.7% of the Company’s pharmacy sales, the largest of which was

approximately 1.1% of the Company’s pharmacy sales. During fiscal 2014, approximately 30.6% of the

Company’s pharmacy sales were to customers covered by Medicare Part D. Any significant loss of

third-party payor business could have a material adverse effect on the Company’s business and results

of operations.

During fiscal 2014, the Company purchased brand pharmaceuticals and some generic

pharmaceuticals, which amounted to approximately 88.2% of the dollar volume of its prescription

drugs, from a single wholesaler, McKesson Corporation (‘‘McKesson’’), under a contract that the

Company amended and restated in February 2014 and now runs through March 31, 2019. Under the

amended and restated contract, with limited exceptions, the Company is required to purchase all of its

branded pharmaceutical products and almost all of its generic (non-brand name) pharmaceutical

products from McKesson. If the Company’s relationship with McKesson was disrupted, it could

temporarily have difficulty filling prescriptions for brand-named and generic drugs until it executed a

replacement wholesaler agreement or developed and implemented self-distribution processes.

Derivatives

The Company may enter into interest rate swap agreements to hedge the exposure to increasing

rates with respect to its variable rate debt, when the Company deems it prudent to do so. Upon

69